PROTECTED SOURCE SCRIPT

RSI with AVG MA'S -> PROFABIGHI_CAPITAL

🌟 Overview

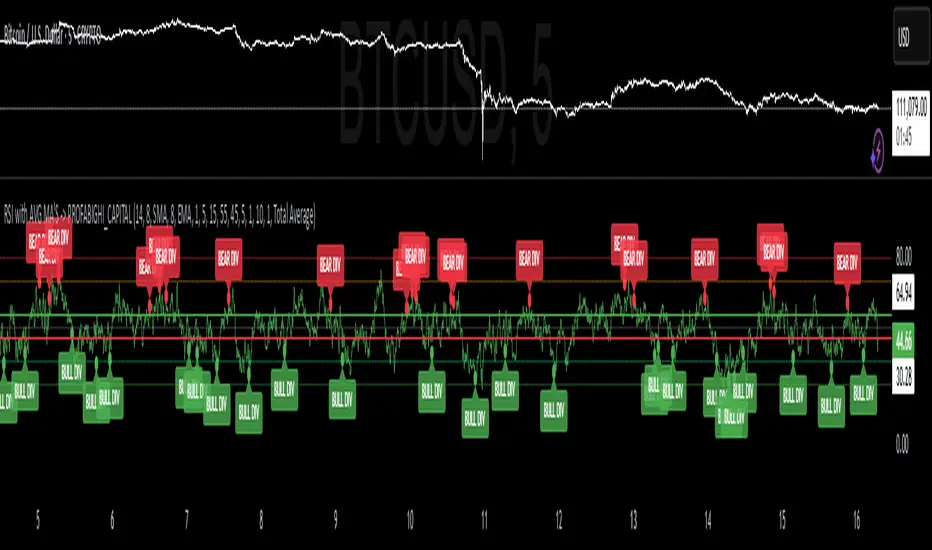

The RSI with AVG MAs → PROFABIGHI_CAPITAL indicator enhances traditional RSI analysis by layering moving averages across multiple timeframes, providing smoothed momentum signals and divergence detection for spotting overbought/oversold conditions and potential reversals. It allows traders to focus on averaged RSI values or individual components for clearer entry cues in trending or ranging markets.

⚙️ RSI & MA Settings

– RSI Period: Adjustable lookback for calculating relative strength across selected timeframes.

– MA1 Period & Type: Length and style for the first smoothing layer on RSI, with options from simple to advanced adaptive averages.

– MA2 Period & Type: Length and style for the second smoothing layer, enabling dual-filtered RSI views for reduced noise.

⏰ Timeframe Settings

– Timeframe 1, 2, 3: Select higher timeframes to aggregate RSI and MA data, creating a multi-resolution momentum overview.

📏 Level Settings

– Long Line: Customizable threshold for bullish momentum signals based on averaged RSI crossovers.

– Short Line: Customizable threshold for bearish momentum signals, aiding quick reversal identification.

🔍 Divergence Settings

– Pivot Lookback: Bars to scan for highs/lows in price and RSI for divergence patterns.

– Label Offset: Positioning adjustment for visual divergence markers.

– Divergence Pivot Detection Length: Sensitivity control for left-side pivot confirmation to balance signals.

– Divergence Pivot Confirmation Length: Right-side delay for fewer false positives in pattern validation.

– Plot Bullish/Bearish Divergences: Toggles for displaying upward (bullish) or downward (bearish) divergence alerts.

👁️ Display Options

– Display Option: Choose to show all lines, specific MAs, raw RSI, or the total average for customized chart focus.

📊 Multi-Timeframe Calculations

The indicator computes RSI on each selected timeframe, then applies chosen moving averages to smooth values, averaging them for a consensus signal that filters single-timeframe noise. Divergences are scanned by comparing price pivots against averaged RSI extremes, highlighting mismatches for reversal potential.

📈 Signal Generation

– Momentum Crossovers: Bullish cues when averages rise above the long line; bearish when dropping below the short line.

– Overbought/Oversold Alerts: Warnings for averages crossing extreme levels like 70 or 80 for caution, and 50 for directional shifts.

– Divergence Triggers: Bullish when price hits lower lows but RSI forms higher lows; bearish on price higher highs with RSI lower highs.

🔔 Alert Conditions

– MA & Total Average Alerts: Notifications for entries into danger zones (above 70/80) or health/sell zones (below 70/50).

– RSI Pressure Alerts: Signals for overbought pressure above 70 or selling momentum below 50.

