OPEN-SOURCE SCRIPT

Multi Market Structure Trend

OVERVIEW

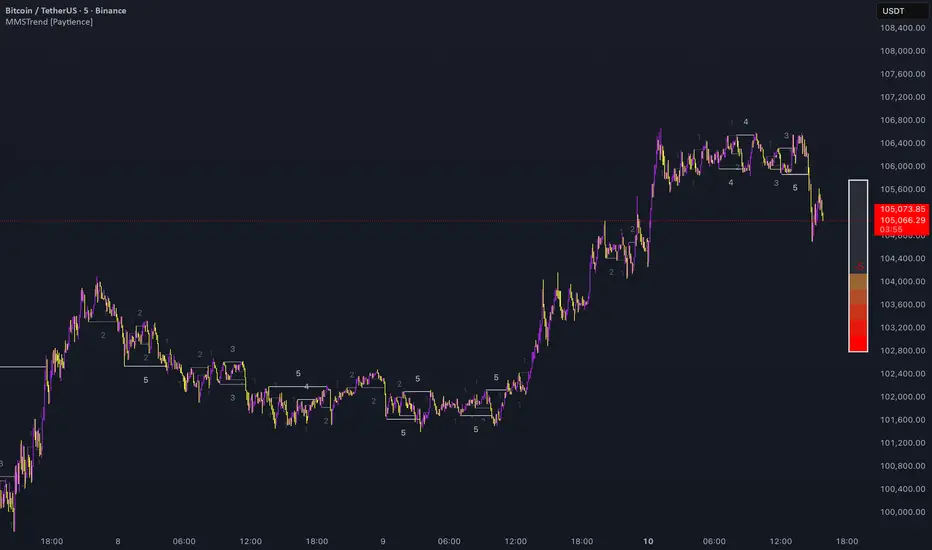

Multi Market Structure Trend [Paytience] is a multi-layered market structure analyzer that detects trend shifts across five independent pivot-based structures. Each pivot uses a different lookback length, offering a comprehensive view of structural momentum from short-term to long-term.

The indicator visually displays the net trend direction using colored candlesticks and a dynamic gauge that tracks how many of the 5 market structure layers are currently bullish or bearish.

⯁ STRUCTURE TRACKING SYSTEM

The indicator tracks five separate market structure layers in parallel using pivot-based breakouts. Each one can be individually enabled or disabled.

Each structure works as follows:

⯁ CANDLE COLOR GRADIENT SYSTEM

The indicator calculates the average directional bias from all enabled market structures to determine the current trend score.

⯁ TREND GAUGE PANEL

Displayed at the middle-right side of the chart, the gauge shows the current trend strength in real time.

⯁ USAGE

This indicator is highly effective for traders who want to:

⯁ CONCLUSION

Multi Market Structure Trend [Paytience] offers a unique and powerful way to assess trend direction using stacked market structure logic. With five independently calculated structure layers, colored candle feedback, and a real-time trend gauge, traders can better time entries, filter noise, and confirm multi-timeframe alignment — all within a single chart overlay.

Multi Market Structure Trend [Paytience] is a multi-layered market structure analyzer that detects trend shifts across five independent pivot-based structures. Each pivot uses a different lookback length, offering a comprehensive view of structural momentum from short-term to long-term.

The indicator visually displays the net trend direction using colored candlesticks and a dynamic gauge that tracks how many of the 5 market structure layers are currently bullish or bearish.

⯁ STRUCTURE TRACKING SYSTEM

The indicator tracks five separate market structure layers in parallel using pivot-based breakouts. Each one can be individually enabled or disabled.

Each structure works as follows:

- A bullish MSB (Market Structure Break) occurs when price breaks above the most recent swing high.

- A bearish MSB occurs when price breaks below the most recent swing low.

- Structure breaks are plotted as horizontal lines and labeled with the number (1 to 5) corresponding to their pivot layer.

⯁ CANDLE COLOR GRADIENT SYSTEM

The indicator calculates the average directional bias from all enabled market structures to determine the current trend score.

- Each structure contributes a score of +1 for bullish and -1 for bearish.

- The total score ranges from -5 (all bearish) to +5 (all bullish).

- Candlesticks are colored using a smooth gradient:

- Bright Green: Strong bullish trend (e.g., +5).

- Orange: Neutral mixed trend (e.g., 0).

- Red: Strong bearish trend (e.g., -5).

- Bright Green: Strong bullish trend (e.g., +5).

⯁ TREND GAUGE PANEL

Displayed at the middle-right side of the chart, the gauge shows the current trend strength in real time.

- The bar consists of up to 10 gradient cells (5 up, 5 down).

- Each active market structure pushes the score in one direction.

- The central cell displays a numeric trend score:

- +5 = All 5 market structures bullish

- 0 = Mixed/neutral trend

- -5 = All 5 market structures bearish

- Colors of the gauge bars match the candle gradient system.

⯁ USAGE

This indicator is highly effective for traders who want to:

- Monitor short- and long-term structure shifts simultaneously on a single chart.

- Use structure alignment as a trend confirmation tool — for example, waiting for at least 2 out of 5 structures to align before entering a trade.

- Visually filter noise from different time horizons using the gauge and candle gradient.

- Track CHoCH (Change of Character) transitions clearly and across multiple scales.

⯁ CONCLUSION

Multi Market Structure Trend [Paytience] offers a unique and powerful way to assess trend direction using stacked market structure logic. With five independently calculated structure layers, colored candle feedback, and a real-time trend gauge, traders can better time entries, filter noise, and confirm multi-timeframe alignment — all within a single chart overlay.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Get Access To Our Premium Paytience Indicators: paytience.io

All scripts & content provided by Paytience are for informational & educational purposes only. Past performance does not guarantee future results. 🦉

All scripts & content provided by Paytience are for informational & educational purposes only. Past performance does not guarantee future results. 🦉

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Get Access To Our Premium Paytience Indicators: paytience.io

All scripts & content provided by Paytience are for informational & educational purposes only. Past performance does not guarantee future results. 🦉

All scripts & content provided by Paytience are for informational & educational purposes only. Past performance does not guarantee future results. 🦉

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.