OPEN-SOURCE SCRIPT

Updated Risk Volume Calculator

Bid volume calculation from average volatility

On label (top to bot):

Percents - averaged by [smoothing] moving in timeframe resolution

Cash - selected risk volume in usdt

Lots - bid volume in lots wich moving in Percents with used leverage is Cash

U can switch on channels to visualise volatility*2 channel or stakan settings

On label (top to bot):

Percents - averaged by [smoothing] moving in timeframe resolution

Cash - selected risk volume in usdt

Lots - bid volume in lots wich moving in Percents with used leverage is Cash

U can switch on channels to visualise volatility*2 channel or stakan settings

Release Notes

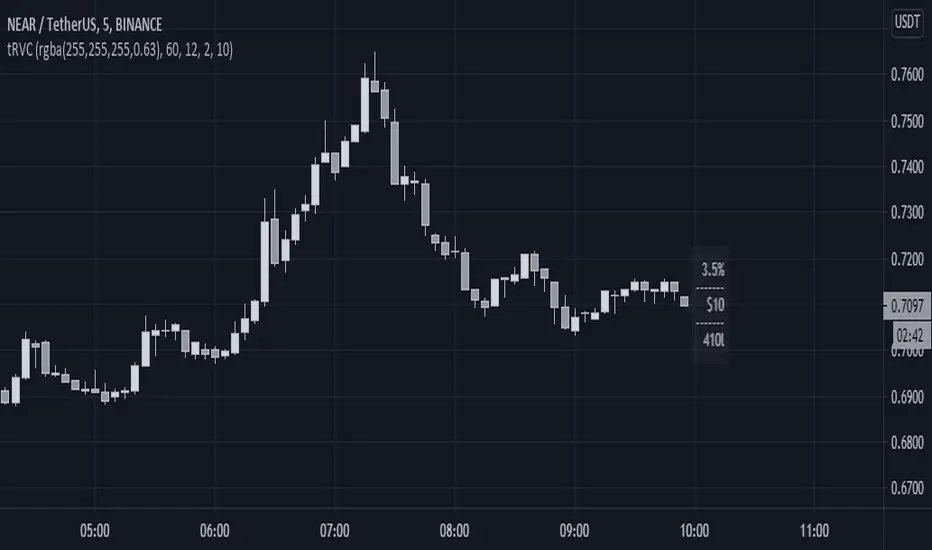

Position volume calculation based on the average instrument volatility and the amount of risk in base currencyOn label (top to bot):

Percents (0.6%) - average moving in selected resolution

Cash ($10) - risk volume in base currency

Lots (2.77l) - the volume of the bet with a 0.6% move will create a profit or loss of 10

U can switch on channels to visualise volatility*2 channel or stakan settings

Release Notes

Position volume calculation based on the average instrument volatility as amount of risk in base currencyOn label (top to bot):

Percents (1.7%) - average moving in selected resolution (60)

Cash ($10) - risk amount in base currency

Lots (19.613l) - the volume of bet wich 1.7% moving create a profit or loss of $10

U can switch on channels to visualise volatility*2 channel

Release Notes

Added smart lots volume rounderOpen-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.