OPEN-SOURCE SCRIPT

DRACO TOMAS EMA Trend Follower

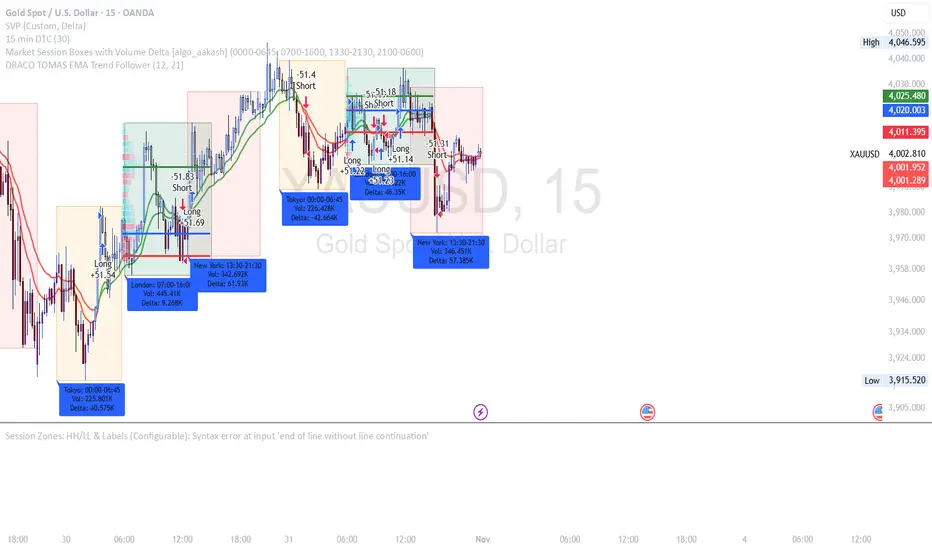

🐉 DRACO TOMAS EMA Trend Follower

Description:

The DRACO TOMAS EMA Trend Follower is a simple yet powerful trend-following strategy designed to capture directional moves based on exponential moving average (EMA) crossovers. It automatically detects trend changes and manages positions dynamically.

Core Logic:

The strategy uses two EMAs — a Fast EMA (default 12) and a Slow EMA (default 21) — to identify the market trend.

When the Fast EMA crosses above the Slow EMA, the strategy opens a long position, signaling bullish momentum.

When the Fast EMA crosses below the Slow EMA, the strategy opens a short position, signaling bearish momentum.

The color of the EMAs changes dynamically: green for uptrends, red for downtrends.

Exit rules:

Longs are closed when the EMAs turn red (trend reversal to bearish).

Shorts are closed when the EMAs turn green (trend reversal to bullish).

Position Sizing:

The system uses 10% of equity per trade by default, allowing flexible risk management and compounding.

Purpose:

Designed for traders who want a clean and efficient EMA crossover system to follow trends automatically on any timeframe or asset.

Best Used For:

Swing trading and trend confirmation

Identifying major directional shifts

Testing EMA-based momentum systems

Description:

The DRACO TOMAS EMA Trend Follower is a simple yet powerful trend-following strategy designed to capture directional moves based on exponential moving average (EMA) crossovers. It automatically detects trend changes and manages positions dynamically.

Core Logic:

The strategy uses two EMAs — a Fast EMA (default 12) and a Slow EMA (default 21) — to identify the market trend.

When the Fast EMA crosses above the Slow EMA, the strategy opens a long position, signaling bullish momentum.

When the Fast EMA crosses below the Slow EMA, the strategy opens a short position, signaling bearish momentum.

The color of the EMAs changes dynamically: green for uptrends, red for downtrends.

Exit rules:

Longs are closed when the EMAs turn red (trend reversal to bearish).

Shorts are closed when the EMAs turn green (trend reversal to bullish).

Position Sizing:

The system uses 10% of equity per trade by default, allowing flexible risk management and compounding.

Purpose:

Designed for traders who want a clean and efficient EMA crossover system to follow trends automatically on any timeframe or asset.

Best Used For:

Swing trading and trend confirmation

Identifying major directional shifts

Testing EMA-based momentum systems

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.