OPEN-SOURCE SCRIPT

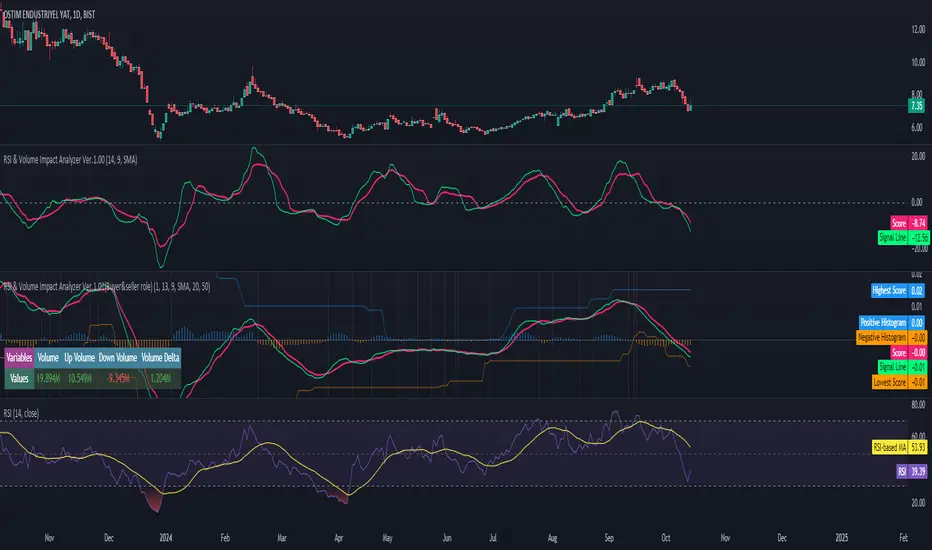

Updated RSI & Volume Impact Analyzer Ver.1.00

Description:

The RSI VOL Score indicator combines the Relative Strength Index (RSI) and volume data through a mathematical calculation to assist traders in identifying and confirming potential trend reversals and continuations. By leveraging both momentum (RSI) and volume data, this indicator provides a more comprehensive view of market strength compared to using RSI or volume alone.

How It Works:

This indicator calculates a score by comparing the RSI against its moving average, adjusted by the volume data. The resulting score quantifies market momentum and strength. When the score crosses its signal line, it may indicate key moments where the market shifts between bullish and bearish trends, potentially helping traders spot these changes earlier.

Calculation Methods:

The RSI VOL Score allows users to select between several calculation methods to suit their strategy:

SMA (Simple Moving Average): Provides a balanced smoothing approach.

EMA (Exponential Moving Average): Reacts more quickly to recent price changes, offering faster signals.

VWMA (Volume Weighted Moving Average): Emphasizes high-volume periods, focusing on stronger market moves.

WMA (Weighted Moving Average): Applies greater weight to recent data for a more responsive signal.

What the Indicator Plots:

Score Line: Represents a combined metric based on RSI and volume, helping traders gauge the overall strength of the trend.

Signal Line: A smoothed version of the score that helps traders identify potential trend changes. Bullish signals occur when the score crosses above the signal line, while bearish signals occur when the score drops below.

Key Features:

Trend Identification: The score and signal line crossovers can help confirm emerging bullish or bearish trends, allowing traders to act on upward or downward momentum.

Customizable Settings: Traders can adjust the lengths of the RSI and signal line and choose between different moving averages (SMA, EMA, VWMA, WMA) to tailor the indicator to their trading style.

Timeframe-Specific: The indicator works within the selected timeframe, ensuring accurate trend analysis based on the current market context.

Practical Use Cases:

Trending Markets: In trending markets, this indicator helps confirm bullish or bearish signals by validating price moves with volume. Traders can use the crossover of the score and signal line as a guide for entering or exiting trades based on trend strength.

Ranging Markets: In ranging markets, the indicator helps filter out false signals by confirming if price movements are backed by volume, making it a useful tool for traders looking to avoid entering during weak or uncertain market conditions.

