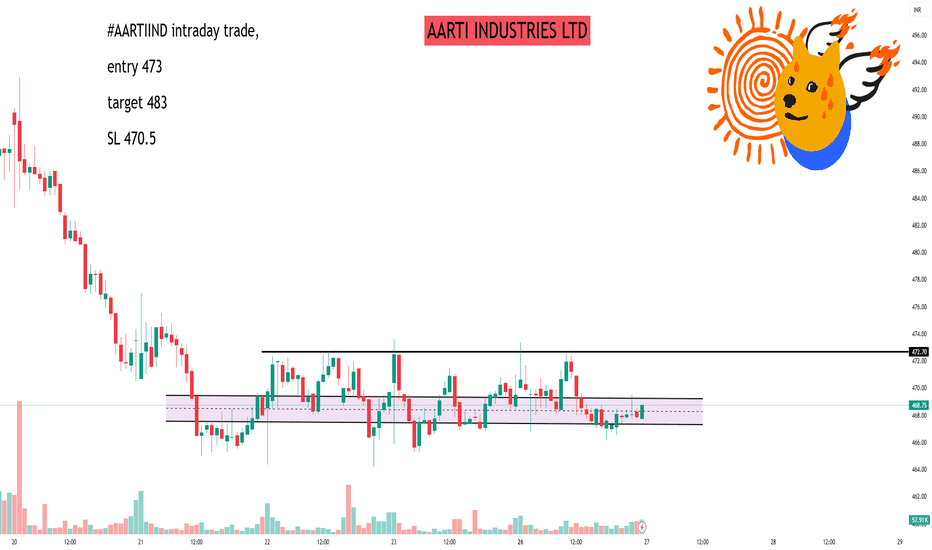

Trade ideas

Aarti Industries Limited (AARTIIND)Aarti Industries Limited:- Manufacturing and supplying specialty chemicals, intermediates, and pharmaceuticals, catering to diverse industries such as agrochemicals, pharmaceuticals, polymers, additives, and energy.

Integrated Manufacturing: The company leverages backward and forward integration across its value chain, producing key raw materials in-house to ensure cost efficiency and supply chain control.

Diversified Product Portfolio: It offers over 200 products, including benzene-based intermediates, specialty chemicals, and active pharmaceutical ingredients (APIs), reducing dependency on a single market.

Custom Synthesis: A significant portion of revenue comes from tailored solutions for global clients, particularly in the U.S. and Europe, through long-term contracts.

Export-Oriented: Approximately 60-70% of its revenue is generated from exports, targeting regulated markets with high-quality standards.

Innovation and R&D: The company invests in research and development to develop new molecules and improve processes, supported by multiple R&D centers.

Sustainability Focus: It emphasizes eco-friendly production processes and energy-efficient technologies to align with global environmental norms.

Key points:

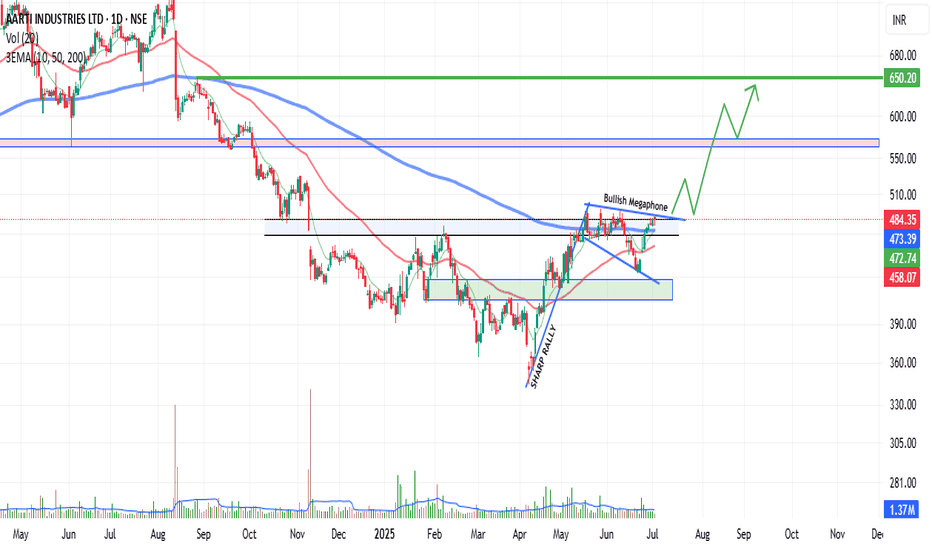

The stock has risen 37% from its 52-week low of INR 344.20 (April 2025) but is 37.5% below its 52-week high of INR 765.50 (August 2024).

potential Bullish Megaphone pattern on the chart,with resistance near INR 500 and support at INR 450-460. A breakout above INR 500 could target INR 540-555.

** Recent news indicates a potential recovery in the chemical cycle, improved demand and profitability in key segments like energy.

