OPEN-SOURCE SCRIPT

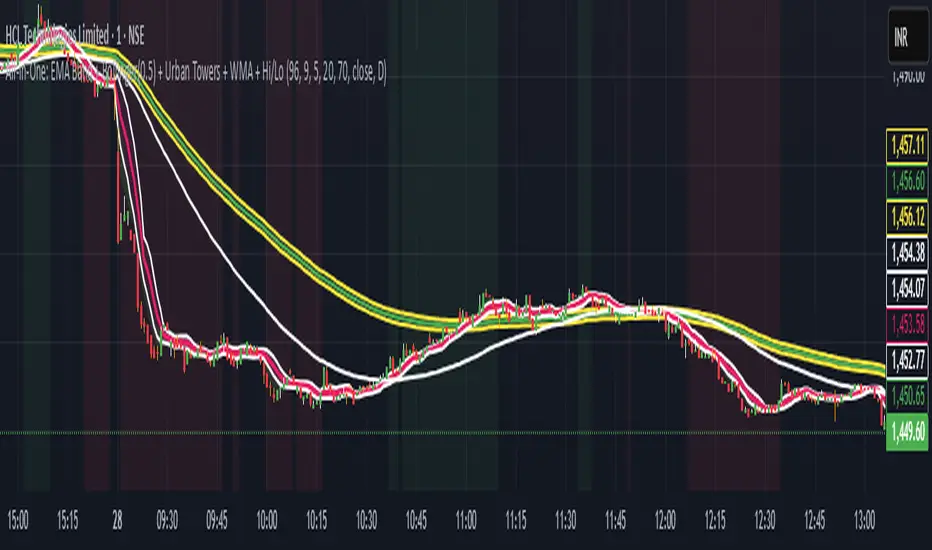

Updated Scalping, Swing Pro: Urban Towers + Bollinger(0.5)+ WMA by Kidev

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.

Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Release Notes

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Release Notes

This indicator combines narrow Bollinger Bands (σ = 0.5) with a Weighted Moving Average (WMA-96) to provide traders with a reliable framework for identifying both short-term scalps and medium-term swing setups.Bollinger Bands (0.5σ):

Traditional Bollinger Bands at 2σ cover ~95% of price movement, while 0.5σ bands narrow the focus to ~50% of price activity. This tighter structure makes them ideal for detecting volatility contractions, consolidations, and early breakout signals.

WMA-96 as Trend Reference:

The 96-period WMA acts as a slower, more stable directional guide. Unlike shorter WMAs, this longer setting filters noise and serves as a reference line for the dominant trend. Traders can use it as an anchor for intraday or swing positions.

Scalping & Swing Benefits:

Price holding above the WMA-96 while staying near the upper 0.5σ band often signals strength.

Contractions (squeezes) in the 0.5σ band followed by expansion frequently mark breakout zones.

Pullbacks toward the WMA-96 combined with band signals can act as re-entry or risk-defined trade areas.

This script provides a balanced view of momentum and stability — the 0.5σ bands reveal short-term volatility shifts, while the WMA-96 grounds the trader in the prevailing trend.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.