OPEN-SOURCE SCRIPT

Codi's Perp-Spot Basis

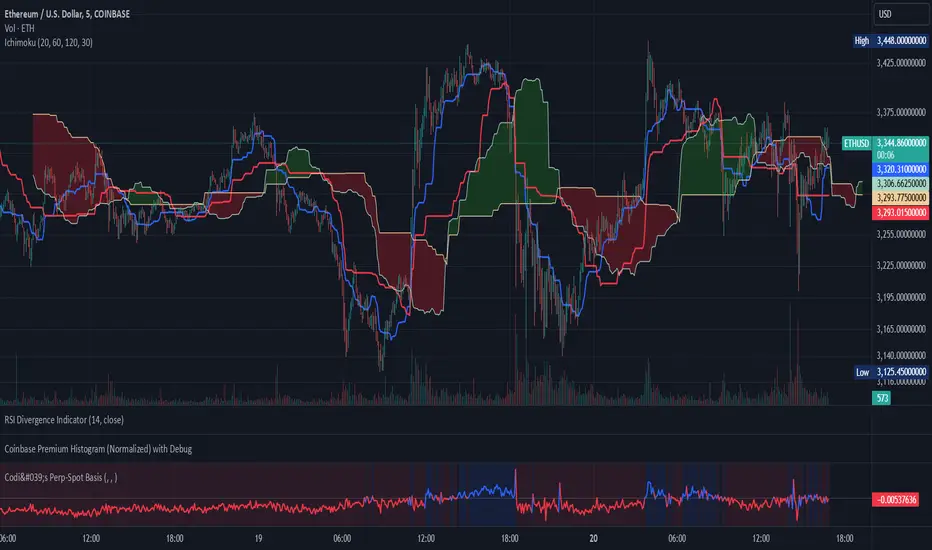

# Perp-Spot Basis Indicator

This indicator calculates the percentage basis between perpetual futures and spot prices for crypto assets. It is inspired by the original concept from **Krugermacro**, with the added improvement of **automatic detection of the asset pairs** based on the current chart symbol. This enhancement makes it faster and easier to apply across different assets without manual configuration.

## How It Works

The indicator compares the perpetual futures price (e.g., `BTCUSDT.P`) to the spot price (e.g., `BTCUSDT`) on Binance. The difference is expressed as a percentage: (Perp - Spot) / Spot * 100

The results are displayed in a color-coded graph:

- **Blue (Positive Basis):** Perpetual futures are trading at a premium, indicating **bullish sentiment** among derivatives traders.

- **Red (Negative Basis):** Perpetual futures are trading at a discount, indicating **bearish sentiment** among derivatives traders.

This percentage basis is a core component in understanding funding rates and derivatives market dynamics. It serves as a faster proxy for funding rates, which typically lag behind real-time price movements.

---

## How to Use It

### General Concept

- **Red (Negative Basis):** Ideal to execute **longs** when derivatives traders are overly bearish.

- **Blue (Positive Basis):** Ideal to execute **shorts** when derivatives traders are overly bullish.

### Pullback Sniping

1. During an **uptrend**:

- If the basis turns **red** temporarily, it can signal an opportunity to **buy the dip**.

2. During a **downtrend**:

- If the basis turns **blue** temporarily, it can signal an opportunity to **sell the rip**.

3. Wait for the basis to **pop back** (higher in uptrend, lower in downtrend) to time entries more effectively—this often coincides with **stop runs** or **liquidations**.

### Intraday Execution

- **When price is falling**:

- If the basis is **red**, the move is derivatives-led (**normal**).

- If the basis is **blue**, spot traders are leading, and perps are offside—wait for **price dumps** before longing.

- **When price is rising**:

- If the basis is **blue**, the move is derivatives-led (**normal**).

- If the basis is **red**, spot traders are leading, and perps are offside—wait for **price pops** before shorting.

### Larger Time Frames

- **Consistently Blue Basis:** Indicates a **bull market** as derivatives traders are bullish over the long term.

- **Consistently Red Basis:** Indicates a **bear market** as derivatives traders are bearish over the long term.

---

## Improvements Over the Original

This version of the Perp-Spot Basis indicator **automatically detects the Binance perpetual futures and spot pairs** based on the current chart symbol. For example:

- If you are viewing `ETHUSDT`, it automatically references `ETHUSDT.P` for the perpetual futures pair and `ETHUSDT` for the spot pair in BINANCE.

This indicator calculates the percentage basis between perpetual futures and spot prices for crypto assets. It is inspired by the original concept from **Krugermacro**, with the added improvement of **automatic detection of the asset pairs** based on the current chart symbol. This enhancement makes it faster and easier to apply across different assets without manual configuration.

## How It Works

The indicator compares the perpetual futures price (e.g., `BTCUSDT.P`) to the spot price (e.g., `BTCUSDT`) on Binance. The difference is expressed as a percentage: (Perp - Spot) / Spot * 100

The results are displayed in a color-coded graph:

- **Blue (Positive Basis):** Perpetual futures are trading at a premium, indicating **bullish sentiment** among derivatives traders.

- **Red (Negative Basis):** Perpetual futures are trading at a discount, indicating **bearish sentiment** among derivatives traders.

This percentage basis is a core component in understanding funding rates and derivatives market dynamics. It serves as a faster proxy for funding rates, which typically lag behind real-time price movements.

---

## How to Use It

### General Concept

- **Red (Negative Basis):** Ideal to execute **longs** when derivatives traders are overly bearish.

- **Blue (Positive Basis):** Ideal to execute **shorts** when derivatives traders are overly bullish.

### Pullback Sniping

1. During an **uptrend**:

- If the basis turns **red** temporarily, it can signal an opportunity to **buy the dip**.

2. During a **downtrend**:

- If the basis turns **blue** temporarily, it can signal an opportunity to **sell the rip**.

3. Wait for the basis to **pop back** (higher in uptrend, lower in downtrend) to time entries more effectively—this often coincides with **stop runs** or **liquidations**.

### Intraday Execution

- **When price is falling**:

- If the basis is **red**, the move is derivatives-led (**normal**).

- If the basis is **blue**, spot traders are leading, and perps are offside—wait for **price dumps** before longing.

- **When price is rising**:

- If the basis is **blue**, the move is derivatives-led (**normal**).

- If the basis is **red**, spot traders are leading, and perps are offside—wait for **price pops** before shorting.

### Larger Time Frames

- **Consistently Blue Basis:** Indicates a **bull market** as derivatives traders are bullish over the long term.

- **Consistently Red Basis:** Indicates a **bear market** as derivatives traders are bearish over the long term.

---

## Improvements Over the Original

This version of the Perp-Spot Basis indicator **automatically detects the Binance perpetual futures and spot pairs** based on the current chart symbol. For example:

- If you are viewing `ETHUSDT`, it automatically references `ETHUSDT.P` for the perpetual futures pair and `ETHUSDT` for the spot pair in BINANCE.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.