OPEN-SOURCE SCRIPT

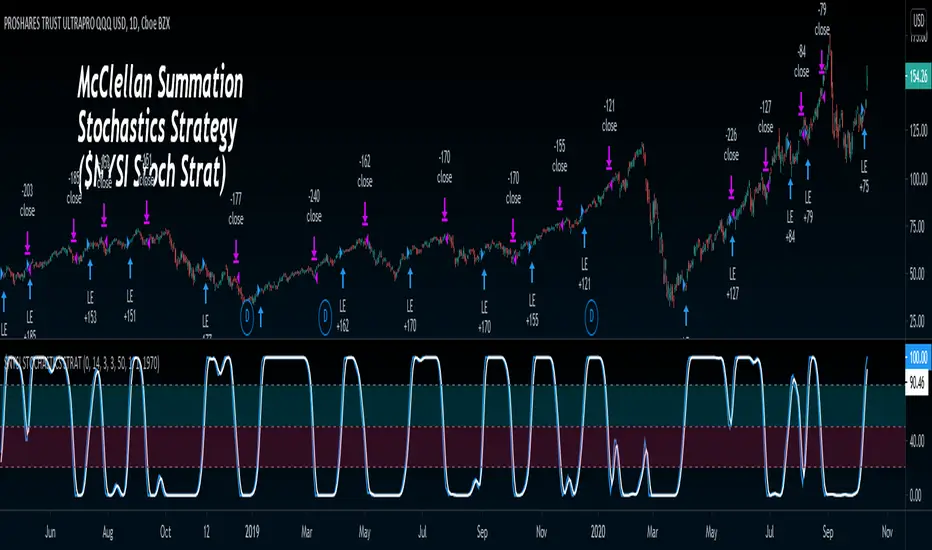

Updated TKP McClellan Summation Index Stochastics Strategy

This strategy uses NYSE McClellan summation Index as an input for Stochastics to produce Buy/Sell signals. Buy signal is produced when Stochastics K Line Closes over 50, and Sell signal when closes under 50.

Info on McClellan Summation Index: investopedia.com/terms/m/mcclellansummation.asp

Info on Stochastics: investopedia.com/articles/technical/073001.asp

Simple yet effective strategy, let me know if you have any questions!

Info on McClellan Summation Index: investopedia.com/terms/m/mcclellansummation.asp

Info on Stochastics: investopedia.com/articles/technical/073001.asp

Simple yet effective strategy, let me know if you have any questions!

Release Notes

I've added two things in this update. 1. Time stamp so you can now back-test from a different start date... for example, since 2019, the strategy is 90% profitable on $TQQQ.

2. I added the ability to change the threshold on Buy/Sell crossover level.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.