OPEN-SOURCE SCRIPT

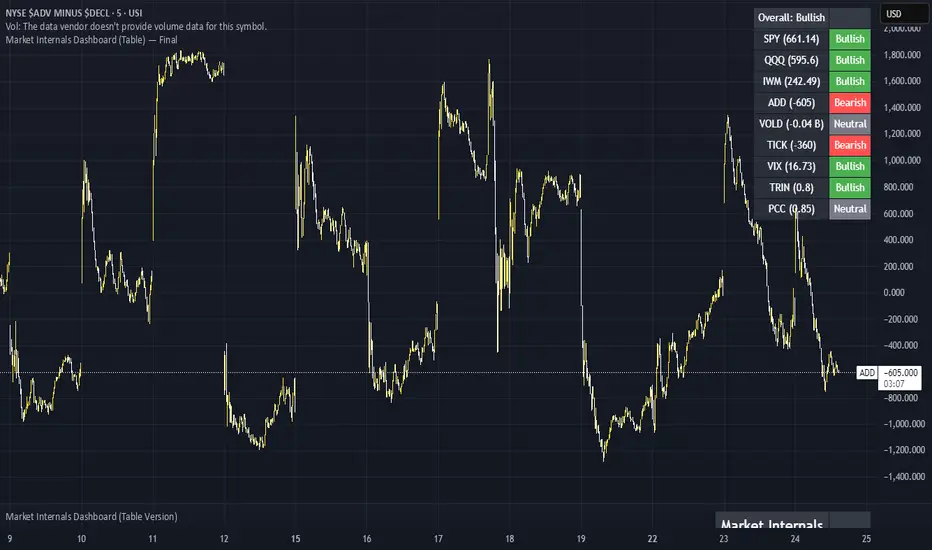

Updated Market Internals Dashboard (Table) v5 - Fixed

Has a Dashboard for Market Internals and 3 Indices, very helpful

Release Notes

Here’s a breakdown for each category and the key thresholds traders watch:1.

> +1000 (NYSE): Strong upside participation → bias calls.

< –1000: Broad downside participation → bias puts.

Between –500 and +500 = choppy / indecision.

2.

Measures number of stocks upticking vs. downticking.

+800 or higher spikes → strong buying pressure.

–800 or lower spikes → strong selling pressure.

Constant readings above 0 = bullish tape.

Constant readings below 0 = bearish tape.

3.

Falling VIX intraday → risk-on, bias calls.

Rising VIX intraday → risk-off, bias puts.

<15 = complacency (strong bullish environment).

>20 = fear (bearish environment).

Watch directional change intraday, not just level.

4.

TRIN = advancing/declining volume ÷ advancing/declining issues.

<1.0 = bullish (volume favors advancers).

>1.0 = bearish (volume favors decliners).

Extreme <0.7 → very bullish, sometimes exhaustion.

Extreme >1.3–1.5 → very bearish, possible capitulation.

5. Put/Call Ratio (USI:PCC)

<0.8 = bullish sentiment (calls overweight puts).

>1.2 = bearish sentiment (puts overweight calls).

Middle ground (0.9–1.1) = neutral chop.

Note: Works best as a contrarian signal on extremes.

6. SPY, QQQ, IWM (Price vs. 20 SMA in our script)

Above 20 SMA = bullish bias.

Below 20 SMA = bearish bias.

Confirms what internals are saying.

How to Use Together

✅ Strong Call Setup:

ADD > +1000, TICK persistently > 0, TRIN < 1, VIX flat or falling, PCC < 0.8.

✅ Strong Put Setup:

ADD < –1000, TICK persistently < 0, TRIN > 1, VIX rising, PCC > 1.2.

⚠️ Neutral / Chop Zone:

ADD between –500 and +500, TICK flipping around 0, TRIN near 1, VIX flat → avoid trading until confirmation.

📈 How to Read VOLD (NYSE:VOLD)

Here are the key thresholds most pros use intraday:

VOLD Value Meaning Bias

+500M to +1B+ Strong upside volume – broad participation 📈 Call bias

+200M to +500M Moderate bullish volume 📈 Mild call bias

–200M to –500M Moderate bearish volume 📉 Mild put bias

–500M to –1B+ Strong downside volume – broad selling pressure 📉 Put bias

Near 0 Mixed or no conviction ⚠️ Chop zone – avoid trades

💡 Pro tip:

VOLD tends to trend all day once the session bias is set. If it’s above +500M early and rising, odds are the market closes bullish. Same for heavy negative VOLD.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.