OPEN-SOURCE SCRIPT

Updated CBG Keltner Channels

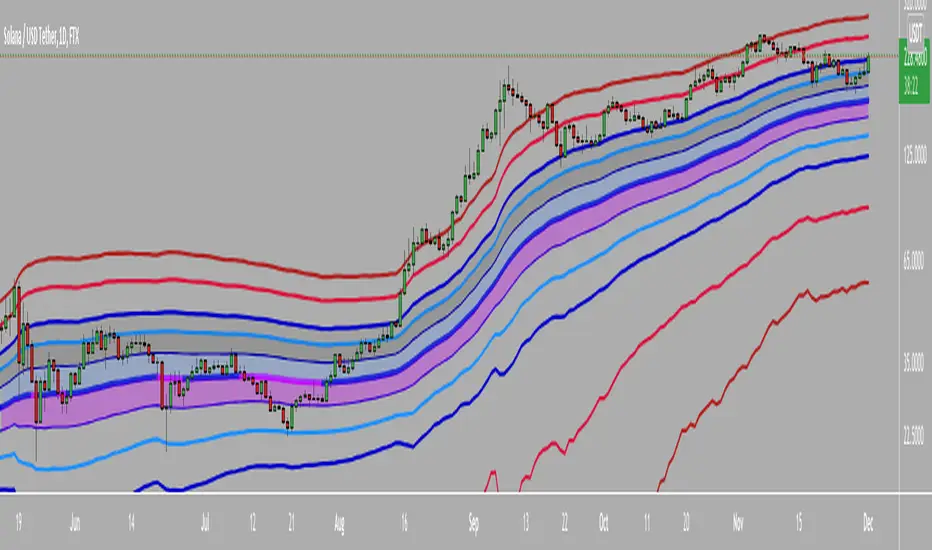

Here's an updated version of the CBG Keltner Channel indicator.

1. Added a new option for painting bars and backgrounds.

- Option 5 will paint up bars if the midline moving average is moving up and price is above the control moving average. It will paint down bars if the opposite is true. If neither are true, it will paint a neutral color. The neutral color defaults to gray bars and no color for backgrounds.

2. I've also added a 3rd band.

The chart here shows the default settings except for the inner band which is turned off.

1. Added a new option for painting bars and backgrounds.

- Option 5 will paint up bars if the midline moving average is moving up and price is above the control moving average. It will paint down bars if the opposite is true. If neither are true, it will paint a neutral color. The neutral color defaults to gray bars and no color for backgrounds.

2. I've also added a 3rd band.

The chart here shows the default settings except for the inner band which is turned off.

Release Notes

I added a new painting method. Here's the description:"6. Cross Back and Break Out"

Color changes when price breaks back above or below upper band2 or below lower band2.

It stays that color until the opposite band2 is breached and then price comes back. Color remains until the opposite band is breached and comes back. This colors the bars and background as price moves from one outer band to the opposite outer band.

Color also changes if price breaks under the outer band before hitting the opposite band.

Release Notes

11/29/2021- Converted to Pinescript v5

- Removed painting option 6 due to compile errors. I will have to re-write that function in the future. Let me know if anyone is using it.

- Optimized code and re-factored the multi timeframe supprt.

Release Notes

// *** 2021/11/29 ***Forgot to mention a couple of items so re-publishing.

- Converted to v5

- Removed painting option 6 due to compile errors. I will have to re-write that function in the future. Let me know if anyone is using it.

- Optimized code and re-factored the multi timeframe supprt.

- Most importantly, I've added 2 more bands! Default settings are 1, 2, 3, 5 & 7.

- I've also made the default MA type the Wilder MA. Check it out. It tracks really well.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.