PROTECTED SOURCE SCRIPT

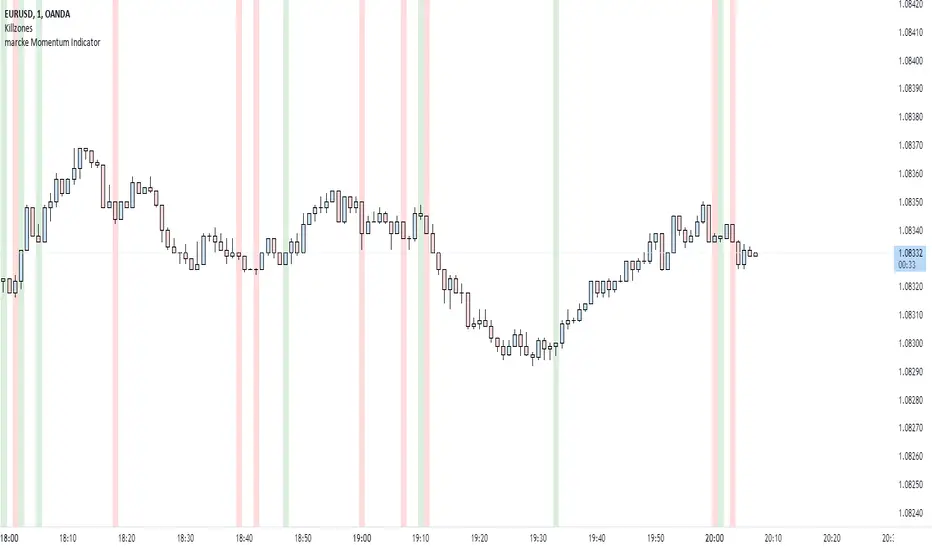

Updated marcke Momentum Indicator

Here's a breakdown:

Input Parameter: The length parameter specifies the number of bars (candles) to look back when calculating momentum. It allows you to adjust the sensitivity of the momentum calculation.

Momentum Calculation: The script calculates momentum using the closing price of the current candle (close) minus the closing price of the candle length bars ago (close[length]). This calculation gives you the change in price over the specified period.

Conditions: Based on the calculated momentum, the script determines whether the current candle exhibits bullish momentum (if momentum > 0) or bearish momentum (if momentum < 0).

Identifying First Momentum Candle: To identify the first candle where momentum conditions are met, the script checks if the current candle satisfies the momentum condition (bullish_momentum or bearish_momentum) and if the previous candle does not. This indicates a change in momentum from the previous candle.

Coloring: The script assigns colors (first_bullish_color and first_bearish_color) for the background of the first bullish and bearish momentum candles, respectively, using the bgcolor() function.

Visualization: Additionally, the script plots the momentum line on the chart using the plot() function to provide visual representation of the momentum values over time.

Overall, the momentum calculation in this script measures the change in price over a specified lookback period, and it identifies the first candle where bullish or bearish momentum conditions are met. Adjusting the length parameter allows you to customize the sensitivity of the momentum calculation to suit your analysis needs.

Input Parameter: The length parameter specifies the number of bars (candles) to look back when calculating momentum. It allows you to adjust the sensitivity of the momentum calculation.

Momentum Calculation: The script calculates momentum using the closing price of the current candle (close) minus the closing price of the candle length bars ago (close[length]). This calculation gives you the change in price over the specified period.

Conditions: Based on the calculated momentum, the script determines whether the current candle exhibits bullish momentum (if momentum > 0) or bearish momentum (if momentum < 0).

Identifying First Momentum Candle: To identify the first candle where momentum conditions are met, the script checks if the current candle satisfies the momentum condition (bullish_momentum or bearish_momentum) and if the previous candle does not. This indicates a change in momentum from the previous candle.

Coloring: The script assigns colors (first_bullish_color and first_bearish_color) for the background of the first bullish and bearish momentum candles, respectively, using the bgcolor() function.

Visualization: Additionally, the script plots the momentum line on the chart using the plot() function to provide visual representation of the momentum values over time.

Overall, the momentum calculation in this script measures the change in price over a specified lookback period, and it identifies the first candle where bullish or bearish momentum conditions are met. Adjusting the length parameter allows you to customize the sensitivity of the momentum calculation to suit your analysis needs.

Release Notes

Here's a breakdown:Input Parameter: The length parameter specifies the number of bars (candles) to look back when calculating momentum. It allows you to adjust the sensitivity of the momentum calculation.

Momentum Calculation: The script calculates momentum using the closing price of the current candle (close) minus the closing price of the candle length bars ago (close[length]). This calculation gives you the change in price over the specified period.

Conditions: Based on the calculated momentum, the script determines whether the current candle exhibits bullish momentum (if momentum > 0) or bearish momentum (if momentum < 0).

Identifying First Momentum Candle: To identify the first candle where momentum conditions are met, the script checks if the current candle satisfies the momentum condition (bullish_momentum or bearish_momentum) and if the previous candle does not. This indicates a change in momentum from the previous candle.

Coloring: The script assigns colors (first_bullish_color and first_bearish_color) for the background of the first bullish and bearish momentum candles, respectively, using the bgcolor() function.

Visualization: Additionally, the script plots the momentum line on the chart using the plot() function to provide visual representation of the momentum values over time.

Overall, the momentum calculation in this script measures the change in price over a specified lookback period, and it identifies the first candle where bullish or bearish momentum conditions are met. Adjusting the length parameter allows you to customize the sensitivity of the momentum calculation to suit your analysis needs.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.