OPEN-SOURCE SCRIPT

VWAP Pullback + RSI Confirmation

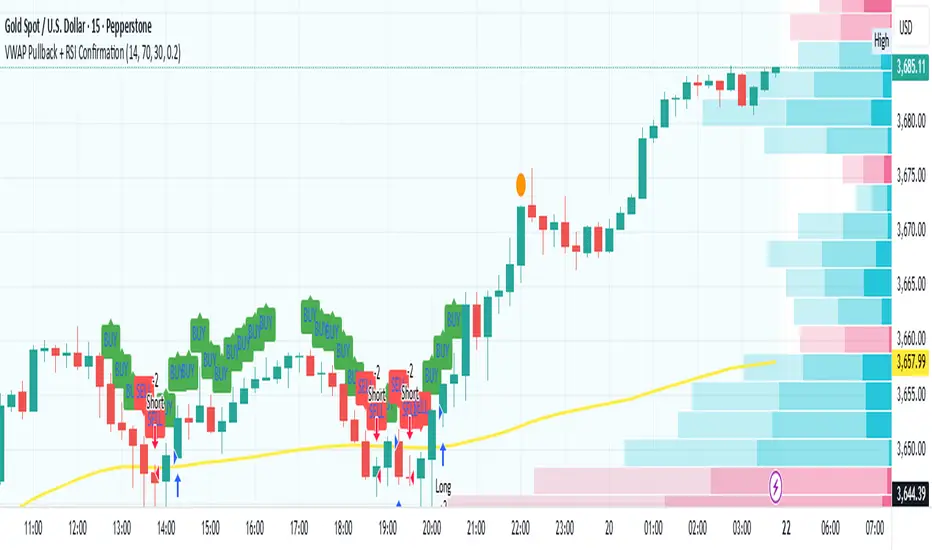

This strategy focuses on trend continuation entries. Instead of betting on reversions, it looks for opportunities when price pulls back to VWAP but the dominant trend remains intact.

Trend Bias:

Price above VWAP = bullish environment → look for BUY pullbacks.

Price below VWAP = bearish environment → look for SELL pullbacks.

Entry Logic:

BUY: Price pulls back near VWAP, RSI stays above oversold (momentum intact).

SELL: Price pulls back near VWAP, RSI stays below overbought (momentum intact).

Exit Rule:

Stop-loss just below/above VWAP.

Take-profit at 1.5–2x risk (default script uses ~2%).

Best Timeframes:

15m–1H → good for intraday trend-following setups.

Daily → captures stronger, longer trends.

⚡ This strategy is powerful in trending markets because VWAP acts as a "magnet" for pullbacks, while RSI prevents overbought/oversold traps.

Trend Bias:

Price above VWAP = bullish environment → look for BUY pullbacks.

Price below VWAP = bearish environment → look for SELL pullbacks.

Entry Logic:

BUY: Price pulls back near VWAP, RSI stays above oversold (momentum intact).

SELL: Price pulls back near VWAP, RSI stays below overbought (momentum intact).

Exit Rule:

Stop-loss just below/above VWAP.

Take-profit at 1.5–2x risk (default script uses ~2%).

Best Timeframes:

15m–1H → good for intraday trend-following setups.

Daily → captures stronger, longer trends.

⚡ This strategy is powerful in trending markets because VWAP acts as a "magnet" for pullbacks, while RSI prevents overbought/oversold traps.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.