OPEN-SOURCE SCRIPT

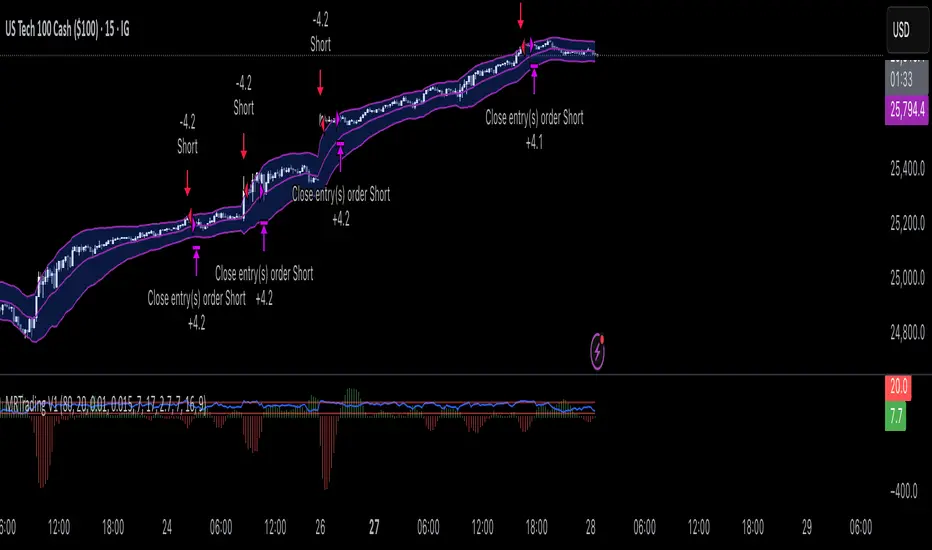

Mean Reversion Trading V1

Overview

This is a simple mean reversion strategy that combines RSI, Keltner Channels, and MACD Histograms to predict reversals. Current parameters were optimized for NASDAQ 15M and performance varies depending on asset. The strategy can be optimized for specific asset and timeframe.

How it works

Long Entry (All must be true):

1. RSI < Lower Threshold

2. Close < Lower KC Band

3. MACD Histogram > 0 and rising

4. No open trades

Short Entry (All must be true):

1. RSI > Upper Threshold

2. Close > Upper KC Band

3. MACD Histogram < 0 and falling

4. No open trades

Long Exit:

1. Stop Loss: Average position size x ( 1 - SL percent)

2. Take Profit: Average position size x ( 1 + TP percent)

3. MACD Histogram crosses below zero

Short Exit:

1. Stop Loss: Average position size x ( 1 + SL percent)

2. Take Profit: Average position size x ( 1 - TP percent)

3. MACD Histogram crosses above zero

Settings and parameters are explained in the tooltips.

Important

Initial capital is set as 100,000 by default and 100 percent equity is used for trades

This is a simple mean reversion strategy that combines RSI, Keltner Channels, and MACD Histograms to predict reversals. Current parameters were optimized for NASDAQ 15M and performance varies depending on asset. The strategy can be optimized for specific asset and timeframe.

How it works

Long Entry (All must be true):

1. RSI < Lower Threshold

2. Close < Lower KC Band

3. MACD Histogram > 0 and rising

4. No open trades

Short Entry (All must be true):

1. RSI > Upper Threshold

2. Close > Upper KC Band

3. MACD Histogram < 0 and falling

4. No open trades

Long Exit:

1. Stop Loss: Average position size x ( 1 - SL percent)

2. Take Profit: Average position size x ( 1 + TP percent)

3. MACD Histogram crosses below zero

Short Exit:

1. Stop Loss: Average position size x ( 1 + SL percent)

2. Take Profit: Average position size x ( 1 - TP percent)

3. MACD Histogram crosses above zero

Settings and parameters are explained in the tooltips.

Important

Initial capital is set as 100,000 by default and 100 percent equity is used for trades

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.