– Divergence Alerts: Specific messages for bullish or bearish patterns, including price and RSI value details.

📉 Visualization

– Averaged Lines: Color-coded plots for individual timeframes, MAs, RSI, or totals, with options to isolate views.

– Horizontal Levels: Dotted lines at standard extremes (80/70/50/35/25) and solid custom lines for long/short thresholds.

– Divergence Markers: Circle plots at pivot points, with labeled boxes detailing price/RSI comparisons for quick scans.

– Flexible Display: Toggle between full clutter or streamlined averages to suit analysis style.

✅ Key Takeaways

– Multi-timeframe RSI smoothing uncovers reliable momentum without single-frame whipsaws.

– Dual MAs and averages provide layered confirmation for crossovers and extremes.

– Built-in divergences add reversal edge, with alerts for hands-free monitoring.

– Customizable views and levels adapt to any timeframe or trading approach.

The RSI with AVG MAs → PROFABIGHI_CAPITAL indicator enhances traditional RSI analysis by layering moving averages across multiple timeframes, providing smoothed momentum signals and divergence detection for spotting overbought/oversold conditions and potential reversals. It allows traders to focus on averaged RSI values or individual components for clearer entry cues in trending or ranging markets.

⚙️ RSI & MA Settings

– RSI Period: Adjustable lookback for calculating relative strength across selected timeframes.

– MA1 Period & Type: Length and style for the first smoothing layer on RSI, with options from simple to advanced adaptive averages.

– MA2 Period & Type: Length and style for the second smoothing layer, enabling dual-filtered RSI views for reduced noise.

⏰ Timeframe Settings

– Timeframe 1, 2, 3: Select higher timeframes to aggregate RSI and MA data, creating a multi-resolution momentum overview.

📏 Level Settings

– Long Line: Customizable threshold for bullish momentum signals based on averaged RSI crossovers.

– Short Line: Customizable threshold for bearish momentum signals, aiding quick reversal identification.

🔍 Divergence Settings

– Pivot Lookback: Bars to scan for highs/lows in price and RSI for divergence patterns.

– Label Offset: Positioning adjustment for visual divergence markers.

– Divergence Pivot Detection Length: Sensitivity control for left-side pivot confirmation to balance signals.

– Divergence Pivot Confirmation Length: Right-side delay for fewer false positives in pattern validation.

– Plot Bullish/Bearish Divergences: Toggles for displaying upward (bullish) or downward (bearish) divergence alerts.

👁️ Display Options

– Display Option: Choose to show all lines, specific MAs, raw RSI, or the total average for customized chart focus.

📊 Multi-Timeframe Calculations

The indicator computes RSI on each selected timeframe, then applies chosen moving averages to smooth values, averaging them for a consensus signal that filters single-timeframe noise. Divergences are scanned by comparing price pivots against averaged RSI extremes, highlighting mismatches for reversal potential.

📈 Signal Generation

– Momentum Crossovers: Bullish cues when averages rise above the long line; bearish when dropping below the short line.

– Overbought/Oversold Alerts: Warnings for averages crossing extreme levels like 70 or 80 for caution, and 50 for directional shifts.

– Divergence Triggers: Bullish when price hits lower lows but RSI forms higher lows; bearish on price higher highs with RSI lower highs.

🔔 Alert Conditions

– MA & Total Average Alerts: Notifications for entries into danger zones (above 70/80) or health/sell zones (below 70/50).

– RSI Pressure Alerts: Signals for overbought pressure above 70 or selling momentum below 50.

– Divergence Alerts: Specific messages for bullish or bearish patterns, including price and RSI value details.

📉 Visualization

– Averaged Lines: Color-coded plots for individual timeframes, MAs, RSI, or totals, with options to isolate views.

– Horizontal Levels: Dotted lines at standard extremes (80/70/50/35/25) and solid custom lines for long/short thresholds.

– Divergence Markers: Circle plots at pivot points, with labeled boxes detailing price/RSI comparisons for quick scans.

– Flexible Display: Toggle between full clutter or streamlined averages to suit analysis style.

✅ Key Takeaways

– Multi-timeframe RSI smoothing uncovers reliable momentum without single-frame whipsaws.

– Dual MAs and averages provide layered confirmation for crossovers and extremes.

– Built-in divergences add reversal edge, with alerts for hands-free monitoring.

– Customizable views and levels adapt to any timeframe or trading approach.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.