PROTECTED SOURCE SCRIPT

tripleFlows Master EUR - by ManhDN

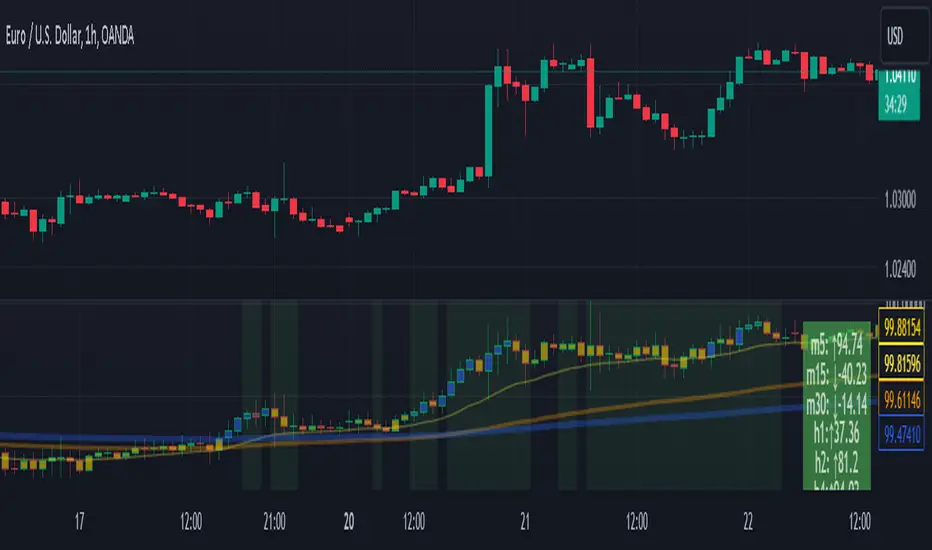

The TripleFlows Master EUR indicator is a technical analysis tool designed for TradingView to systematically evaluate the strength or weakness of the Euro (EUR) across 7 major currency pairs. This indicator provides a clear and objective measure of EUR momentum by analyzing moving averages, aggregating the data into a comprehensive Flow Index, and visualizing the collective price action of the Euro.

---

How It Works

1. Data Collection:

- The indicator pulls price data from the 7 most significant EUR currency pairs:

EUR/USD, EUR/JPY, EUR/GBP, EUR/AUD, EUR/CAD, EUR/NZD, and EUR/CHF.

2. Moving Average Calculation:

- For each of the 7 currency pairs, the indicator computes:

- A 5-period moving average (MA).

- A 20-period moving average (MA).

- It then compares these two moving averages to identify whether the trend for each pair is bullish or bearish:

- If MA(5) > MA(20), the trend is considered bullish for the Euro.

- If MA(5) < MA(20), the trend is considered bearish for the Euro.

3. Flow Index Aggregation:

- The indicator aggregates the trend signals from all 7 currency pairs to calculate a Flow Index, which ranges from -100 to +100:

- +100: All 7 pairs indicate a bullish trend for EUR (maximum strength).

- -100: All 7 pairs indicate a bearish trend for EUR (maximum weakness).

- Values closer to 0 indicate a more neutral market condition.

4. Visual Representation of Composite Price Action:

- In addition to the Flow Index, the TripleFlows Master EUR generates a **composite candlestick chart** based on the aggregated price action of the 7 EUR pairs.

- This chart provides a clear visual representation of the Euro's overall price behavior, allowing traders to analyze trends directly through candlestick patterns and moving averages.

- By observing this chart, traders can make decisions based on the combined action of all 7 pairs, rather than relying on a single pair.

5. Triple Flow Calculation Across Timeframes:

- The Flow Index is calculated on three timeframes:

- Junior (short timeframe).

- Medior (medium timeframe).

- Senior (long timeframe).

- The indicator evaluates the Flow Index across these three timeframes to determine Triple Flow:

- Triple Flow Up (Bullish): All three timeframes show a Flow Index of +100.

- Triple Flow Down (Bearish): All three timeframes show a Flow Index of -100.

---

Purpose and Application

- Trend Confirmation:

The TripleFlows Master EUR provides objective trend confirmation by synthesizing data across multiple pairs and timeframes.

- Bullish Trend: Look for opportunities to go long when Triple Flow Up is confirmed.

- Bearish Trend: Look for opportunities to go short when Triple Flow Down is confirmed.

- Multi-Timeframe Consistency:

The synchronization of the Flow Index across junior, medior, and senior timeframes ensures high-probability setups by aligning short-term and long-term trends.

- Composite Price Action Analysis:

The composite candlestick chart simplifies the analysis of EUR price behavior by aggregating data from 7 pairs, helping traders identify trends, key levels, and patterns visually.

---

Outputs and Visuals

1. Flow Index:

- Displayed as a value between -100 and +100, showing the aggregated strength or weakness of the Euro.

2. Composite Candlestick Chart:

- A real-time chart that represents the Euro's collective price action across 7 pairs.

3. Triple Flow Status:

- Visual indication of Triple Flow conditions (e.g., Triple Flow Up or Triple Flow Down) based on the alignment of Flow Index values across all three timeframes.