Interpreting the Score and Signal Lines:

Bullish Signal: A bullish signal occurs when the score crosses above the signal line, indicating a potential upward trend in momentum and price.

Bearish Signal: A bearish signal is generated when the score crosses below the signal line, suggesting a potential downward trend or weakening market momentum.

By mathematically combining RSI and volume data into a single trend score, the RSI VOL Score indicator provides traders with a powerful tool for identifying trend shifts early and making more confident trading decisions.

Important Note:

The signals generated by this indicator should be interpreted in conjunction with other analysis tools. It is always advisable to confirm signals before making any trading decisions.

Disclaimer:

This indicator is designed to assist traders in their decision-making process and does not provide financial advice. The creators of this tool are not responsible for any financial losses or trading decisions made based on its signals. Trading involves significant risk, and users should seek professional advice or conduct their own research before making any trading decisions.

The RSI VOL Score indicator combines the Relative Strength Index (RSI) and volume data through a mathematical calculation to assist traders in identifying and confirming potential trend reversals and continuations. By leveraging both momentum (RSI) and volume data, this indicator provides a more comprehensive view of market strength compared to using RSI or volume alone.

How It Works:

This indicator calculates a score by comparing the RSI against its moving average, adjusted by the volume data. The resulting score quantifies market momentum and strength. When the score crosses its signal line, it may indicate key moments where the market shifts between bullish and bearish trends, potentially helping traders spot these changes earlier.

Calculation Methods:

The RSI VOL Score allows users to select between several calculation methods to suit their strategy:

SMA (Simple Moving Average): Provides a balanced smoothing approach.

EMA (Exponential Moving Average): Reacts more quickly to recent price changes, offering faster signals.

VWMA (Volume Weighted Moving Average): Emphasizes high-volume periods, focusing on stronger market moves.

WMA (Weighted Moving Average): Applies greater weight to recent data for a more responsive signal.

What the Indicator Plots:

Score Line: Represents a combined metric based on RSI and volume, helping traders gauge the overall strength of the trend.

Signal Line: A smoothed version of the score that helps traders identify potential trend changes. Bullish signals occur when the score crosses above the signal line, while bearish signals occur when the score drops below.

Key Features:

Trend Identification: The score and signal line crossovers can help confirm emerging bullish or bearish trends, allowing traders to act on upward or downward momentum.

Customizable Settings: Traders can adjust the lengths of the RSI and signal line and choose between different moving averages (SMA, EMA, VWMA, WMA) to tailor the indicator to their trading style.

Timeframe-Specific: The indicator works within the selected timeframe, ensuring accurate trend analysis based on the current market context.

Practical Use Cases:

Trending Markets: In trending markets, this indicator helps confirm bullish or bearish signals by validating price moves with volume. Traders can use the crossover of the score and signal line as a guide for entering or exiting trades based on trend strength.

Ranging Markets: In ranging markets, the indicator helps filter out false signals by confirming if price movements are backed by volume, making it a useful tool for traders looking to avoid entering during weak or uncertain market conditions.

Interpreting the Score and Signal Lines:

Bullish Signal: A bullish signal occurs when the score crosses above the signal line, indicating a potential upward trend in momentum and price.

Bearish Signal: A bearish signal is generated when the score crosses below the signal line, suggesting a potential downward trend or weakening market momentum.

By mathematically combining RSI and volume data into a single trend score, the RSI VOL Score indicator provides traders with a powerful tool for identifying trend shifts early and making more confident trading decisions.

Important Note:

The signals generated by this indicator should be interpreted in conjunction with other analysis tools. It is always advisable to confirm signals before making any trading decisions.

Disclaimer:

This indicator is designed to assist traders in their decision-making process and does not provide financial advice. The creators of this tool are not responsible for any financial losses or trading decisions made based on its signals. Trading involves significant risk, and users should seek professional advice or conduct their own research before making any trading decisions.

