OPEN-SOURCE SCRIPT

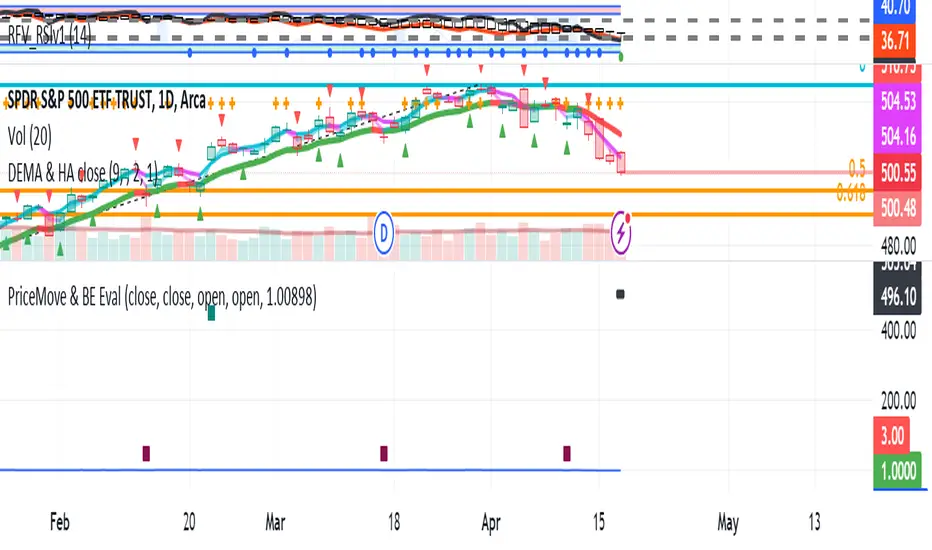

Updated Price Move exceed % Threshold & BE Evaluation -Tom1trader

https://www.tradingview.com/chart/OsBXckpZ/

Category is difficult with this one. I chose ROC as the closest as this measures the historical % of a given change amount.

This indicator is in a separate panel above or below the main chart. I use it only for Options trading to help with probability reckoning.

Use it (at your own risk) and the code freely and please ask any questions, glad to add detail / clarify and glad to know if you see I screwed something up. :-)

1. Plots when a percent move per candle is exceeded [from previous close] +exceeded is an "x" at top of panel and - is an "x" at panel bottom.

2. Plots (at last candle only) prices that are the selected % above and below the current close with thick black lines. TIP: For this to work best, in chart settings

"Scales" tab, check the "Indicator last value" and "No overlapping labels" check box.

3. Sums the number of times it occurs in a given number of candles ("Bars to sum . ." input).

TIP: On longer time frames (month+) reduce the length ("Bars . . sum" input) until get sums% plot.

4. Plots green and red lines for plus and minus sums as a percentage.

User inputs:

***** BTW did you know you can customize the time frame so one candle is (for example) 3 trading days?

1. Set the time frame of chart - NOTE this can be customized to what you need by scrolling to the bottom and adding the time frame you want i.e. 3 days or 2

weeks per candle. Remember these are trading times so 21 calendar days are 3 weeks or 15 trading days.

2. Choose the % threshold default 2% (+1.02 and its inverse for -) steps are 1/10th of a % (.001).

3. Choose the sum length("Bars . . sum . ") from 10 to 100 in number of candles.

Bottom line you can see the historical percentages and prices for a given percent move or can dial in a given break even (plus , minus or both) to see its past % occurrence and % move. One has to take into account changes in the market which show up clearly from the x above or below showing each occurrence (example: See more hits ("x"s) recently? Sum for recent length only to get more accurate reflection of market now.). Anyhow it is fun to play with and is part of how I do my own probability reckoning.

Category is difficult with this one. I chose ROC as the closest as this measures the historical % of a given change amount.

This indicator is in a separate panel above or below the main chart. I use it only for Options trading to help with probability reckoning.

Use it (at your own risk) and the code freely and please ask any questions, glad to add detail / clarify and glad to know if you see I screwed something up. :-)

1. Plots when a percent move per candle is exceeded [from previous close] +exceeded is an "x" at top of panel and - is an "x" at panel bottom.

2. Plots (at last candle only) prices that are the selected % above and below the current close with thick black lines. TIP: For this to work best, in chart settings

"Scales" tab, check the "Indicator last value" and "No overlapping labels" check box.

3. Sums the number of times it occurs in a given number of candles ("Bars to sum . ." input).

TIP: On longer time frames (month+) reduce the length ("Bars . . sum" input) until get sums% plot.

4. Plots green and red lines for plus and minus sums as a percentage.

User inputs:

***** BTW did you know you can customize the time frame so one candle is (for example) 3 trading days?

1. Set the time frame of chart - NOTE this can be customized to what you need by scrolling to the bottom and adding the time frame you want i.e. 3 days or 2

weeks per candle. Remember these are trading times so 21 calendar days are 3 weeks or 15 trading days.

2. Choose the % threshold default 2% (+1.02 and its inverse for -) steps are 1/10th of a % (.001).

3. Choose the sum length("Bars . . sum . ") from 10 to 100 in number of candles.

Bottom line you can see the historical percentages and prices for a given percent move or can dial in a given break even (plus , minus or both) to see its past % occurrence and % move. One has to take into account changes in the market which show up clearly from the x above or below showing each occurrence (example: See more hits ("x"s) recently? Sum for recent length only to get more accurate reflection of market now.). Anyhow it is fun to play with and is part of how I do my own probability reckoning.

Release Notes

Count occurrences of price exceeding a chosen % move with up and down moves counted separately. Source in "from" period and target in "to" period selectable (i.e. How many times in last selected period has the price gone down and up from previous [choice ohlc] to current [choice ohlc] candle? More detail: In last 100 trading 1Ds from the close of one day until the open of the next day has price exceeded the selected percentage [.02 = 2%]? 1D in this case just means it is being used in the daily timeframe. Useful to determine how often your target or break even or stop loss etc. has been exceeded/hit in the past. Because you can look at each occurrence you can see the situation when it happened [up/down trend, reversal point, after exhaustion move and etc.Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.