4. Alerts:

- The indicator includes alerts for when a Triple Flow Up or Down condition is detected, allowing users to respond to key market opportunities.

---

Technical Notes

- Flow Index Calculation:

The calculation is based purely on the relative position of the 5-period and 20-period moving averages across 7 pairs. It does not rely on external factors, ensuring the results are fully derived from price data.

- Composite Price Action:

The composite candlestick chart integrates the aggregated price movements of 7 pairs into a single, easy-to-read visual representation.

- Scalability Across Timeframes:

The TripleFlows Master EUR can be applied to any trading style, as it adapts to various timeframes:

- Junior timeframe for intraday analysis.

- Medior timeframe for swing trading.

- Senior timeframe for position trading.

---

Conclusion

The TripleFlows Master EUR indicator provides a robust, data-driven solution for analyzing the Euro’s performance across major currency pairs. By aggregating price action from 7 pairs into a composite candlestick chart and synchronizing trends across multiple timeframes, the indicator eliminates the limitations of analyzing individual pairs in isolation. This comprehensive approach ensures traders can identify trends and opportunities with greater accuracy and confidence.

---

How It Works

1. Data Collection:

- The indicator pulls price data from the 7 most significant EUR currency pairs:

EUR/USD, EUR/JPY, EUR/GBP, EUR/AUD, EUR/CAD, EUR/NZD, and EUR/CHF.

2. Moving Average Calculation:

- For each of the 7 currency pairs, the indicator computes:

- A 5-period moving average (MA).

- A 20-period moving average (MA).

- It then compares these two moving averages to identify whether the trend for each pair is bullish or bearish:

- If MA(5) > MA(20), the trend is considered bullish for the Euro.

- If MA(5) < MA(20), the trend is considered bearish for the Euro.

3. Flow Index Aggregation:

- The indicator aggregates the trend signals from all 7 currency pairs to calculate a Flow Index, which ranges from -100 to +100:

- +100: All 7 pairs indicate a bullish trend for EUR (maximum strength).

- -100: All 7 pairs indicate a bearish trend for EUR (maximum weakness).

- Values closer to 0 indicate a more neutral market condition.

4. Visual Representation of Composite Price Action:

- In addition to the Flow Index, the TripleFlows Master EUR generates a **composite candlestick chart** based on the aggregated price action of the 7 EUR pairs.

- This chart provides a clear visual representation of the Euro's overall price behavior, allowing traders to analyze trends directly through candlestick patterns and moving averages.

- By observing this chart, traders can make decisions based on the combined action of all 7 pairs, rather than relying on a single pair.

5. Triple Flow Calculation Across Timeframes:

- The Flow Index is calculated on three timeframes:

- Junior (short timeframe).

- Medior (medium timeframe).

- Senior (long timeframe).

- The indicator evaluates the Flow Index across these three timeframes to determine Triple Flow:

- Triple Flow Up (Bullish): All three timeframes show a Flow Index of +100.

- Triple Flow Down (Bearish): All three timeframes show a Flow Index of -100.

---

Purpose and Application

- Trend Confirmation:

The TripleFlows Master EUR provides objective trend confirmation by synthesizing data across multiple pairs and timeframes.

- Bullish Trend: Look for opportunities to go long when Triple Flow Up is confirmed.

- Bearish Trend: Look for opportunities to go short when Triple Flow Down is confirmed.

- Multi-Timeframe Consistency:

The synchronization of the Flow Index across junior, medior, and senior timeframes ensures high-probability setups by aligning short-term and long-term trends.

- Composite Price Action Analysis:

The composite candlestick chart simplifies the analysis of EUR price behavior by aggregating data from 7 pairs, helping traders identify trends, key levels, and patterns visually.

---

Outputs and Visuals

1. Flow Index:

- Displayed as a value between -100 and +100, showing the aggregated strength or weakness of the Euro.

2. Composite Candlestick Chart:

- A real-time chart that represents the Euro's collective price action across 7 pairs.

3. Triple Flow Status:

- Visual indication of Triple Flow conditions (e.g., Triple Flow Up or Triple Flow Down) based on the alignment of Flow Index values across all three timeframes.

4. Alerts:

- The indicator includes alerts for when a Triple Flow Up or Down condition is detected, allowing users to respond to key market opportunities.

---

Technical Notes

- Flow Index Calculation:

The calculation is based purely on the relative position of the 5-period and 20-period moving averages across 7 pairs. It does not rely on external factors, ensuring the results are fully derived from price data.

- Composite Price Action:

The composite candlestick chart integrates the aggregated price movements of 7 pairs into a single, easy-to-read visual representation.

- Scalability Across Timeframes:

The TripleFlows Master EUR can be applied to any trading style, as it adapts to various timeframes:

- Junior timeframe for intraday analysis.

- Medior timeframe for swing trading.

- Senior timeframe for position trading.

---

Conclusion

The TripleFlows Master EUR indicator provides a robust, data-driven solution for analyzing the Euro’s performance across major currency pairs. By aggregating price action from 7 pairs into a composite candlestick chart and synchronizing trends across multiple timeframes, the indicator eliminates the limitations of analyzing individual pairs in isolation. This comprehensive approach ensures traders can identify trends and opportunities with greater accuracy and confidence.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.