OPEN-SOURCE SCRIPT

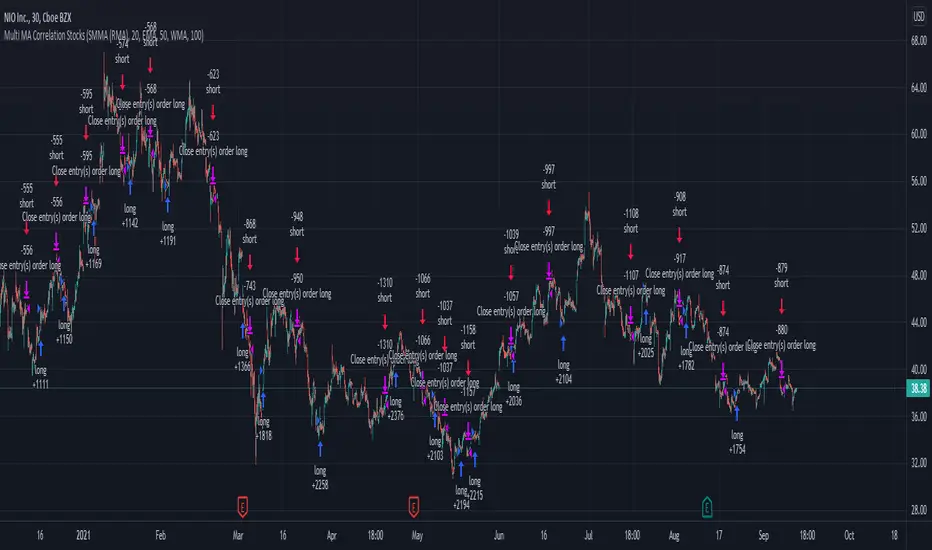

Swing Stock Market Multi MA Correlation

This is a swing strategy adapted to stock market using correlation with either SP500 or Nasdaq, so its best to trade stocks from this region.

Its components are

Correlation Candle

Fast moving average to choose from SMA , EMA , SMMA (RMA), WMA and VWMA

Medium moving Average to choose from SMA , EMA , SMMA (RMA), WMA and VWMA

Slow moving average to choose from SMA , EMA , SMMA (RMA), WMA and VWMA

Rules for entry

Long: fast ma > medium ma and medium ma > slow ma

Short: fast ma< medium ma and medium ma < slow ma.

Rules for exit

We exit when we receive an inverse condition.

Caution:

This strategy use no risk management inside, so be careful with it .

If you have any questions, let me know !

Its components are

Correlation Candle

Fast moving average to choose from SMA , EMA , SMMA (RMA), WMA and VWMA

Medium moving Average to choose from SMA , EMA , SMMA (RMA), WMA and VWMA

Slow moving average to choose from SMA , EMA , SMMA (RMA), WMA and VWMA

Rules for entry

Long: fast ma > medium ma and medium ma > slow ma

Short: fast ma< medium ma and medium ma < slow ma.

Rules for exit

We exit when we receive an inverse condition.

Caution:

This strategy use no risk management inside, so be careful with it .

If you have any questions, let me know !

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

🔻Website: finaur.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

🔻Website: finaur.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

🔻Strategies: finaur.com/lab/

🔻Blog: finaur.com/blog/

🔻Telegram : t.me/finaur_com/

🔻Trader Psychology Profile – thelumenism.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.