OPEN-SOURCE SCRIPT

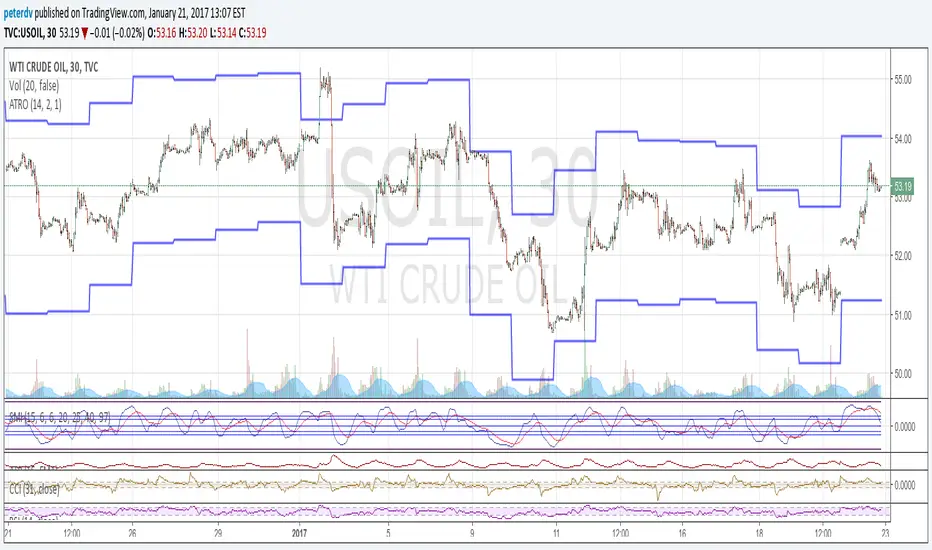

Average True Range Overlay

Plots ATR calculated on a daily basis as an overlay on the current chart.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.