OPEN-SOURCE SCRIPT

Updated ATR SL 10/10

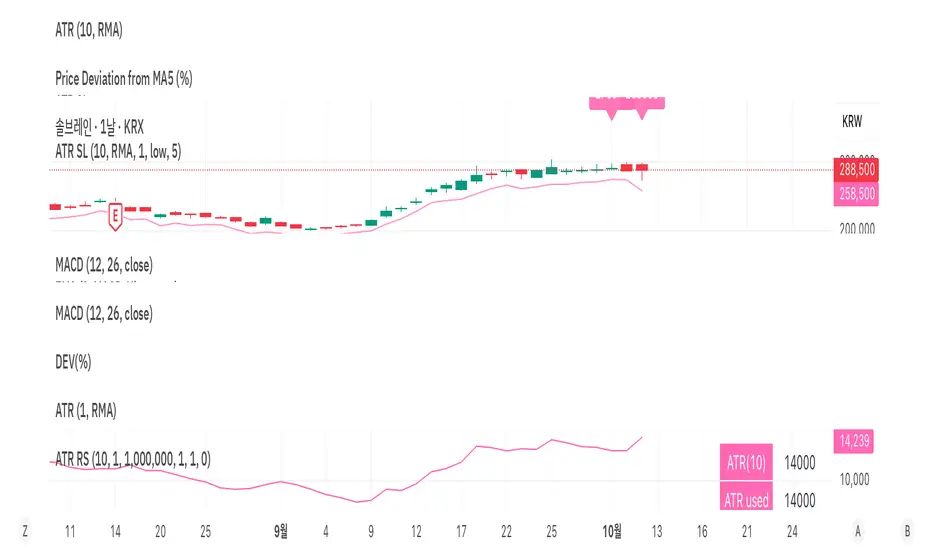

This indicator draws an ATR-based trailing stop on the main chart and shows two compact labels:

• Stop line = Low − (ATR × Multiplier).

• “Today” label: the current bar’s stop price.

• “5-bar Max” label: the highest stop value over the last N bars (rolling window). Labels auto-separate slightly if they overlap so both remain readable.

ATR selection logic

• On confirmed bars (after close): uses today’s ATR.

• In real-time (bar not confirmed): uses max(today’s ATR, yesterday’s ATR) to avoid under-estimating volatility early in the session.

Inputs

• Length: ATR period.

• Smoothing: RMA/SMA/EMA/WMA for ATR.

• Multiplier: stop distance in ATR units.

• Long Base: price source for the long stop (usually Low).

• Show Price Line: toggle the pink stop line.

• Lookback: window for the rolling 5-bar maximum label.

Notes

• Overlay = true; the line scales with the price chart.

• Prices/labels use mintick formatting for clean alignment.

• Works on any timeframe; ATR is computed from the active chart’s bars with the above real-time safeguard.

• Stop line = Low − (ATR × Multiplier).

• “Today” label: the current bar’s stop price.

• “5-bar Max” label: the highest stop value over the last N bars (rolling window). Labels auto-separate slightly if they overlap so both remain readable.

ATR selection logic

• On confirmed bars (after close): uses today’s ATR.

• In real-time (bar not confirmed): uses max(today’s ATR, yesterday’s ATR) to avoid under-estimating volatility early in the session.

Inputs

• Length: ATR period.

• Smoothing: RMA/SMA/EMA/WMA for ATR.

• Multiplier: stop distance in ATR units.

• Long Base: price source for the long stop (usually Low).

• Show Price Line: toggle the pink stop line.

• Lookback: window for the rolling 5-bar maximum label.

Notes

• Overlay = true; the line scales with the price chart.

• Prices/labels use mintick formatting for clean alignment.

• Works on any timeframe; ATR is computed from the active chart’s bars with the above real-time safeguard.

Release Notes

This indicator draws an ATR-based trailing stop on the main chart and shows two compact labels:

• Stop line = Low − (ATR × Multiplier).

• “Today” label: the current bar’s stop price.

• “5-bar Max” label: the highest stop value over the last N bars (rolling window). Labels auto-separate slightly if they overlap so both remain readable.

ATR selection logic

• On confirmed bars (after close): uses today’s ATR.

• In real-time (bar not confirmed): uses max(today’s ATR, yesterday’s ATR) to avoid under-estimating volatility early in the session.

Inputs

• Length: ATR period.

• Smoothing: RMA/SMA/EMA/WMA for ATR.

• Multiplier: stop distance in ATR units.

• Long Base: price source for the long stop (usually Low).

• Show Price Line: toggle the pink stop line.

• Lookback: window for the rolling 5-bar maximum label.

Notes

• Overlay = true; the line scales with the price chart.

• Prices/labels use mintick formatting for clean alignment.

• Works on any timeframe; ATR is computed from the active chart’s bars with the above real-time safeguard.

Release Notes

This indicator draws an ATR-based trailing stop on the main chart and shows two compact labels:• Stop line = Low − (ATR × Multiplier).

• “Today” label: the current bar’s stop price.

• “5-bar Max” label: the highest stop value over the last N bars (rolling window). Labels auto-separate slightly if they overlap so both remain readable.

ATR selection logic

• On confirmed bars (after close): uses today’s ATR.

• In real-time (bar not confirmed): uses max(today’s ATR, yesterday’s ATR) to avoid under-estimating volatility early in the session.

Inputs

• Length: ATR period.

• Smoothing: RMA/SMA/EMA/WMA for ATR.

• Multiplier: stop distance in ATR units.

• Long Base: price source for the long stop (usually Low).

• Show Price Line: toggle the pink stop line.

• Lookback: window for the rolling 5-bar maximum label.

Notes

• Overlay = true; the line scales with the price chart.

• Prices/labels use mintick formatting for clean alignment.

• Works on any timeframe; ATR is computed from the active chart’s bars with the above real-time safeguard.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.