Release Notes

RSI & Volume Impact Analyzer Ver. 1.01 (Buyer & Seller Role)Description: The updated RSI & Volume Impact Analyzer combines traditional RSI and advanced volume analysis by integrating buyer and seller activity, offering traders a more nuanced view of market momentum. This version introduces volume delta calculations and up/down volume analysis, providing insights into buying and selling pressure within the market. By comparing the RSI against its moving average and factoring in volume dynamics, this indicator helps traders identify potential trend reversals and market strength with greater precision.

New Features & Improvements:

Buyer & Seller Volume Analysis:

This update introduces the calculation of up volume, down volume, and volume delta, allowing users to see the balance between buyers and sellers.

A detailed table is included to display these values directly on the chart, making it easier to assess the overall market activity and pressure at a glance.

Volume Delta Integration for Momentum:

Instead of relying on traditional volume, this version uses volume delta to adjust the score calculation. This new approach helps traders better identify market momentum shifts based on buyer and seller pressure.

Visual Crossover Lines:

Vertical lines are now plotted whenever the score crosses the signal line. Green lines indicate a bullish crossover, while red lines mark a bearish crossover, giving traders a clear visual cue for potential market entry and exit points.

Highest/Lowest Score Tracking:

The indicator now tracks the highest and lowest score over a customizable lookback period. This feature allows traders to see the relative strength of momentum over time, offering valuable context when interpreting signals.

Histogram Visualization:

A histogram is introduced to visualize the difference between the score and signal lines. Positive differences are plotted in blue, while negative differences are shown in orange. This makes it easier to identify momentum direction and strength at a glance.

Core Functionality:

Score Line:

Combines RSI and volume delta to create a comprehensive market strength metric. The score line helps traders gauge the overall momentum and potential trend direction.

Signal Line:

A smoothed version of the score line, designed to filter out noise and provide clear signals for potential trend changes.

Trend Identification:

The crossover of the score and signal lines highlights potential bullish and bearish signals, helping traders confirm emerging trends and take action accordingly.

Customizable Settings:

Users can adjust the RSI and volume delta lengths, as well as the signal line calculation method (SMA, EMA, VWMA, WMA), to fit their personal trading strategies.

Practical Use Cases:

Trending Markets: Use the score and signal line crossovers to confirm trends, validating price moves with volume dynamics to avoid false signals.

Ranging Markets: The inclusion of volume delta ensures that the indicator remains effective even in sideways markets by highlighting periods of stronger buying or selling pressure.

Interpreting the Indicator:

Bullish Signal: A bullish signal occurs when the score crosses above the signal line, indicating a potential upward trend in price and market momentum.

Bearish Signal: A bearish signal is generated when the score crosses below the signal line, suggesting weakening market momentum or a potential downward trend.

Important Note: The RSI & Volume Impact Analyzer is designed to be used in conjunction with other analysis tools. It is advisable to confirm signals from this indicator before making any trading decisions.

Disclaimer: This indicator is intended to assist traders in their decision-making process and does not provide financial advice. The developers of this tool are not responsible for any financial losses or trading decisions made based on its signals. Trading involves significant risk, and users should seek professional advice or conduct their own research before making any trading decisions.

Release Notes

RSI & Volume Impact Analyzer – Ver. 1.02 Update NotesRelease Date: June 2025

What’s New:

Improved Visual Accessibility

Volume table text colors (for up volume, down volume, and delta) have been updated with higher-contrast tones for better visibility on white and light backgrounds. This change was based on user feedback.

Score Scaling Adjustment

The calculated score is now multiplied by 1000 for better visual clarity. This makes score differences easier to detect and improves overall chart readability.

Pine Script Version Update

The script has been upgraded to Pine Script version 6, with updated import references to ensure full compatibility with the latest TradingView engine.

Histogram Style Enhancement

The histogram plot has been changed from bar style to column style for a cleaner and more structured visual effect.

Refined Aesthetic Improvements

Minor color updates have been applied to the score line, signal line, and the highest/lowest score plots for a more balanced and readable display.

Summary:

Version 1.02 is a visual and structural refinement of version 1.01. The core logic and analytical framework remain unchanged. This update improves visibility, modernizes styling, and enhances user experience without affecting signal integrity.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.