PROTECTED SOURCE SCRIPT

Premarket Zones

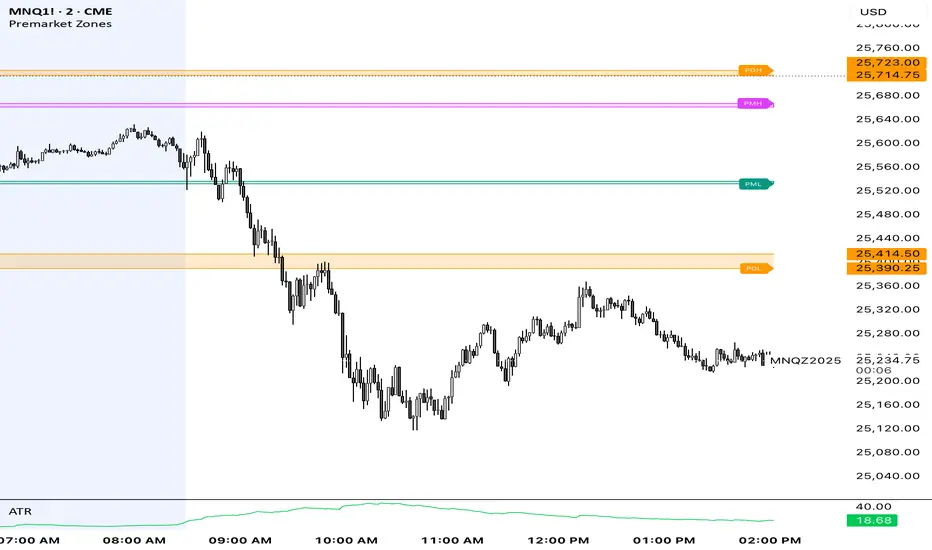

This indicator is built for index futures traders (ES, NQ, RTY, YM) who trade liquidity, session structure, and high-probability reaction levels using true CME futures timing.

It automatically plots:

Premarket High & Low zones (wick + body)

Previous Day Futures RTH High & Low zones (PDH / PDL)

Clean right-edge labels

First-touch alerts (once per day)

All calculations are based on Central Time (CT) and CME futures sessions, not equity cash-market hours.

🕒 Session Definitions (CME / Central Time)

Session Time (CT) Purpose

Premarket 03:00 – 08:30 Overnight liquidity build

Futures RTH (Calc) 08:30 – 15:00 True CME regular trading hours

Plot Window 03:00 – 16:00 Visual extension of zones

This script intentionally uses 08:30 CT as the futures open — not 09:30 equity cash open.

🔷 Premarket Zones (PMH / PML)

The indicator builds two premarket zones using multi-timeframe precision.

How they are calculated:

1-minute candles → capture the true wick extremes

5-minute candles → capture the dominant body area

Zones:

Premarket High Zone (PMH)

Between the highest 5-minute candle body and the highest 1-minute wick

Premarket Low Zone (PML)

Between the lowest 1-minute wick and the lowest 5-minute candle body

Key behavior:

Zones finalize at 08:30 CT

Once finalized, zones are drawn as boxes that extend left to 03:00 CT

Zones extend forward through the trading day for context

PMH / PML labels are plotted on the right edge

These zones represent overnight liquidity pools commonly used for:

Opening drive continuation

Liquidity sweeps

Mean reversion

Acceptance vs rejection at the open

🔶 Previous Day High / Low (PDH / PDL)

This script plots TRUE futures PDH / PDL, not equity-based levels.

How they are calculated:

Uses only the prior day’s futures RTH (08:30–15:00 CT)

1-minute candles → wick extremes

5-minute candles → body value areas

Zones:

PDH Zone: 5m body → 1m wick

PDL Zone: 1m wick → 5m body

These levels represent:

Institutional reference points

Prior session balance extremes

High-probability reaction zones

Clean PDH / PDL labels are plotted on the right edge.

