OPEN-SOURCE SCRIPT

Overnight Effect High Volatility Crypto (AiBitcoinTrend)

👽 Overview of the Strategy

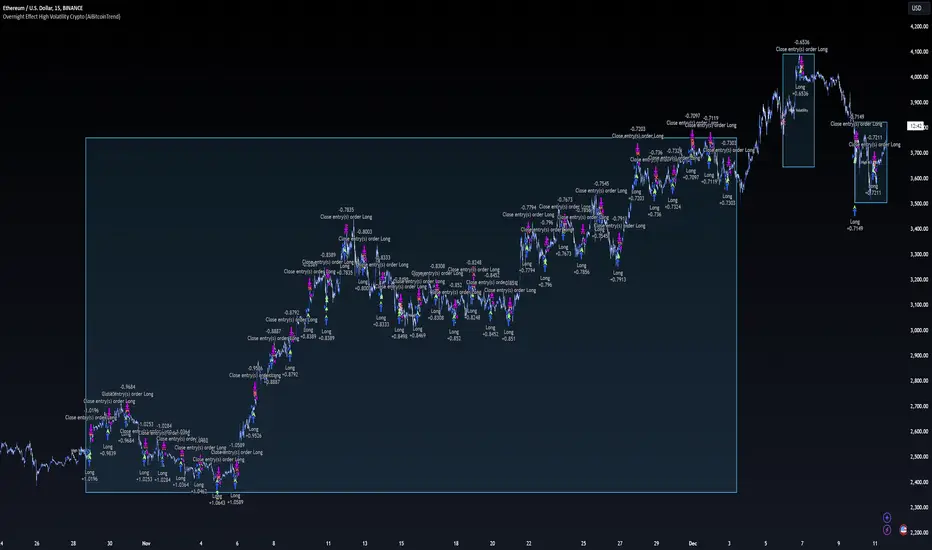

This strategy leverages the overnight effect in the cryptocurrency market, specifically targeting the two-hour window from 21:00 UTC to 23:00 UTC. The strategy is designed to be applied only during periods of high volatility, which is determined using historical volatility data. This approach, inspired by research from Padyšák and Vojtko (2022), aims to capitalize on statistically significant return patterns observed during these hours.

Deep Backtesting with a High Volatility Filter

Deep Backtesting without a High Volatility Filter

👽 How the Strategy Works

👽 Market Context and Global Time Zone Impact

👾 Why 21:00 to 23:00 UTC?

This global market inactivity creates a period where significant moves can occur in the cryptocurrency market, particularly during high volatility.

👽 Strategy Parameters

👽 Benefits of the Strategy

👽 Considerations

Disclaimer: This information is for entertainment purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

This strategy leverages the overnight effect in the cryptocurrency market, specifically targeting the two-hour window from 21:00 UTC to 23:00 UTC. The strategy is designed to be applied only during periods of high volatility, which is determined using historical volatility data. This approach, inspired by research from Padyšák and Vojtko (2022), aims to capitalize on statistically significant return patterns observed during these hours.

Deep Backtesting with a High Volatility Filter

Deep Backtesting without a High Volatility Filter

👽 How the Strategy Works

- Volatility Calculation:

Each day at 00:00 UTC, the strategy calculates the 30-day historical volatility of crypto returns (typically Bitcoin). The historical volatility is the standard deviation of the log returns over the past 30 days, representing the market's recent volatility level. - Median Volatility Benchmark:

The median of the 30-day historical volatility is calculated over a 365-day period (one year). This median acts as a benchmark to classify each day as either:

👾 High Volatility: When the current 30-day volatility exceeds the median volatility.

👾 Low Volatility: When the current 30-day volatility is below the median. - Trading Rule:

If the day is classified as a High Volatility Day, the strategy executes the following trades:

👾 Buy at 21:00 UTC.

👾 Sell at 23:00 UTC. - Trade Execution Details:

The strategy uses a 0.02% fee per trade.

Each trade is executed with 25% of the available capital. This allocation helps manage risk while allowing for compounding returns. - Rationale:

The returns during the 22:00 and 23:00 UTC hours have been found to be statistically significant during high volatility periods. The overnight effect is believed to drive this phenomenon due to the asynchronous closing hours of global financial markets. This creates unique trading opportunities in the cryptocurrency market, where exchanges remain open 24/7.

👽 Market Context and Global Time Zone Impact

👾 Why 21:00 to 23:00 UTC?

- During this window, major traditional financial markets are closed:

- NYSE (New York) closes at 21:00 UTC.

- London and European markets are closed during these hours.

- Asian markets (Tokyo, Hong Kong, etc.) open later, leaving this window largely unaffected by traditional trading flows.

This global market inactivity creates a period where significant moves can occur in the cryptocurrency market, particularly during high volatility.

👽 Strategy Parameters

- Volatility Period: 30 days.

The lookback period for calculating historical volatility. - Median Period: 365 days.

The lookback period for calculating the median volatility benchmark. - Entry Time: 21:00 UTC.

Adjust this to your local time if necessary (e.g., 16:00 in New York, 22:00 in Stockholm). - Exit Time: 23:00 UTC.

Adjust this to your local time if necessary (e.g., 18:00 in New York, 00:00 midnight in Stockholm).

👽 Benefits of the Strategy

- Seasonality Effect:

The strategy captures consistent patterns driven by the overnight effect and high volatility periods. - Risk Reduction:

Since trades are executed during a specific window and only on high volatility days, the strategy helps mitigate exposure to broader market risk. - Simplicity and Efficiency:

The strategy is moderately complex, making it accessible for traders while offering significant returns. - Global Applicability:

Suitable for traders worldwide, with clear guidelines on adjusting for local time zones.

👽 Considerations

- Market Conditions: The strategy works best in a high-volatility environment.

- Execution: Requires precise timing to enter and exit trades at the specified hours.

- Time Zone Adjustments: Ensure you convert UTC times accurately based on your location to execute trades at the correct local times.

Disclaimer: This information is for entertainment purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

👾 Adam at AI Bitcoin Trend

👽 We are the Quants!

👇 Be part of the fastest-growing quant trading community! 👇

discord.gg/7weCgzN5a7

🌕 Famous on Threads!

🪐 simpleaitrading.com/

👽 We are the Quants!

👇 Be part of the fastest-growing quant trading community! 👇

discord.gg/7weCgzN5a7

🌕 Famous on Threads!

🪐 simpleaitrading.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

👾 Adam at AI Bitcoin Trend

👽 We are the Quants!

👇 Be part of the fastest-growing quant trading community! 👇

discord.gg/7weCgzN5a7

🌕 Famous on Threads!

🪐 simpleaitrading.com/

👽 We are the Quants!

👇 Be part of the fastest-growing quant trading community! 👇

discord.gg/7weCgzN5a7

🌕 Famous on Threads!

🪐 simpleaitrading.com/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.