OPEN-SOURCE SCRIPT

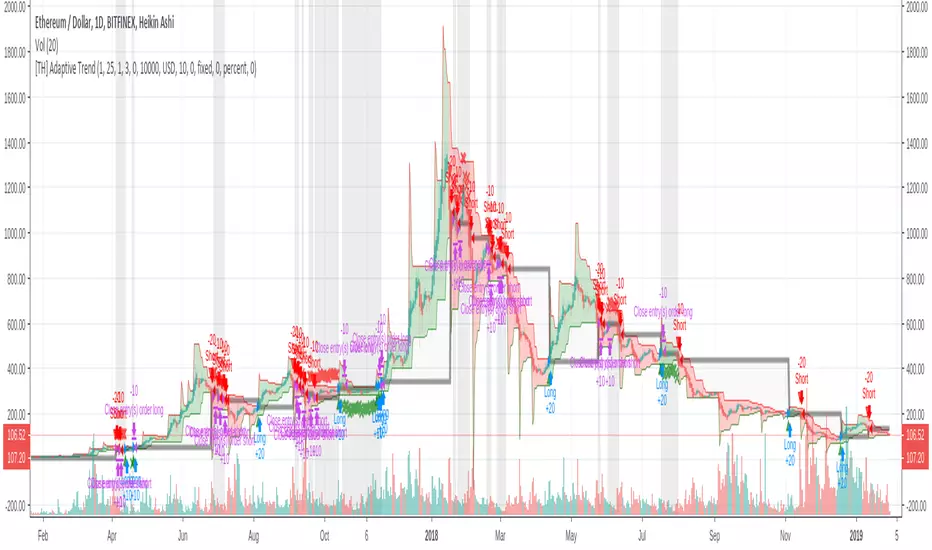

[TH] Adaptive Trend : Strategy

Adaptive Trend : Strategy

*** It should be used with 'heikin ashi' chart ***

*** It should be used with 'heikin ashi' chart ***

- Super Trend

Basically, it is super trend strategy ( Rajandran R Supertrend )

- My idea is,

1. (scale) Factor of super trend is related with sensitivity of Up/Down trend change

2. Constant Factor cause failure of super trend strategy when market prices variance is low ( ie. high Factor ==> miss short trend )

3. By using variance measure ( like BollingerBand ) as a varying Factor, maybe we can catch short trend and long trend together - Loss Cut

The silver thick line is loss cut line & silver background means exit position status

I found that silver background is appear usually when price moves horizontally

1. It is set to open price of actual position entry ( heikin ashi chart's open price = loss cut line = (open + close)/2 )

2. If position is long

==> loss cut is executed when low price is lower than loss cut line

==> re-entry when low price is higher than loss cut line

3. If Position is short

==> loss cut is executed when high price is higher than loss cut line

==> re-entry when high price is lower than loss cut lin

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.