PROTECTED SOURCE SCRIPT

Session Volume Profile HVN

Session Volume Profile HVN - Comprehensive Indicator Description

Overview

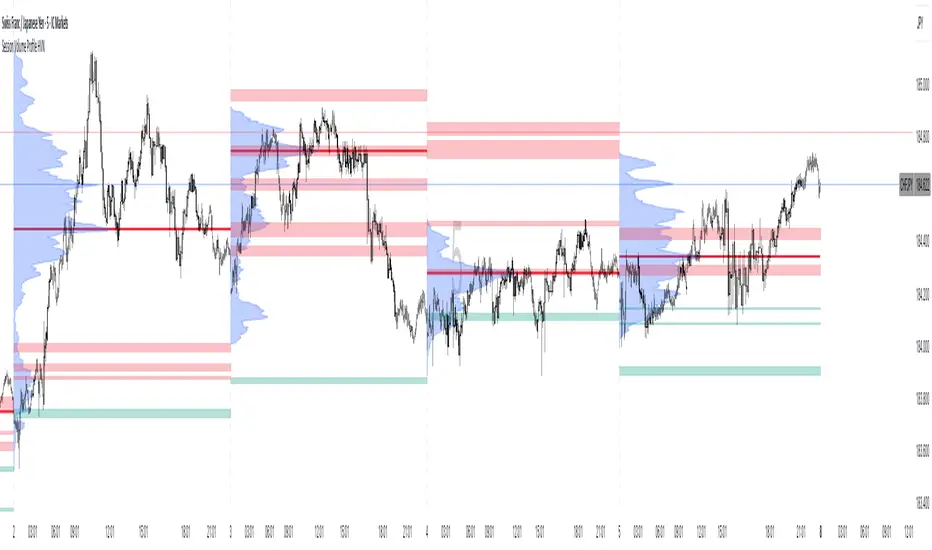

The Session Volume Profile HVN is an advanced volume analysis indicator that provides traders with a visual representation of volume distribution across price levels within defined trading sessions. This powerful tool combines traditional volume profile analysis with High Volume Node (HVN) detection and Volume Point of Control (VPOC) tracking to help identify key support and resistance areas based on trading activity.

Key Features

1. Dynamic Volume Profile Visualization

Creates a comprehensive volume profile for each trading session (daily, weekly, or custom timeframes)

Displays volume distribution as a horizontal histogram, showing where the most trading activity occurred

Automatically scales to fit the price range of each session

Customizable number of price levels (rows) for granular or broad analysis

Profile extension capability to project volume areas into subsequent sessions

2. Volume Point of Control (VPOC)

Automatically identifies and marks the price level with the highest volume in each session

Displays VPOC as a prominent horizontal line that can extend into future sessions

Tracks multiple historical VPOCs with customizable extension limits

Optional date labels for easy identification of when each VPOC was formed

Particularly useful for identifying potential support/resistance levels based on peak trading activity

3. High Volume Node (HVN) Detection

Sophisticated algorithm that identifies significant volume clusters within the profile

Validates HVNs based on customizable strength criteria

Two display options:

Levels: Shows HVNs as horizontal lines (solid for VPOC, dotted for other nodes)

Areas: Displays HVNs as shaded boxes covering the full price range of the node

Color-coded based on price position relative to previous close:

Bullish color for HVNs below the previous close (potential support)

Bearish color for HVNs above the previous close (potential resistance)

4. Multi-Timeframe Analysis

Profile Timeframe: Defines the session boundaries (e.g., daily, weekly, monthly)

Resolution Timeframe: Uses lower timeframe data for more accurate volume distribution

Automatically adjusts to ensure compatibility with chart timeframe

Enables precise volume analysis even on higher timeframe charts

Practical Applications

Support and Resistance Identification

VPOCs and HVNs often act as significant support/resistance levels

Multiple confluent HVNs can indicate strong price zones

Historical VPOC levels provide context for potential price reactions

Trading Strategy Development

Entry/exit points near HVN boundaries

Stop loss placement beyond significant volume nodes

Trend continuation or reversal signals when price breaks through HVN areas

Market Structure Analysis

Identify accumulation/distribution zones

Recognize price acceptance or rejection at specific levels

Understand market participant behavior through volume concentration

Customization Options

Visual Settings

Adjustable colors for profile, VPOC lines, and HVN areas

Line width controls for better visibility

Label size options from tiny to huge

Profile transparency for chart clarity

Technical Parameters

Number of price levels (rows) for profile resolution

HVN detection strength for sensitivity adjustment

VPOC extension count for historical reference

Profile extension percentage for future projection

Display Preferences

Toggle VPOC visibility

Enable/disable HVN display

Choose between line or area representation for HVNs

Control date label display based on timeframe

Best Practices

Timeframe Selection: Choose profile timeframes that align with your trading style (day traders might use hourly profiles, swing traders daily or weekly)

