OPEN-SOURCE SCRIPT

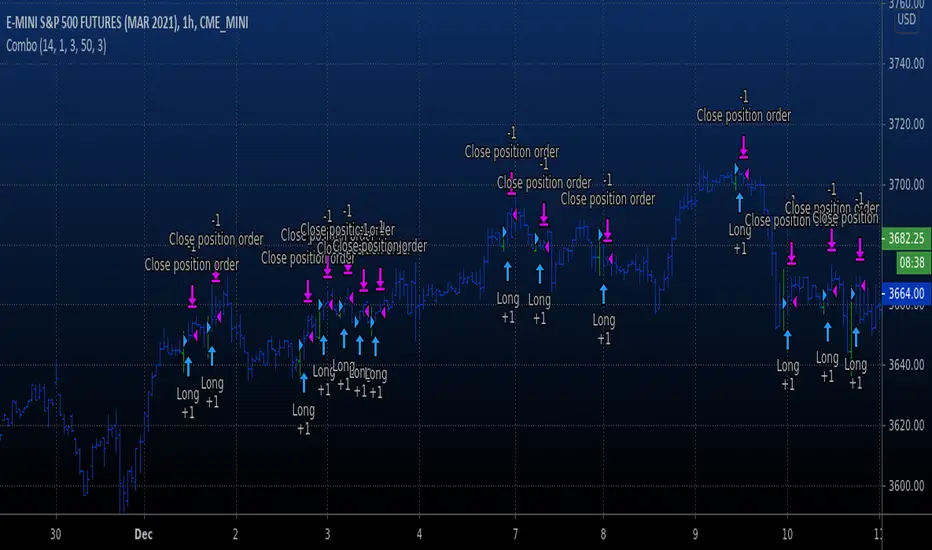

Combo Backtest 123 Reversal & Key Reversal Up

This is combo strategies for get a cumulative signal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

A key reversal is a one-day trading pattern that may signal the reversal of a trend.

Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

How Does a Key Reversal Work?

Depending on which way the stock is trending, a key reversal day occurs when:

In an uptrend -- prices hit a new high and then close near the previous day's lows.

In a downtrend -- prices hit a new low, but close near the previous day's highs

WARNING:

- For purpose educate only

- This script to change bars colors.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Second strategy

A key reversal is a one-day trading pattern that may signal the reversal of a trend.

Other frequently-used names for key reversal include "one-day reversal" and "reversal day."

How Does a Key Reversal Work?

Depending on which way the stock is trending, a key reversal day occurs when:

In an uptrend -- prices hit a new high and then close near the previous day's lows.

In a downtrend -- prices hit a new low, but close near the previous day's highs

WARNING:

- For purpose educate only

- This script to change bars colors.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.