Multi-Timeframe RSI Oscillator -> PROFABIGHI_CAPITAL

The Multi-Timeframe RSI Oscillator → PROFABIGHI_CAPITAL aggregates RSI signals from multiple timeframes into a weighted composite for layered momentum analysis, helping traders spot overbought/oversold alignments across scales without single-frame bias.

It smooths the blend for clearer trends, with optional overlays for individual readings and consensus checks to confirm directional strength.

📊 RSI Settings

– RSI Length: Adjustable lookback for computing relative strength on all selected timeframes.

– RSI Source: Data input, such as closing prices, for RSI base calculations.

⏰ Timeframes

– Timeframe 1 (Fast): Quickest scale for capturing short-term price swings and early signals.

– Timeframe 2 (Medium): Balanced scale for intermediate momentum without excessive noise.

– Timeframe 3 (Slow): Slower scale for validating trends over extended periods.

– Timeframe 4 (Ultra Slow): Longest scale for overarching market regime insights.

⚖️ Weights

– Weight 1 (Fast): Emphasis on the fastest timeframe's RSI in the overall blend.

– Weight 2 (Medium): Contribution from the medium timeframe for steady influence.

– Weight 3 (Slow): Role of the slow timeframe in anchoring the composite.

– Weight 4 (Ultra Slow): Impact of the ultra-slow timeframe for long-view stability.

👁️ Display Settings

– Smoothing Length: Period to refine the composite line via exponential averaging.

– Show Individual RSIs: Toggle to reveal separate timeframe lines for detailed comparison.

– Show Current Timeframe RSI: Option to include the chart's native RSI for reference.

📏 Levels

– Overbought Level: Upper threshold flagging potential exhaustion from buying pressure.

– Oversold Level: Lower threshold indicating possible rebound from selling fatigue.

– Neutral Upper/Lower: Inner boundaries defining the range for mild bullish or bearish tilts.

🎨 Colors

– Overbought Color: Hue for extreme upper zones and sell warnings.

– Oversold Color: Shade for deep lower zones and buy cues.

– Neutral Color: Tint for balanced readings in consolidation.

– Current TF Color: Distinct shade for the active chart's RSI line.

📈 Calculations

– Multi-Timeframe RSIs: Fetches RSI values from each selected scale, falling back to current if invalid.

– Weighted Blend: Combines readings proportionally by user weights for a unified momentum score.

– Smoothing Application: Applies exponential average to the mix for trend-smoothing without lag.

📡 Signals

– Crossover Triggers: Bullish on upward breaks from oversold; bearish on downward from overbought for reversal plays.

– Consensus Alignment: All timeframes above midline for bullish harmony; below for bearish.

– Strength Gauge: Absolute composite value measures overall conviction across scales.

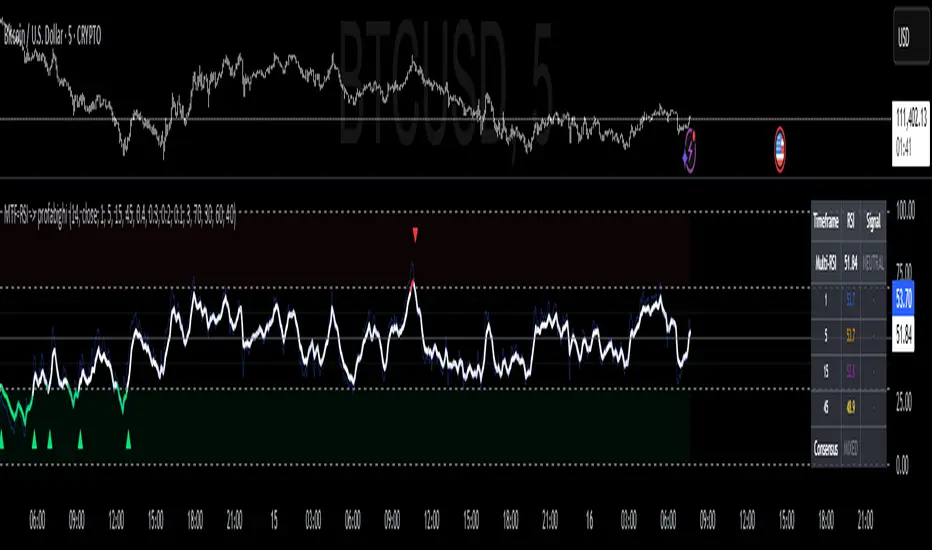

📉 Visualization

– Composite Line: Prominent plot that shifts hues by zone for quick momentum assessment.

– Individual Overlays: Subtle lines for enabled timeframes, highlighting divergences when shown.

– Current TF Line: Dedicated trace for the chart's RSI to anchor analysis.

– Reference Lines: Dashed extremes, dotted neutrals, solid midline for level guidance.

– Zone Fills: Gentle shading in overbought/oversold regions for visual alerts.

– Signal Markers: Minimal triangles at crossovers for non-cluttered buy/sell hints.

– Info Table: Compact top-right summary of composite and timeframe values, signals, and consensus.

🔔 Alerts

– Buy Crossover: Notification when composite rises above oversold for potential longs.

– Sell Crossover: Warning when composite falls below overbought for potential shorts.

✅ Key Takeaways

– Layers timeframes for robust RSI without isolated-frame pitfalls.

– Weighting tunes sensitivity from aggressive to conservative views.

– Consensus and visuals unify multi-scale insights for confident trades.

– Adaptable smoothing and toggles suit any chart speed or style.

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact PROFABIGHI_CAPITAL directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact PROFABIGHI_CAPITAL directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.