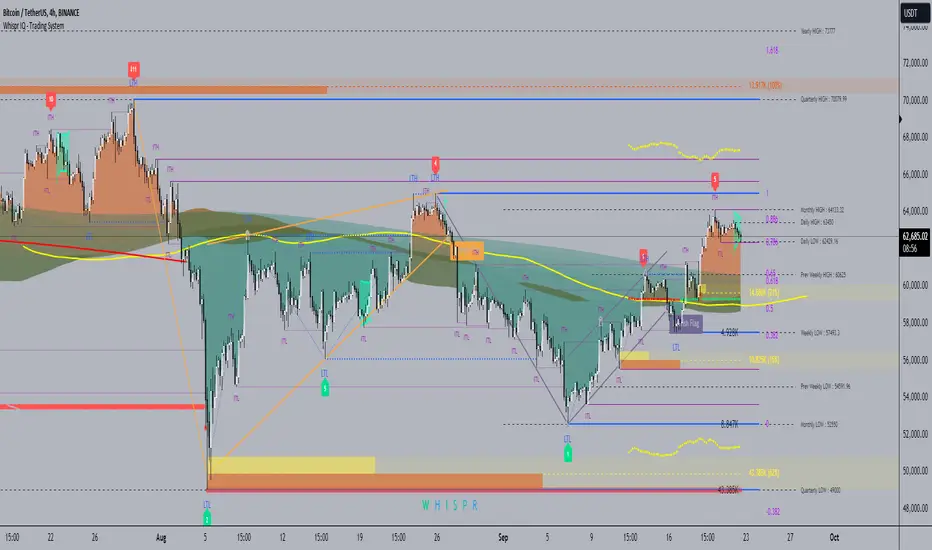

Whispr IQ - Trading System

This advanced multi-component indicator combines several powerful analysis tools to provide a comprehensive view of market conditions and potential trading opportunities.

Key Components:

Kernel Regression Ribbon

Institutional Order Flow

Volume Profile

Order Blocks

Swing Points and Liquidity

Naked POC (Point of Control)

Fibonacci Levels

Zig Zag Patterns

Divergence Scanner

Squeeze Bands

How It Works:

Kernel Regression Ribbon

Uses kernel regression to create a smoothed ribbon of price action

Multiple timeframes analyzed to show short, medium and long-term trends

Color coding indicates bullish/bearish bias

Institutional Order Flow

Identifies areas of high volume and potential institutional activity

Highlights order blocks, liquidity levels, and fair value gaps

Helps visualize potential support/resistance zones

Volume Profile

Displays volume distribution at different price levels

Identifies high volume nodes and value areas

Useful for determining potential reversal points

Order Blocks

Highlights significant swing highs/lows with high volume

Indicates potential areas where large players may have placed orders

Useful for identifying key support/resistance levels

Swing Points and Liquidity

Marks major swing highs and lows

Highlights areas of potential liquidity buildup

Helps identify trend changes and potential reversal zones

Naked POC

Shows uncovered Points of Control from volume profile analysis

Indicates areas of high trading activity that price has moved away from

Potential magnet for price to return to

Fibonacci Levels

Plots key Fibonacci retracement and extension levels

Useful for identifying potential support, resistance and targets

Multiple Fibonacci sequences used for confirmation

Zig Zag Patterns

Identifies key swing highs and lows

Filters out minor price movements

Helps visualize overall trend structure

Divergence Scanner

Scans for regular and hidden divergences on multiple indicators

Signals potential trend reversals or continuations

Configurable to scan RSI, MACD, CCI and other oscillators

Squeeze Bands

Identifies periods of low volatility (squeezes)

Signals potential for explosive moves when volatility expands

Based on Bollinger Bands and Keltner Channel relationships

The Whispr IQ system combines all these elements to provide a holistic view of market conditions. Traders can use the various signals and overlays to identify high-probability trade setups, key support/resistance levels, trend direction on multiple timeframes, and potential reversals.

This indicator is designed for experienced traders who can interpret the multiple data points and use them in conjunction with their own analysis and risk management. It's a powerful tool that can enhance trading decisions when used properly as part of a complete trading plan.

Overview

Whispr IQ is an innovative, closed-source trading system that combines multiple advanced analytical components to provide traders with a comprehensive market analysis tool. This system is designed to offer unique insights into market dynamics, trend identification, and potential trading opportunities across various timeframes.

Key Components and Their Synergy

1. Adaptive Trend Analysis

At the core of Whispr IQ is our proprietary Adaptive Trend Analysis (ATA) algorithm. Unlike traditional moving averages, ATA uses dynamic kernel regression to create a smoothed ribbon that adapts to market volatility. This provides a more accurate representation of short, medium, and long-term trends.

How it works: ATA analyzes price action across multiple timeframes, adjusting its sensitivity based on market conditions.

Unique feature: Color-coded ribbons indicate trend strength and potential reversals, offering clearer signals than standard indicators.

2. Institutional Flow Detector

Our Institutional Flow Detector (IFD) goes beyond simple volume analysis. It uses a combination of volume, price action, and order book data to identify potential institutional activity.

How it works: IFD analyzes order blocks, liquidity levels, and fair value gaps to highlight areas of significant market interest.

Unique feature: Proprietary algorithms filter out retail noise to focus on institutional-level moves.

3. Dynamic Volume Profiling

Whispr IQ incorporates an advanced volume profiling system that adapts to changing market conditions.

How it works: It creates a real-time, multi-timeframe volume profile that highlights key value areas and potential support/resistance zones.

Unique feature: Our system includes a "Naked POC" detector that identifies uncovered high-volume areas, providing potential price targets.

4. Adaptive Fibonacci Projection

Unlike standard Fibonacci tools, our Adaptive Fibonacci Projection (AFP) dynamically adjusts based on market structure.

How it works: AFP identifies key swing points and calculates Fibonacci levels that adapt to changing market conditions.

Unique feature: Integration with our ATA system for more accurate support and resistance identification.

5. Advanced Divergence Detection

Whispr IQ includes a sophisticated divergence scanner that goes beyond simple price-indicator comparisons.

How it works: It analyzes multiple indicators (RSI, MACD, CCI) across various timeframes to identify both regular and hidden divergences.

Unique feature: AI-enhanced pattern recognition to filter out false signals and highlight high-probability divergences.

6. Volatility Expansion Predictor

Our Volatility Expansion Predictor (VEP) is designed to anticipate potential breakouts before they occur.

How it works: VEP analyzes the relationship between Bollinger Bands and Keltner Channels, along with other proprietary volatility metrics.

Unique feature: Integration with our IFD system to correlate low volatility periods with institutional accumulation.

How to Use Whispr IQ

Trend Identification: Use the ATA ribbons to identify the overall market direction across multiple timeframes.

Support/Resistance: Combine IFD, Dynamic Volume Profiling, and AFP to identify key levels.

Entry Points: Look for confluences between VEP signals and Advanced Divergence Detection.

Risk Management: Use the Naked POC and key levels identified by IFD for stop loss and take profit placement.

Conclusion

Whispr IQ is not just a collection of indicators, but a sophisticated system where each component works in harmony to provide a holistic view of the market. By combining advanced analytical techniques with machine learning algorithms, Whispr IQ offers traders a unique edge in identifying high-probability trading opportunities.

Note: This is a closed-source indicator. For access or further information, please contact the author directly via TradingView's private messaging system.

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact AIWAY directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact AIWAY directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.