OPEN-SOURCE SCRIPT

Updated Supertrend with Stochastic OB/OS Arrows @KING

TradingView Idea: Supertrend with Stochastic Arrows KING

Overview:

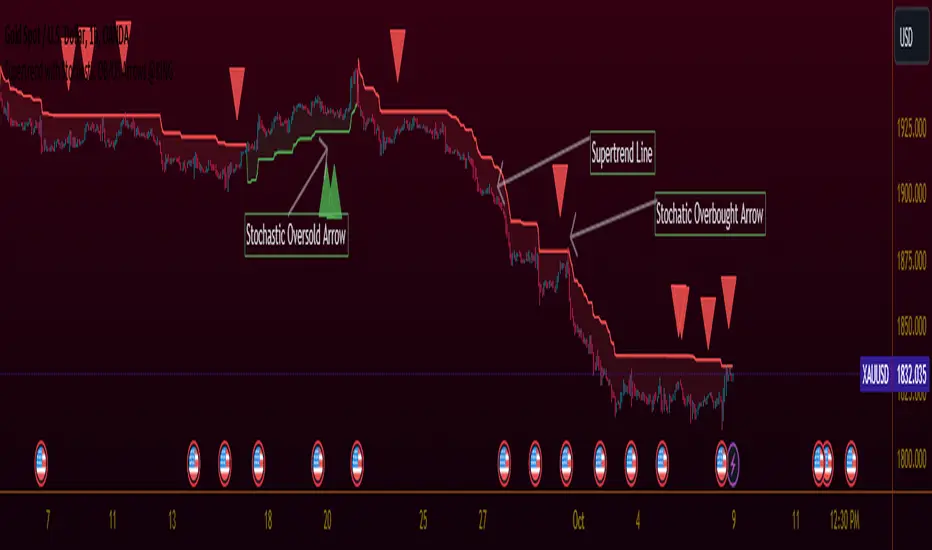

- Combining the Supertrend indicator with Stochastic arrows for a comprehensive market

view, providing insights into trend direction and potential reversal points.

Supertrend Settings:

- ATR Length: The length parameter for calculating the Average True Range (ATR).

- Factor: A multiplier used to determine the distance of the Supertrend line from the

price.

Supertrend Display:

* The Supertrend is color-coded:

- During an uptrend, it is displayed in green.

- During a downtrend, it is displayed in red.

- The body of the candlesticks is filled with color during the corresponding trend direction.

Stochastic Settings:

- K Length: The period length for the %K line in the Stochastic oscillator.

- K Smoothing: Smoothing factor for %K.

- D Smoothing: Smoothing factor for %D.

- Overbought Level: The threshold indicating an overbought condition.

- Oversold Level: The threshold indicating an oversold condition.

Arrows:

- Buy arrows are displayed below the bars during a downtrend when Stochastic is below the

oversold level.

- Sell arrows are displayed above the bars during an uptrend when Stochastic is above the

overbought level.

Supertrend Display:

- The Supertrend line is plotted with a color change based on its direction.

- The body of the candlesticks is filled with green during an uptrend and red during a downtrend.

Usage:

- Traders can use this script to identify potential entry and exit points, leveraging the

insights provided by both the Supertrend indicator and Stochastic oscillator. This

combination aims to capture trend strength and potential reversal opportunities.

Release Notes

TradingView Idea: Supertrend with Stochastic Arrows KING

Overview:

- Combining the Supertrend indicator with Stochastic arrows for a comprehensive market view, providing insights into trend direction and potential reversal points.

Supertrend Settings:

- ATR Length: The length parameter for calculating the Average True Range (ATR).

- Factor: A multiplier used to determine the distance of the Supertrend line from the price.

Supertrend Display:

- The Supertrend is color-coded:

- During an uptrend, it is displayed in green.

- During a downtrend, it is displayed in red.

- The body of the candlesticks is filled with color during the corresponding trend direction.

Stochastic Settings:

- K Length: The period length for the %K line in the Stochastic oscillator.

- K Smoothing: Smoothing factor for %K.

- D Smoothing: Smoothing factor for %D.

- Overbought Level: The threshold indicating an overbought condition.

- Oversold Level: The threshold indicating an oversold condition.

Arrows:

- Buy arrows are displayed below the bars during a downtrend when Stochastic is below the oversold level.

- Sell arrows are displayed above the bars during an uptrend when Stochastic is above the overbought level.

Supertrend Display:

- The Supertrend line is plotted with a color change based on its direction.

- The body of the candlesticks is filled with green during an uptrend and red during a downtrend.

Usage:

- Traders can use this script to identify potential entry and exit points, leveraging the insights provided by both the Supertrend indicator and Stochastic oscillator. This combination aims to capture trend strength and potential reversal opportunities.

---

This format uses for bold and

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.