PROTECTED SOURCE SCRIPT

Updated Shark 32 Pattern Pro

Hello Traders!

The Shark32 pattern comprises multiple inside bars—each candle’s high/low is contained within the previous candle’s range—creating a tight consolidation zone. Once price breaks out, volatility frequently expands, producing sharper moves. The pattern is known for its relatively high continuation rate and the ability to offer tight risk/reward setups. It also calculates statistics, highlights stop/target levels, and offers fully customizable visuals so you can adapt the tool to your trading style.

Key Features:

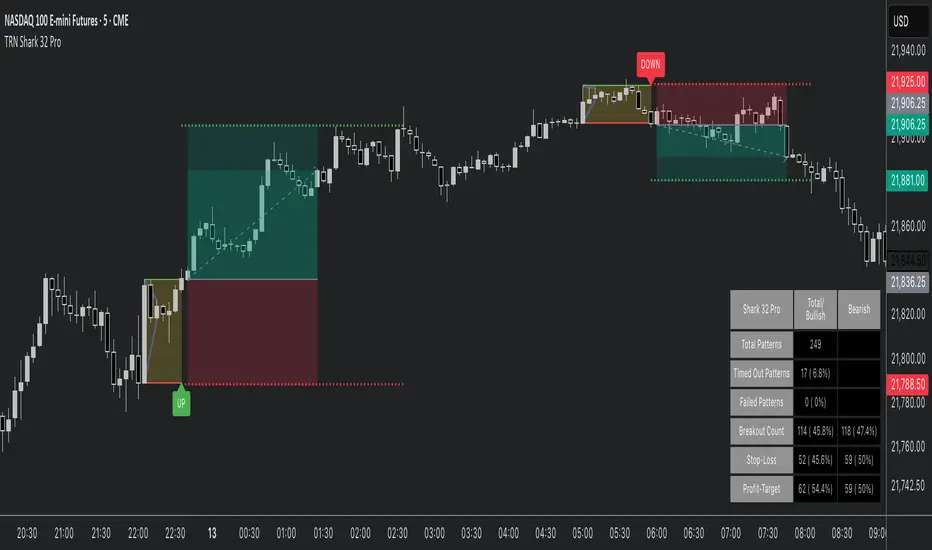

[chart image placeholder – Show a breakout and labeled stop-loss/target lines, highlighting potential trade management.]

Statistics at a Glance (based on Bulkowski's studies):

How to Trade with This Indicator:

Tips for Better Reliability:

[chart image placeholder – Demonstrate a failed breakout labeled “Shark 32 Failure,” noting quick stop-loss execution.]

Why This Indicator?

Final Thoughts:

This Shark 32 Pro indicator gives you a systematic way to spot—and trade—a compact yet powerful three-candle formation. Combine it with solid risk management and trend analysis for best results. Monitor volume and confirm breakouts with a candle close beyond the pattern’s range. While the pattern can fail, tight stops and clear targets help keep your trading efficient and disciplined.

The Shark32 pattern comprises multiple inside bars—each candle’s high/low is contained within the previous candle’s range—creating a tight consolidation zone. Once price breaks out, volatility frequently expands, producing sharper moves. The pattern is known for its relatively high continuation rate and the ability to offer tight risk/reward setups. It also calculates statistics, highlights stop/target levels, and offers fully customizable visuals so you can adapt the tool to your trading style.

Key Features:

- Detects Shark 32 With Unlimited Inside Bars:

Automatically spots consecutive inside candles (not limited to just two), enabling you to catch more nuanced patterns. - Highlights Breakout:

Clear visual lines and labels mark where price breaks above/below the pattern boundary. - Stop-Loss & Profit Targets:

Draws a suggested stop-loss line and a projected target line, helping you manage risk and set profit objectives quickly. - Statistics & Analysis:

A built-in statistics table tracks pattern frequency, breakouts, stop-hits, target-hits, and more—helping you refine your strategy over time. - Fully Customizable Visuals:

Control line styles, colors, breakout labels, box fill, and more to fit your preference or chart theme. - Quick Resolutions:

This pattern forms fast and typically resolves within just a few bars, appealing to short-term traders.

[chart image placeholder – Show a breakout and labeled stop-loss/target lines, highlighting potential trade management.]

Statistics at a Glance (based on Bulkowski's studies):

- Continuation Bias: ~60% continuation bias.

- Measured Move: 70%+ of bullish breakouts (in bull markets) reach the measured move.

- Throwback: ~64% chance price retraces to the breakout level after an upside break.

- Trend Alignment: Historically, success rates improve when trading in line with the larger trend.

How to Trade with This Indicator:

- Identifying the Pattern: Wait till a Shark 32 pattern is formed.

- Entry Rule: Enter on a confirmed close above the pattern high (for bullish) or below the pattern low (for bearish).

- Stop Placement: Place stops a few ticks beyond the opposite side of the pattern. Tight ranges = small risk. Or use the mid-range of the pattern as a stop level.

- Target Options: Aim for Risk/Reward Ratio of 2R or 3R to capture a strong follow-through. Alternatively, use the measured move of the first bar's height as a target.

Tips for Better Reliability:

- Trend Alignment: Shark 32 breakouts usually work best in the direction of the broader market or trend.

- Confirmation: Look for a significant volume increase at the breakout—helps filter out “fake” moves.

- Throwback Awareness: ~64% of upside breakouts retest the pattern boundary; stay patient if you see a pullback.

- Risk Management: Maintain tight stops and consider using alerts for activation/breakout signals.

[chart image placeholder – Demonstrate a failed breakout labeled “Shark 32 Failure,” noting quick stop-loss execution.]

Why This Indicator?

- Clear Visuals: Highlights the pattern boundary, breakout lines, and potential stop/target levels.

- Customizable: Lets you adjust line styles, risk parameters, alerts, and statistics display.

- Statistical Edge: Built-in table aggregates pattern counts, success/failure rates, and average durations.

Final Thoughts:

This Shark 32 Pro indicator gives you a systematic way to spot—and trade—a compact yet powerful three-candle formation. Combine it with solid risk management and trend analysis for best results. Monitor volume and confirm breakouts with a candle close beyond the pattern’s range. While the pattern can fail, tight stops and clear targets help keep your trading efficient and disciplined.

Release Notes

Chart got updatedProtected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Get Instant Access NOW: trntrading.ai

Join Our Free Discord: discord.gg/JmPJkKtE8Q

Documentation: docs.trntrading.ai

Join Our Free Discord: discord.gg/JmPJkKtE8Q

Documentation: docs.trntrading.ai

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Get Instant Access NOW: trntrading.ai

Join Our Free Discord: discord.gg/JmPJkKtE8Q

Documentation: docs.trntrading.ai

Join Our Free Discord: discord.gg/JmPJkKtE8Q

Documentation: docs.trntrading.ai

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.