HVN Strength Calibration: Adjust the HVN strength parameter based on market volatility and desired sensitivity

Multiple Timeframe Confirmation: Use different profile timeframes to identify confluence zones

Combination with Other Indicators: Enhance analysis by combining with trend indicators, momentum oscillators, or price action patterns

Performance Considerations

The indicator is optimized for smooth performance while maintaining accuracy through:

Efficient data processing algorithms

Smart memory management for historical data

Automatic cleanup of old visual elements

Scalable architecture supporting up to 500 visual elements

Ideal For

Day Traders: Identifying intraday support/resistance levels

Swing Traders: Finding multi-day accumulation zones

Position Traders: Analyzing longer-term volume structures

Market Analysts: Understanding market participant behavior

Algorithmic Traders: Incorporating volume-based levels into automated strategies

Overview

The Session Volume Profile HVN is an advanced volume analysis indicator that provides traders with a visual representation of volume distribution across price levels within defined trading sessions. This powerful tool combines traditional volume profile analysis with High Volume Node (HVN) detection and Volume Point of Control (VPOC) tracking to help identify key support and resistance areas based on trading activity.

Key Features

1. Dynamic Volume Profile Visualization

Creates a comprehensive volume profile for each trading session (daily, weekly, or custom timeframes)

Displays volume distribution as a horizontal histogram, showing where the most trading activity occurred

Automatically scales to fit the price range of each session

Customizable number of price levels (rows) for granular or broad analysis

Profile extension capability to project volume areas into subsequent sessions

2. Volume Point of Control (VPOC)

Automatically identifies and marks the price level with the highest volume in each session

Displays VPOC as a prominent horizontal line that can extend into future sessions

Tracks multiple historical VPOCs with customizable extension limits

Optional date labels for easy identification of when each VPOC was formed

Particularly useful for identifying potential support/resistance levels based on peak trading activity

3. High Volume Node (HVN) Detection

Sophisticated algorithm that identifies significant volume clusters within the profile

Validates HVNs based on customizable strength criteria

Two display options:

Levels: Shows HVNs as horizontal lines (solid for VPOC, dotted for other nodes)

Areas: Displays HVNs as shaded boxes covering the full price range of the node

Color-coded based on price position relative to previous close:

Bullish color for HVNs below the previous close (potential support)

Bearish color for HVNs above the previous close (potential resistance)

4. Multi-Timeframe Analysis

Profile Timeframe: Defines the session boundaries (e.g., daily, weekly, monthly)

Resolution Timeframe: Uses lower timeframe data for more accurate volume distribution

Automatically adjusts to ensure compatibility with chart timeframe

Enables precise volume analysis even on higher timeframe charts

Practical Applications

Support and Resistance Identification

VPOCs and HVNs often act as significant support/resistance levels

Multiple confluent HVNs can indicate strong price zones

Historical VPOC levels provide context for potential price reactions

Trading Strategy Development

Entry/exit points near HVN boundaries

Stop loss placement beyond significant volume nodes

Trend continuation or reversal signals when price breaks through HVN areas

Market Structure Analysis

Identify accumulation/distribution zones

Recognize price acceptance or rejection at specific levels

Understand market participant behavior through volume concentration

Customization Options

Visual Settings

Adjustable colors for profile, VPOC lines, and HVN areas

Line width controls for better visibility

Label size options from tiny to huge

Profile transparency for chart clarity

Technical Parameters

Number of price levels (rows) for profile resolution

HVN detection strength for sensitivity adjustment

VPOC extension count for historical reference

Profile extension percentage for future projection

Display Preferences

Toggle VPOC visibility

Enable/disable HVN display

Choose between line or area representation for HVNs

Control date label display based on timeframe

Best Practices

Timeframe Selection: Choose profile timeframes that align with your trading style (day traders might use hourly profiles, swing traders daily or weekly)

HVN Strength Calibration: Adjust the HVN strength parameter based on market volatility and desired sensitivity

Multiple Timeframe Confirmation: Use different profile timeframes to identify confluence zones

Combination with Other Indicators: Enhance analysis by combining with trend indicators, momentum oscillators, or price action patterns

Performance Considerations

The indicator is optimized for smooth performance while maintaining accuracy through:

Efficient data processing algorithms

Smart memory management for historical data

Automatic cleanup of old visual elements

Scalable architecture supporting up to 500 visual elements

Ideal For

Day Traders: Identifying intraday support/resistance levels

Swing Traders: Finding multi-day accumulation zones

Position Traders: Analyzing longer-term volume structures

Market Analysts: Understanding market participant behavior

Algorithmic Traders: Incorporating volume-based levels into automated strategies

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.