OPEN-SOURCE SCRIPT

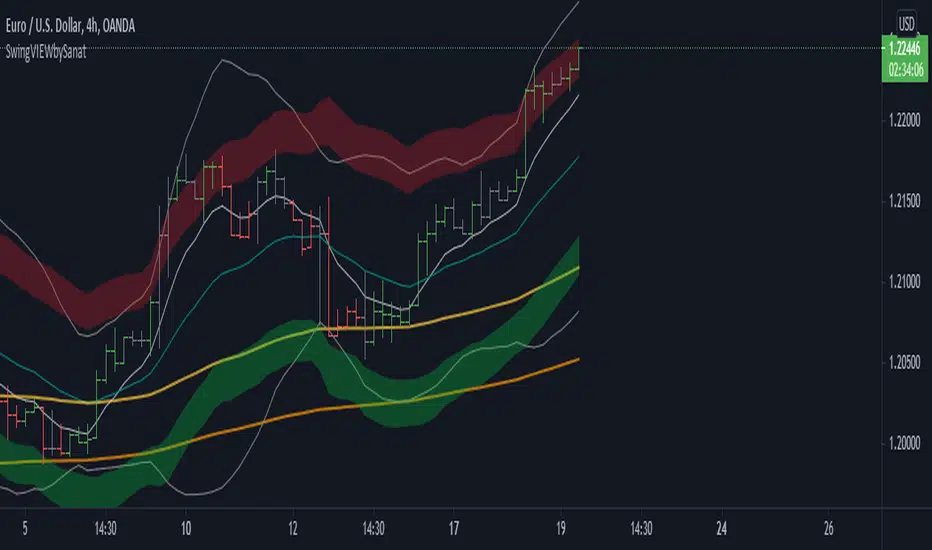

Updated SVIEW

This is momentum based indicator

Input

1. Two EMA

2. Stochastic

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

29 minutes ago

Release Notes:

This is combination of

1. Ema diff

2. stochastic

3. Keltner channel

4. Bollinger bands

5. bunch of EMAs

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

Input

1. Two EMA

2. Stochastic

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

29 minutes ago

Release Notes:

This is combination of

1. Ema diff

2. stochastic

3. Keltner channel

4. Bollinger bands

5. bunch of EMAs

Thought process

1. Difference between fast and slow ema has a oscillating nature.

2. Stochastic %k %d crossover gives early signals

3. early entry gives low risk high reward setup

Calculation

1. A= EMA (fast) - EMA (slow)

2. B =Stochastic(%K)-Stochastic(%D)

When A is increasing and B is positive, bar is green

When A is decreasing and B is negative, bar is red

Else, bar is black

Use

This is an early entry signal system. When used with Channel trading system, it gives high probability, low risk high reward setups

Example

When price has breached below -2 Keltner channel, and impulse candle turns green, go long (or sell put options )

Release Notes

Default layout simplifiedLogic for bar color modified

Release Notes

update in this version1. for bar color, smooth stochastic used in place of stochastic

2. default layout made visually more simple

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.