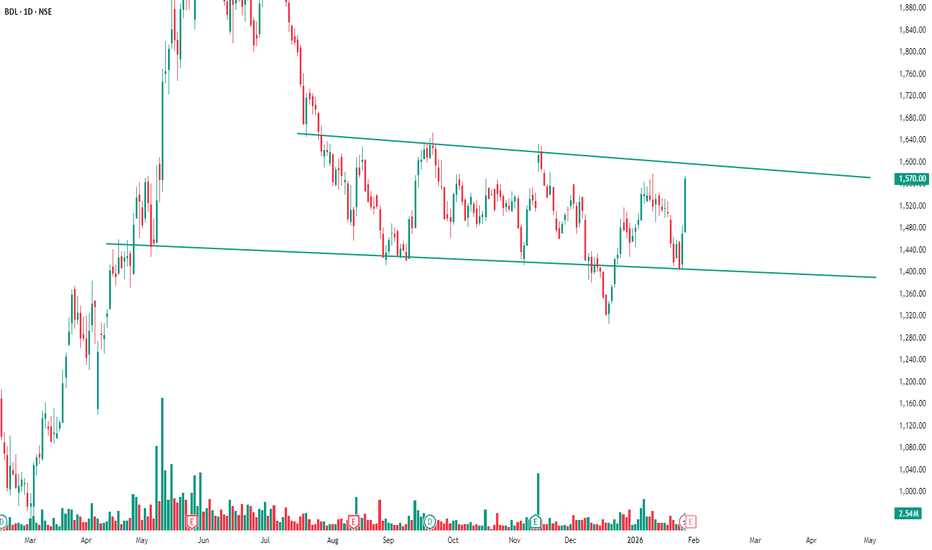

BDL Trading Inside a Clear Downward ChannelBDL is moving within a well-defined downward channel, respecting both resistance at the top and support at the bottom.

The price has once again reacted strongly from the lower trendline, showing that buyers are actively defending this zone. This repeated bounce confirms that the structure is still

Bharat Dynamics Ltd.

No trades

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

15.80 INR

5.50 B INR

33.45 B INR

91.91 M

About Bharat Dynamics Ltd.

Sector

Industry

CEO

Madhavarao A.

Website

Headquarters

Hyderabad

Founded

1970

IPO date

Mar 23, 2018

Identifiers

2

ISIN INE171Z01026

Bharat Dynamics Ltd. engages in the manufacture of defenses equipment. It specializes in surface-to-air missiles, air defense systems, heavy weight torpedoes, air-to-air missiles, and other allied equipment. The company was founded on July 16, 1970 and is headquartered in Hyderabad, India.

Related stocks

NSE DEFENCE STOCK ( Bharat Dynamics ltd ) Week le time fram of stock of (NSE) (/Bharat Dynamics ltd /) look good for futer accourding to me target is on your sceen .

. \ If it break level of $1556 price then ther is heigh problaty of going up . ( Accourding to Me ).

. (I AM NOT SEBI REGISTER PLISE ANALYISE YOUR SELF ALSO ) THANK YOU.

The Mars Cycle: Sagittarius to Aries good opportune for defense The Mars Cycle: Sagittarius to Aries

This could be a very opportune time for the defense sector.

In financial astrology, Mars represents action, energy, and the military-industrial complex.

Sagittarius (Jupiter's Sign): Mars is in a "Friend's House." This is often a period of planning, policy shi

BDL - Breakdown With Reactive Oversold Conditions💹 Bharat Dynamics Ltd (NSE: BDL)

Sector: Defence | CMP: 1324.3

View: Bearish — Breakdown With Reactive Oversold Conditions

BDL has decisively broken below its recent consolidation structure near the 1350–1380 zone, confirming a bearish continuation phase rather than a routine pullback. The breakdo

Smart Money Accumulating BDL — Are You Watching This Setup?Hello Traders!

