PROTECTED SOURCE SCRIPT

Updated Consolidation Range Tracker[Trendoscope]

🎲 Introducing Consolidation Range Tracker: Visualising Price Consolidation after Impulsive Moves

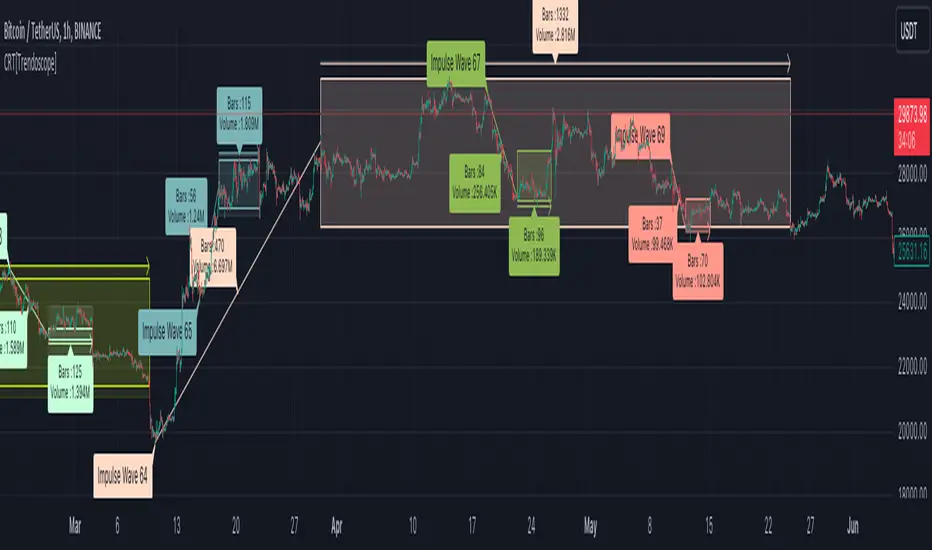

ConsolidationRangeTracker is an innovative indicator designed to assist traders in identifying and tracking price consolidation zones following impulsive market moves. This indicator is built on Auto Motive Wave indicator and Interactive Motive Wave indicator. This is also an attempt to plot Wyckoff Distribution pattern. But, instead of implying the price movement after consolidation, we are just leaving it to the interpretation of the users.

🎲 Process

Overall output can be visualised as

Note: Patterns will not be there on the chart every time. It is normal for indicator not to show any drawings or patterns on the chart.

🎲 Stages of the Indicator

🎯 When an Impulse is formed

When an impulse wave is detected, wave is drawn on the chart along with details such as number of bars and volume spawning the impulse wave and the calculated range based on the input value. An alert of new impulse is also triggered if configured for alerts.

🎯 When an Impulse is updated

When price extends further without consolidating, the impulse wave is also updated to consider the latest values. This repaint is expected and as designed. We will also trigger an alert related to update of an impulse wave.

🎯 Update of range as and when it happens

Range is not bound and it keeps moving based on the highest and lowest price. Value of range is constant and it is calculated based on certain ratio of impulse as configured in settings. But, this range can move up and down based on which direction the price moves.

For example, this is the initial range when the impulse wave is formed.

But, after certain bars, we can see that the range shift slightly up because, price has more upward movement than downward.

No alerts are triggered during this phase.

🎯 Confirmed consolidation

Consolidation range is confirmed after price range through certain bars with respect to number of bars involved in the impulse wave. The default setting of 1 for range bar ratio means that range is confirmed when price ranges for same number of bars as that of impulse.

An alert is triggered when consolidation range is confirmed.

🎯 Breakout

Breakout happen if the price exceeds the range bracket. Breakout may happen either before or after confirmation of consolidation. In either case, an alert is triggered.

Patterns are removed from the chart if the consolidation is not confirmed. In other words, the price did not stay in range for long time.

https://www.tradingview.com/x/ogbnzo6v/

🎲 Settings

Simple settings to define the zigzag base and few pattern related configuration.

🎲 Alerts

Alerts are configured using alert function and are triggered in following scenarios.

