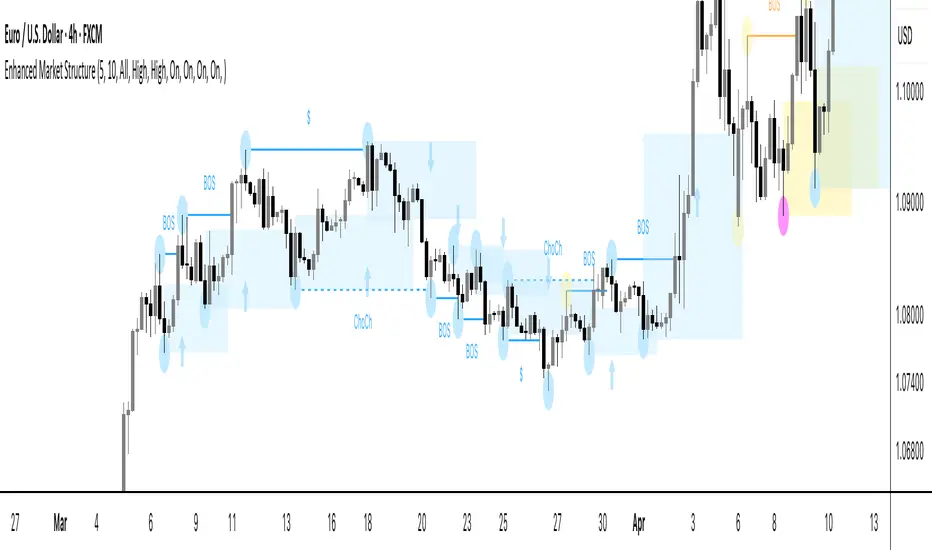

Enhanced Market Structure

This invite-only tool is a purpose-built market-structure framework that blends multiple analytical layers into a single, rule-driven visualization. It is not a generic mashup — each component is custom-coded in-house and interconnected to provide traders with a contextual map of price action across timeframes.

Purpose & Scope

The script consolidates structural shifts, liquidity events, and high-value zones from higher-timeframe analysis (e.g., 4 H, Daily) into the active trading chart. It draws on price-action concepts such as displacement, liquidity sweeps, and retracement zones, but implements them through its own coded logic, allowing traders to read structure without manually scanning multiple charts.

Core Framework & Interactions

Rather than running unrelated indicators side-by-side, all components here feed into each other:

Swing Engine — A zigzag-style pivot detector filters out low-quality swings using displacement thresholds. These swings anchor structural break logic and define leg boundaries for retracements.

Structural Logic — BOS and CHOCH events are generated from swing shifts and displacement confirmation, then validated against liquidity-sweep checks.

Liquidity Mapping — Stop-hunt wicks and sweep zones are automatically flagged to add confluence to break events and rejection patterns.

Retracement & Zone Builder — Custom Fibonacci presets (50 %, 61.8 %, 71.8 %) project consistent high/medium/low-risk entry zones. These zones are classified as external, internal, or microstructure, and extend forward to track price interaction.

Multi-Timeframe Overlay — Higher-timeframe structure remains visible while working on lower execution charts, preserving narrative context during intraday decision-making.

Every module is built from scratch so that structural events, sweeps, and zones all share the same internal data model — meaning they are synchronized rather than “bolted together.”

Visual Outputs

BOS / CHOCH labels with directional color-coding

Liquidity-sweep markers and rejection tags

Bullish/Bearish zones by structural type (external, internal, micro)

Optional Fibonacci overlays on displacement legs

Zone contact arrows marking price interaction (informational only, not trade signals)

Settings Overview

Key adjustable parameters include pivot sensitivity, zone extensions, type filters (all/external/internal), risk-tiered entry zones, internal-structure display, contact arrow toggles, BOS/CHOCH styling, higher-timeframe selection, and optional Fibonacci overlays.

Disclaimer

This script is original in design and execution. While it references well-known concepts, all calculations and visual logic are proprietary. It provides visual analysis only and does not generate or recommend trades. Default parameters are for demonstration; users should adapt settings to their own instruments and timeframes.

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact tradexictsmc directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact tradexictsmc directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.