OPEN-SOURCE SCRIPT

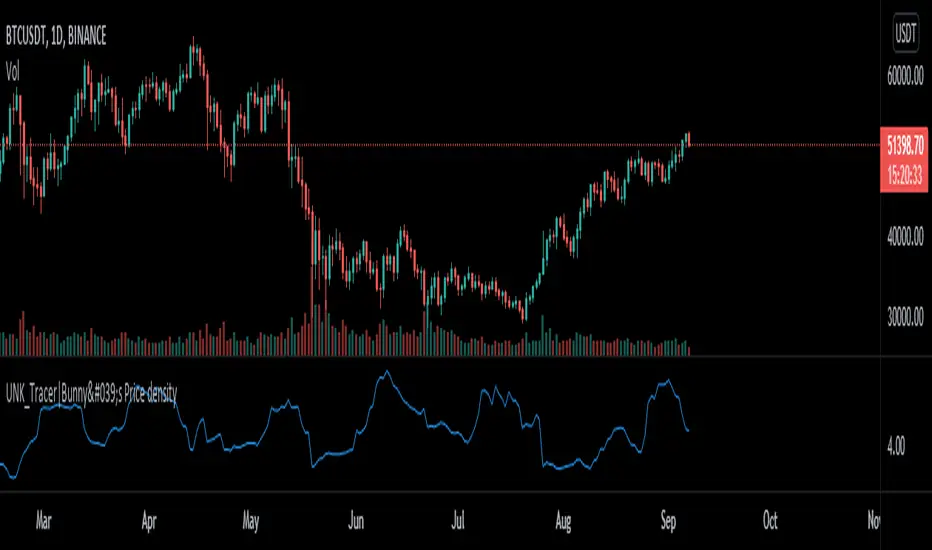

Price density [Measuring Market Noise:Take advantage]

$$ Market noise can be problematic to some types of trading strategies yet beneficial to others.

By measuring noise using the 'Price Density' can enable us to improve our

trading edge and turn noise to our advantage.

Robust analysis of noise can inform us when it is best to avoid trend-following

systems (when noise is too high), and vice versa for systems based on a

mean-reverting trading premise (when market noise is low).

__________________________________________________________________________

Using Noise to our advantage

* Two techniques:

-Measure Noise and trade when suitable for the system

~ High noise = avoid trend-following

~ Low noise = avoid mean-reversion

-Match assets to strategies

~ Only trade 'noisy assets' with Mean-reversion Strategies

~ Only trade 'efficient assests' with Trend-following Strategies

## Price density:-

High values = High noise

Low values = Low noise

___________________________________________________________________________

Disclaimer!! Do your own research

By measuring noise using the 'Price Density' can enable us to improve our

trading edge and turn noise to our advantage.

Robust analysis of noise can inform us when it is best to avoid trend-following

systems (when noise is too high), and vice versa for systems based on a

mean-reverting trading premise (when market noise is low).

__________________________________________________________________________

Using Noise to our advantage

* Two techniques:

-Measure Noise and trade when suitable for the system

~ High noise = avoid trend-following

~ Low noise = avoid mean-reversion

-Match assets to strategies

~ Only trade 'noisy assets' with Mean-reversion Strategies

~ Only trade 'efficient assests' with Trend-following Strategies

## Price density:-

High values = High noise

Low values = Low noise

___________________________________________________________________________

Disclaimer!! Do your own research

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.