🎲 Use Cases

Indicator can be used for identifying few types of patterns on the chart. But, they may involve user's discretion. Major patterns that can be identified are:

🎯 Flag Formation Consolidation after an impulse can be termed as flag and is a sign of trend continuation after consolidation.

🎯 Wyckoff Distribution Long consolidation with high volume after an impulse can be a sign of wyckoff distribution formation. This pattern is trend reversal pattern.

ConsolidationRangeTracker is an innovative indicator designed to assist traders in identifying and tracking price consolidation zones following impulsive market moves. This indicator is built on Auto Motive Wave indicator and Interactive Motive Wave indicator. This is also an attempt to plot Wyckoff Distribution pattern. But, instead of implying the price movement after consolidation, we are just leaving it to the interpretation of the users.

🎲 Process

- Find impulse wave using the methods defined in Auto Motive Wave indicator and Interactive Motive Wave indicator

- Define the range of consolidation based on predefined ratio (available as input settings)

- Track the price movement within range along with number of bars and cumulative volume.

- When price breaks out of the range, check if price ranged long enough to consider it as consolidation.

- Retain the drawings and visualisation if the consolidation is confirmed before the breakout. Or else, remove them from the chart to keep it clean.

Overall output can be visualised as

Note: Patterns will not be there on the chart every time. It is normal for indicator not to show any drawings or patterns on the chart.

🎲 Stages of the Indicator

🎯 When an Impulse is formed

When an impulse wave is detected, wave is drawn on the chart along with details such as number of bars and volume spawning the impulse wave and the calculated range based on the input value. An alert of new impulse is also triggered if configured for alerts.

🎯 When an Impulse is updated

When price extends further without consolidating, the impulse wave is also updated to consider the latest values. This repaint is expected and as designed. We will also trigger an alert related to update of an impulse wave.

🎯 Update of range as and when it happens

Range is not bound and it keeps moving based on the highest and lowest price. Value of range is constant and it is calculated based on certain ratio of impulse as configured in settings. But, this range can move up and down based on which direction the price moves.

For example, this is the initial range when the impulse wave is formed.

But, after certain bars, we can see that the range shift slightly up because, price has more upward movement than downward.

No alerts are triggered during this phase.

🎯 Confirmed consolidation

Consolidation range is confirmed after price range through certain bars with respect to number of bars involved in the impulse wave. The default setting of 1 for range bar ratio means that range is confirmed when price ranges for same number of bars as that of impulse.

An alert is triggered when consolidation range is confirmed.

🎯 Breakout

Breakout happen if the price exceeds the range bracket. Breakout may happen either before or after confirmation of consolidation. In either case, an alert is triggered.

Patterns are removed from the chart if the consolidation is not confirmed. In other words, the price did not stay in range for long time.

https://www.tradingview.com/x/ogbnzo6v/

🎲 Settings

Simple settings to define the zigzag base and few pattern related configuration.

🎲 Alerts

Alerts are configured using alert function and are triggered in following scenarios.

- A new impulse created

- An impulse wave is updated

- Consolidation range confirmed

- Breakout with/without confirmed consolidation.

🎲 Use Cases

Indicator can be used for identifying few types of patterns on the chart. But, they may involve user's discretion. Major patterns that can be identified are:

🎯 Flag Formation Consolidation after an impulse can be termed as flag and is a sign of trend continuation after consolidation.

🎯 Wyckoff Distribution Long consolidation with high volume after an impulse can be a sign of wyckoff distribution formation. This pattern is trend reversal pattern.

Release Notes

Minor update to include the gap also in the outer range. The gap will keep reducing when price range increase within the box.Release Notes

Added option to calculate zigzag and range based on close prices. Library updatesProtected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Trial - trendoscope.io/trial

Subscribe - trendoscope.io/pricing

Blog - docs.trendoscope.io

Subscribe - trendoscope.io/pricing

Blog - docs.trendoscope.io

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Trial - trendoscope.io/trial

Subscribe - trendoscope.io/pricing

Blog - docs.trendoscope.io

Subscribe - trendoscope.io/pricing

Blog - docs.trendoscope.io

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.