🔔 Alerts (Once Per Day)

The indicator includes first-touch alerts for:

PDH

PDL

Premarket High Zone

Premarket Low Zone

Each alert triggers only once per session, making it ideal for:

Trade planning

Discipline-based execution

Prop firm risk control

📈 How Traders Use This Script

This indicator is context-based, not predictive.

Common use cases:

Waiting for liquidity sweeps into PMH / PML

Trading rejection or acceptance at PDH / PDL

Combining with:

VWAP

Opening Range

Market structure

Volume or delta tools

It works especially well on:

Opening range days

Mean-reversion conditions

Trend continuation days after overnight imbalance

🎯 Design Philosophy

Futures-first logic

No clutter

No repainting

No equity-market assumptions

Levels professionals actually use

This script is designed to mirror how professional futures traders map their charts.

⚠️ Notes

Best used on 1m or 5m charts

Designed for CME index futures

Not a standalone trading system

Always manage risk

It automatically plots:

Premarket High & Low zones (wick + body)

Previous Day Futures RTH High & Low zones (PDH / PDL)

Clean right-edge labels

First-touch alerts (once per day)

All calculations are based on Central Time (CT) and CME futures sessions, not equity cash-market hours.

🕒 Session Definitions (CME / Central Time)

Session Time (CT) Purpose

Premarket 03:00 – 08:30 Overnight liquidity build

Futures RTH (Calc) 08:30 – 15:00 True CME regular trading hours

Plot Window 03:00 – 16:00 Visual extension of zones

This script intentionally uses 08:30 CT as the futures open — not 09:30 equity cash open.

🔷 Premarket Zones (PMH / PML)

The indicator builds two premarket zones using multi-timeframe precision.

How they are calculated:

1-minute candles → capture the true wick extremes

5-minute candles → capture the dominant body area

Zones:

Premarket High Zone (PMH)

Between the highest 5-minute candle body and the highest 1-minute wick

Premarket Low Zone (PML)

Between the lowest 1-minute wick and the lowest 5-minute candle body

Key behavior:

Zones finalize at 08:30 CT

Once finalized, zones are drawn as boxes that extend left to 03:00 CT

Zones extend forward through the trading day for context

PMH / PML labels are plotted on the right edge

These zones represent overnight liquidity pools commonly used for:

Opening drive continuation

Liquidity sweeps

Mean reversion

Acceptance vs rejection at the open

🔶 Previous Day High / Low (PDH / PDL)

This script plots TRUE futures PDH / PDL, not equity-based levels.

How they are calculated:

Uses only the prior day’s futures RTH (08:30–15:00 CT)

1-minute candles → wick extremes

5-minute candles → body value areas

Zones:

PDH Zone: 5m body → 1m wick

PDL Zone: 1m wick → 5m body

These levels represent:

Institutional reference points

Prior session balance extremes

High-probability reaction zones

Clean PDH / PDL labels are plotted on the right edge.

🔔 Alerts (Once Per Day)

The indicator includes first-touch alerts for:

PDH

PDL

Premarket High Zone

Premarket Low Zone

Each alert triggers only once per session, making it ideal for:

Trade planning

Discipline-based execution

Prop firm risk control

📈 How Traders Use This Script

This indicator is context-based, not predictive.

Common use cases:

Waiting for liquidity sweeps into PMH / PML

Trading rejection or acceptance at PDH / PDL

Combining with:

VWAP

Opening Range

Market structure

Volume or delta tools

It works especially well on:

Opening range days

Mean-reversion conditions

Trend continuation days after overnight imbalance

🎯 Design Philosophy

Futures-first logic

No clutter

No repainting

No equity-market assumptions

Levels professionals actually use

This script is designed to mirror how professional futures traders map their charts.

⚠️ Notes

Best used on 1m or 5m charts

Designed for CME index futures

Not a standalone trading system

Always manage risk

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.