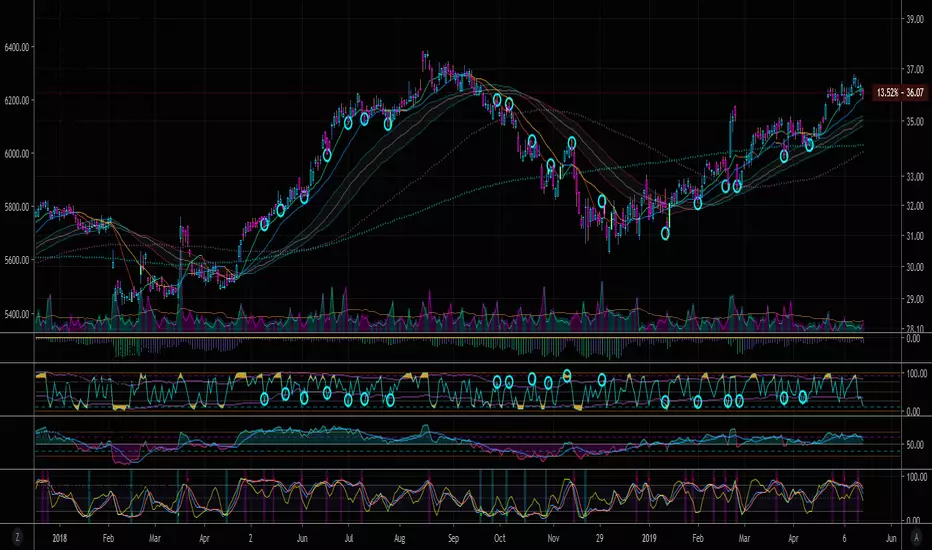

RSI-2

It is used to locate pull back points within a major trend.

These points will generally offer the best risk/reward entry areas.

OB is >90

OS is <10

In an uptrend, long, when RSI-2 is OS

In a downtrend, short, when RSI-2 is OB

Start with 1D chart,

If RSI-2 gives too many signals (false signals) then use higher time frame, such as 3D

If RSi-2 gives not enough signals, then use a lower time frame, such as 3HR

For more information on RSI-2, read "Short term trading strategies that work"-by larry connors, chapter 9

Bollinger bands activated, to fix the prior issue where RSI-2 indicator was not sensitive enough on the current time frame to reach OS (<10) & OB (>90) areas.

With the bolinger bands, it effectively creates a corridor channel to use as OB & OS.

Bolinger band for RSI-2 uses 1 std dev over 31 periods.

traditional bolinger bands are based on: 2 std dev over 20 period ,

tradition TDI is based on: 1.618 std dev over 31 peroids

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact provalesco directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact provalesco directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.