Today’s analysis is on Bharat Dynamics Ltd. (BDL) where a clear Reversal from Bottom Setup is developing. After weeks of sideways consolidation, the stock has formed a clean Rectangle Accumulation Pattern right above a strong demand zone. The latest Hammer candle appearing insid

Support Spotted in Bharat Dynamics LtdSince the listing of BDL stock, it has been trading in a set of parallel channel. Several times it took support and resistance of the channel boundaries.

Positive points about BDL stock chart: -

Current price is around the Support of Parallel Channel.

EMA Support Zone.

Significant Volume activity.

BDL Weekly Chart suggest 37% upside possibility in 8-10 MonthsBDL Weekly Chart suggest 37% upside possibility in 8-10 Months.

Fundamental Analysis:

Company is almost debt free.

Company is expected to give good quarter

Company has been maintaining a healthy dividend payout of 37.1%

Technical Analysis:

Stock has formed Inverted H&S Pattern on weekly charts.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

MODEFENCE

Motilal Oswal Nifty India Defence ETF Units Exchange Traded FundWeight

4.85%

Market value

5.55 M

USD

GROWWDEFNC

Groww Nifty India Defence ETF Units Exchange Traded FundWeight

4.86%

Market value

1.30 M

USD

Explore more ETFs

Frequently Asked Questions

The current price of BDL is 1,303.20 INR — it has increased by 0.76% in the past 24 hours. Watch Bharat Dynamics Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NSE exchange Bharat Dynamics Ltd. stocks are traded under the ticker BDL.

BDL stock has fallen by −8.32% compared to the previous week, the month change is a −16.59% fall, over the last year Bharat Dynamics Ltd. has showed a 7.79% increase.

We've gathered analysts' opinions on Bharat Dynamics Ltd. future price: according to them, BDL price has a max estimate of 2,000.00 INR and a min estimate of 1,250.00 INR. Watch BDL chart and read a more detailed Bharat Dynamics Ltd. stock forecast: see what analysts think of Bharat Dynamics Ltd. and suggest that you do with its stocks.

BDL stock is 3.58% volatile and has beta coefficient of 2.20. Track Bharat Dynamics Ltd. stock price on the chart and check out the list of the most volatile stocks — is Bharat Dynamics Ltd. there?

Today Bharat Dynamics Ltd. has the market capitalization of 465.11 B, it has decreased by −4.29% over the last week.

Yes, you can track Bharat Dynamics Ltd. financials in yearly and quarterly reports right on TradingView.

Bharat Dynamics Ltd. is going to release the next earnings report on May 28, 2026. Keep track of upcoming events with our Earnings Calendar.

BDL earnings for the last quarter are 2.00 INR per share, whereas the estimation was 5.63 INR resulting in a −64.50% surprise. The estimated earnings for the next quarter are 10.95 INR per share. See more details about Bharat Dynamics Ltd. earnings.

Bharat Dynamics Ltd. revenue for the last quarter amounts to 5.67 B INR, despite the estimated figure of 10.73 B INR. In the next quarter, revenue is expected to reach 20.29 B INR.

BDL net income for the last quarter is 729.22 M INR, while the quarter before that showed 2.16 B INR of net income which accounts for −66.22% change. Track more Bharat Dynamics Ltd. financial stats to get the full picture.

Bharat Dynamics Ltd. dividend yield was 0.36% in 2024, and payout ratio reached 31.01%. The year before the numbers were 0.60% and 63.12% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Feb 9, 2026, the company has 2.27 K employees. See our rating of the largest employees — is Bharat Dynamics Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Bharat Dynamics Ltd. EBITDA is 4.67 B INR, and current EBITDA margin is 14.15%. See more stats in Bharat Dynamics Ltd. financial statements.

Like other stocks, BDL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Bharat Dynamics Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Bharat Dynamics Ltd. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Bharat Dynamics Ltd. stock shows the sell signal. See more of Bharat Dynamics Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.