Inverse Fisher Transform Multi-Indicator -> PROFABIGHI_CAPITAL

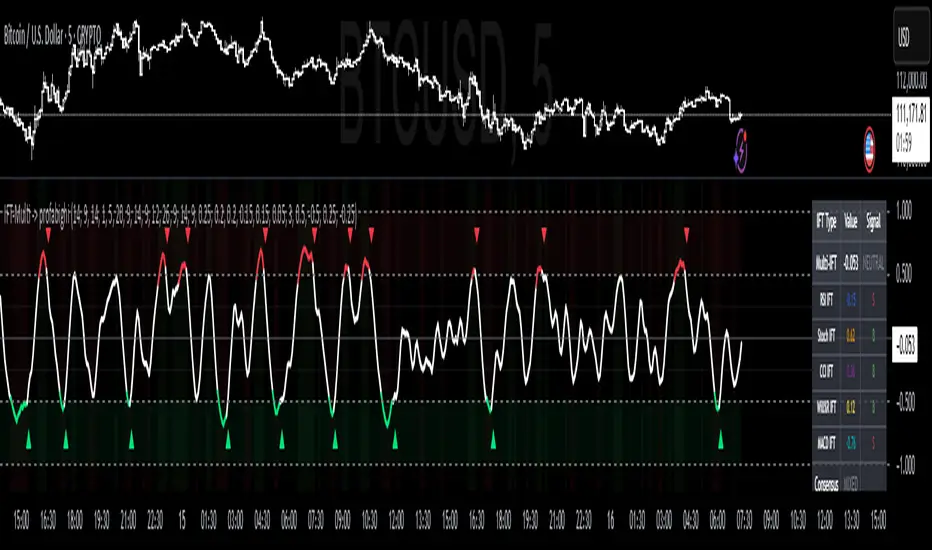

The Inverse Fisher Transform Multi-Indicator → PROFABIGHI_CAPITAL applies the Inverse Fisher Transform to multiple oscillators like RSI, Stochastic, CCI, Williams %R, MACD, and MFI, creating a weighted composite signal for enhanced momentum detection. It helps traders identify overbought/oversold extremes, consensus alignments, and divergences through a smoothed, probabilistic view of market strength.

👁️ Indicator Selection

– Enable RSI IFT: Toggle to incorporate RSI-transformed signals into the composite.

– Enable Stochastic IFT: Toggle to include Stochastic %K-transformed signals.

– Enable CCI IFT: Toggle to add CCI-transformed signals for cycle analysis.

– Enable Williams %R IFT: Toggle to blend Williams %R-transformed signals for momentum extremes.

– Enable MACD IFT: Toggle to integrate MACD-transformed signals for trend convergence.

– Enable MFI IFT: Toggle to factor in MFI-transformed signals for volume-weighted flow.

📊 Oscillator Settings

– RSI Length & IFT Length: Periods for base RSI computation and its IFT smoothing.

– Stochastic %K Length, Smoothing & IFT Length: Periods for Stochastic %K, its smoothing, and IFT application.

– CCI Length & IFT Length: Periods for CCI base and its IFT refinement.

– Williams %R Length & IFT Length: Periods for Williams %R base and IFT smoothing.

– MACD Fast/Slow Length & IFT Length: EMA periods for MACD and its IFT smoothing.

– MFI Length & IFT Length: Periods for MFI base and IFT application.

⚖️ Weights

– RSI/Stochastic/CCI/Williams %R/MACD/MFI Weights: Adjustable contributions to the composite, normalized for balanced influence.

👁️ Display Settings

– Multi-IFT Smoothing: Period to smooth the overall composite line for cleaner trends.

– Show Individual IFTs: Toggle to overlay separate transformed lines for component review.

– Show Zero Line: Toggle the central reference line for positive/negative separation.

📏 Levels

– Overbought/Oversold Levels: Thresholds for extreme momentum zones.

– Neutral Upper/Lower: Boundaries defining the consolidation range.

🎨 Colors

– Overbought/Oversold/Neutral/Bullish/Bearish Colors: Custom hues for zones, signals, and backgrounds.

🔧 Inverse Fisher Transform

The core function normalizes an oscillator's values over a lookback, smooths them, clamps to avoid extremes, then applies the mathematical transform to output a sigmoid-like signal between -1 and 1, amplifying turning points for sharper reversals.

📈 Composite Calculation

– Base Indicators: Computes raw values from selected oscillators using price, volume, and range data.

– IFT Application: Transforms each enabled oscillator individually for bounded, noise-reduced outputs.

– Weighted Blend: Averages transformed values by user weights, then smooths the result for a unified momentum gauge.

📡 Signal Analysis

– Trend & Momentum: Tracks changes in the composite for directional bias and acceleration.

– Crossover Signals: Triggers buys on oversold breaks and sells on overbought drops.

– Zero Crosses: Flags bullish shifts above zero and bearish below for equilibrium changes.

– Momentum Cues: Confirms strength in neutral zones with positive/negative velocity.

– Extreme Alerts: Highlights deep oversold/overbought with turning momentum.

– Consensus Checks: Scans for aligned bullish/bearish readings across all active components.

– Divergence Scans: Detects price-IFT mismatches over lookback periods for reversal hints.

📉 Visualization

– Composite Line: Thick, color-shifting plot for the main Multi-IFT, tinting by zone.

– Individual Overlays: Faint lines for enabled IFTs when toggled, aiding comparison.

– Reference Lines: Dashed overbought/oversold, dotted neutrals, solid zero for quick reads.

– Zone Fills: Subtle shading in extreme areas for visual emphasis.

– Signal Markers: Tiny triangles at crossovers for buy/sell points.

– Consensus Background: Faint bullish/bearish tints when components align.

– Info Table: Top-right panel listing Multi-IFT value/signal, individual readings, consensus, and dominant component.

🔔 Alerts

– Crossover Notifications: For oversold buys or overbought sells.

– Zero Cross Warnings: On equilibrium shifts.

– Momentum Triggers: For neutral zone accelerations.

– Extreme Flags: On deep reversals with velocity.

– Consensus Alerts: When all components agree on direction.

– Divergence Notices: For hidden bullish/bearish setups.

✅ Key Takeaways

– Blends multiple IFT-transformed oscillators for robust, noise-filtered momentum consensus.

– Customizable weights and toggles allow tailored focus on preferred signals.

– Sharpens reversals via Fisher math while spotting divergences for early edges.

– Visual table and zones simplify multi-indicator harmony in any timeframe.

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact PROFABIGHI_CAPITAL directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact PROFABIGHI_CAPITAL directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.