OPEN-SOURCE SCRIPT

Updated Order Blocks with Volume Heatmap & Clusters - VK Trading

Order Blocks with Volume Heatmap & Clusters - VK Trading

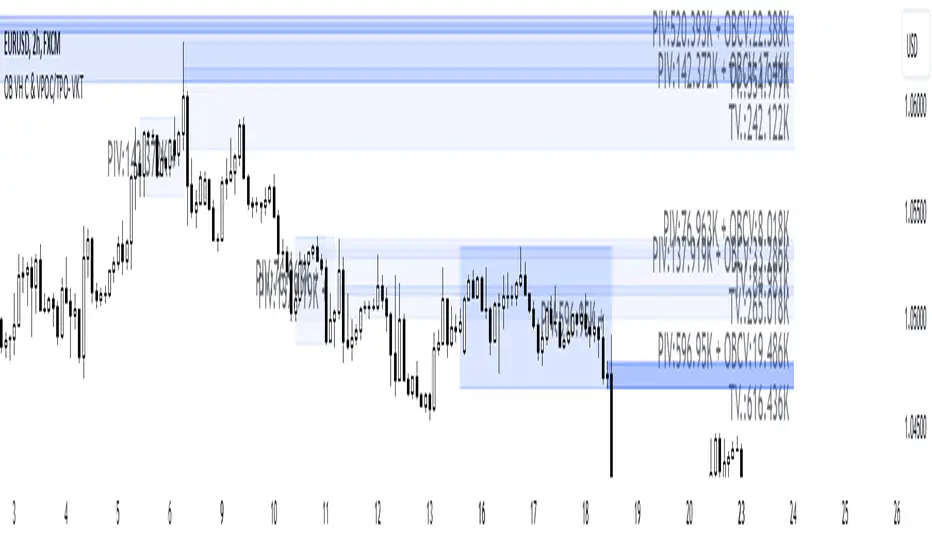

This script is designed to identify and highlight Order Blocks, a key concept in institutional trading, and combines it with powerful tools like volume heatmaps and accumulation clusters for enhanced market analysis. Suitable for traders of all experience levels, this script provides a clear and customizable visualization to help identify significant market zones effectively.

What Does This Script Do?

Key Features

User Benefits:

Disclaimer

This script is intended as an analytical and educational tool. It does not guarantee specific outcomes or eliminate trading risks. Use this tool at your own discretion and always practice proper risk management.

This script is designed to identify and highlight Order Blocks, a key concept in institutional trading, and combines it with powerful tools like volume heatmaps and accumulation clusters for enhanced market analysis. Suitable for traders of all experience levels, this script provides a clear and customizable visualization to help identify significant market zones effectively.

What Does This Script Do?

- Order Block Identification: Highlights bullish and bearish order blocks directly on the chart, making it easier to spot key supply and demand zones.

- Volume Heatmap: A dynamic heatmap adjusts colors based on relative volume, allowing you to quickly identify areas of heightened activity.

- Institutional Accumulation Clusters: Zones of potential institutional accumulation are calculated using a combination of ATR (Average True Range), standardized volume, and RSI (Relative Strength Index).

- Automatic Clearing: Invalidated order blocks are automatically removed, ensuring your charts remain clean and focused.

Key Features

- Customizable Sensitivity: Adjust the script’s sensitivity to tailor order block detection to different market conditions and strategies.

- Advanced Volume Display Options: Toggle volume visibility on or off. Customize the position, size, and color of volume labels for better integration with your chart's design.

- Dynamic Heatmap Intensity: Fine-tune the heatmap’s intensity and color to highlight areas of interest based on trading volume.

- Dual Order Block Detection: Uses two independent detection settings to analyze the market from multiple perspectives.

- Visual Alerts: Automatically draws key level lines based on detected order blocks for better clarity.

User Benefits:

- Clear Market Analysis: Helps pinpoint institutional activity and key levels with minimal effort.

- Increased Efficiency: Automates plotting and analysis, allowing you to focus on decision-making.

- Versatile Compatibility: Complements strategies like Smart Money Concepts, Wyckoff, and Price Action approaches.

Disclaimer

This script is intended as an analytical and educational tool. It does not guarantee specific outcomes or eliminate trading risks. Use this tool at your own discretion and always practice proper risk management.

Release Notes

This updated version of the script introduces advanced features for institutional-level market analysis. Designed for precision and adaptability, the new features focus on enhancing the detection and visualization of order blocks, providing traders with powerful tools for both high-level strategies and intraday scalping.New Features and Improvements

- Volume Point of Control (VPOC): Highlights price levels with the highest traded volume within an order block.

- Time Price Opportunities (TPO): Identifies zones with prolonged price interaction, providing a complementary perspective to VPOC.

Both VPOC and TPO calculations leverage lower timeframes (LTF) for enhanced precision.

Key Features to Keep in Mind

- Cluster Calculations: Clusters represent high-probability areas where institutional activity is likely to occur. Parameters such as ATR, RSI, and volume deviation can be customized to suit your trading style.

- Heatmap Customization: The dynamic color heatmap adjusts based on volume levels, with separate intensity settings for VPOC and TPO zones to ensure optimal clarity in visualization.

- Settings for Different Trading Styles: Optimized parameters for lower timeframes make this script suitable for scalpers. Adjustable settings for sensitivity, lookback periods, and cluster calculation provide flexibility for different trading styles.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.