OPEN-SOURCE SCRIPT

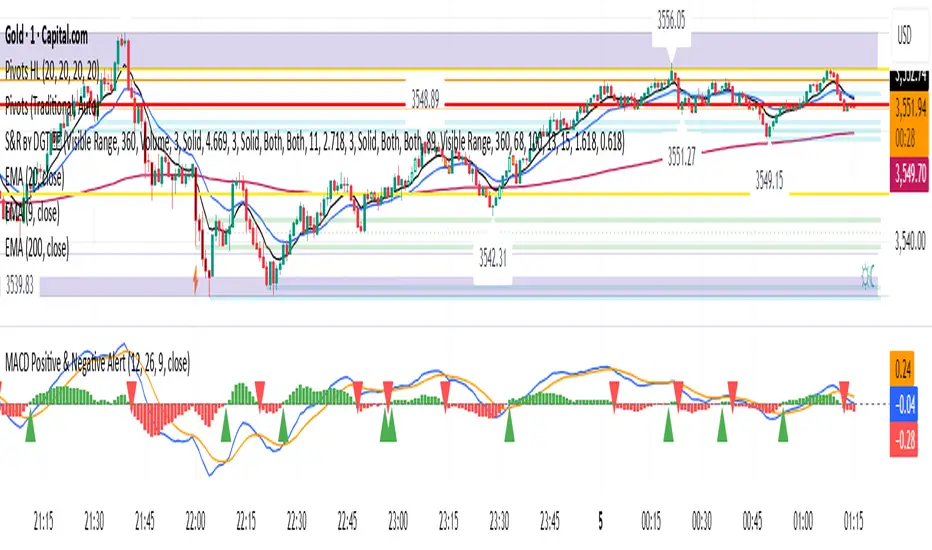

MACD Positive & Negative Alert

The MACD (Moving Average Convergence Divergence) is a momentum and trend-following indicator that helps traders identify the strength and direction of a trend, spot potential reversals, and fine-tune entry/exit timing.

Core Components

- MACD Line:

The difference between the 12-period and 26-period EMA (Exponential Moving Averages). This line highlights shifts in momentum and identifies the prevailing trend direction.

- Signal Line:

A 9-period EMA of the MACD line, acting as a trigger for buy/sell signals. When the MACD line crosses above the signal line, it suggests a bullish signal; when it crosses below, it suggests a bearish one.

- Histogram:

Shows the difference between the MACD line and the signal line as a bar graph. The histogram helps traders gauge the strength of the momentum and can warn of possible reversals. A rapidly growing histogram means strengthening momentum, while a shrinking one indicates weakening momentum.

Main Uses

- Trend Identification:

A positive MACD value typically signals a bullish trend, while a negative value signals a bearish trend.

- Momentum Analysis:

Divergences between MACD and price can warn of upcoming reversals. Increasing MACD histogram bars confirm strong momentum; shrinking bars suggest consolidation or reversal.

- Signal Generation:

Crossovers between the MACD line and the signal line generate trade signals—bullish (buy) if the MACD moves above the signal, bearish (sell) if it falls below l.

Example Interpretation

- MACD Crossover:

If the MACD line crosses above the signal line, it's often considered a buy signal; a cross below is a sell signal.

- Zero Line Cross:

If the MACD histogram moves from below zero to above, this is considered a bullish momentum shift; above zero to below is a bearish move.

The MACD is most effective in trending markets and should ideally be used alongside additional indicators for robust trading decisions.

Core Components

- MACD Line:

The difference between the 12-period and 26-period EMA (Exponential Moving Averages). This line highlights shifts in momentum and identifies the prevailing trend direction.

- Signal Line:

A 9-period EMA of the MACD line, acting as a trigger for buy/sell signals. When the MACD line crosses above the signal line, it suggests a bullish signal; when it crosses below, it suggests a bearish one.

- Histogram:

Shows the difference between the MACD line and the signal line as a bar graph. The histogram helps traders gauge the strength of the momentum and can warn of possible reversals. A rapidly growing histogram means strengthening momentum, while a shrinking one indicates weakening momentum.

Main Uses

- Trend Identification:

A positive MACD value typically signals a bullish trend, while a negative value signals a bearish trend.

- Momentum Analysis:

Divergences between MACD and price can warn of upcoming reversals. Increasing MACD histogram bars confirm strong momentum; shrinking bars suggest consolidation or reversal.

- Signal Generation:

Crossovers between the MACD line and the signal line generate trade signals—bullish (buy) if the MACD moves above the signal, bearish (sell) if it falls below l.

Example Interpretation

- MACD Crossover:

If the MACD line crosses above the signal line, it's often considered a buy signal; a cross below is a sell signal.

- Zero Line Cross:

If the MACD histogram moves from below zero to above, this is considered a bullish momentum shift; above zero to below is a bearish move.

The MACD is most effective in trending markets and should ideally be used alongside additional indicators for robust trading decisions.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.