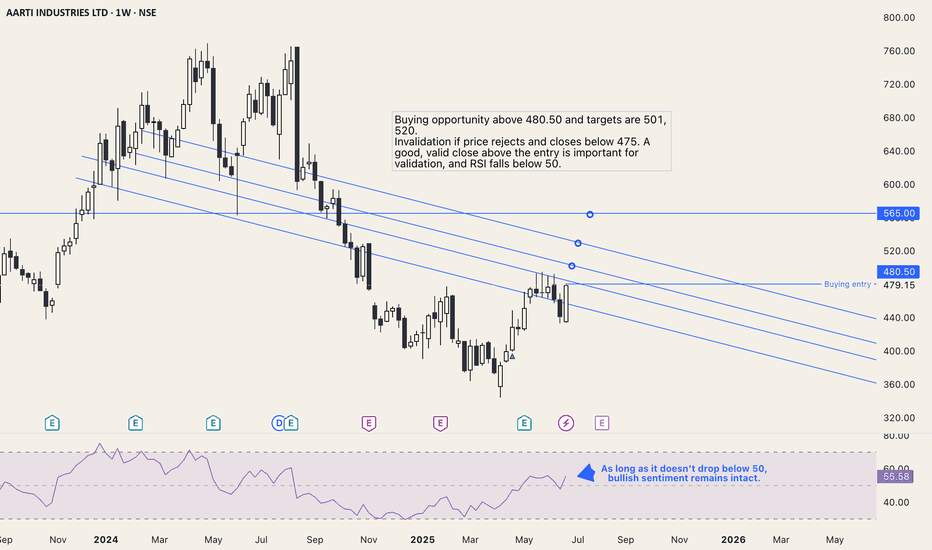

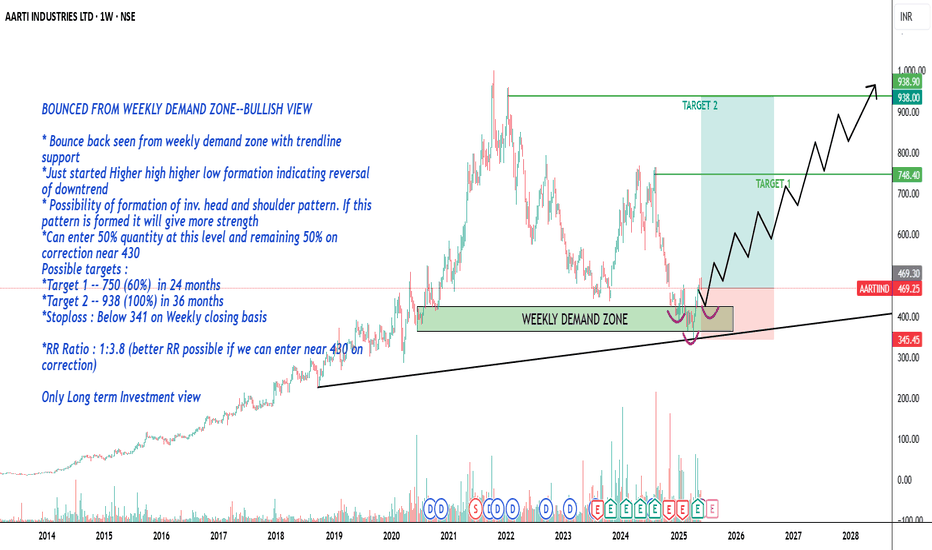

AARTI IND-- Bullish view-Educational PurposeAARTI IND--BOUNCED FROM WEEKLY DEMAND ZONE--BULLISH VIEW

* Bounce back seen from weekly demand zone with trendline support

*Just started Higher high higher low formation indicating reversal of downtrend

* Possibility of formation of inv. head and shoulder pattern. If this pattern is formed it will give more strength

*Can enter 50% quantity at this level and remaining 50% on correction near 430

Possible targets :

*Target 1 -- 750 (60%) in 24 months

*Target 2 -- 938 (100%) in 36 months

*Stop loss : Below 341 on Weekly closing basis

*RR Ratio : 1:3.8 (better RR possible if we can enter near 430 on correction)

Only Long term Investment view

AARTI INDUSTRIES LTD📊 Intraday Support & Resistance Levels (15-Minute Interval)

Based on recent technical data, the following are the key support and resistance levels for AARTIIND:

Support Levels:

S1: ₹466.67

S2: ₹464.97

S3: ₹462.22

Resistance Levels:

R1: ₹472.17

R2: ₹473.87

R3: ₹476.62

These levels are derived from Fibonacci pivot point calculations and are pertinent for intraday trading decisions.

📈 Technical Indicators Overview

Trend Analysis: The stock exhibits a bullish trend in the short to mid-term, with resistance noted around ₹486.90 and support near ₹420.40.

Moving Averages: AARTIIND is trading above its 50-day moving average, indicating upward momentum.

Relative Strength Index (RSI): The RSI is approaching overbought territory, suggesting caution for new long positions.

✅ Trading Strategy Suggestions

Long Positions: Consider entering if the price sustains above ₹472.17 (R1) with strong volume, targeting ₹476.62 (R3).

Short Positions: If the price falls below ₹466.67 (S1), it may test lower supports at ₹464.97 (S2) and ₹462.22 (S3).

Stop-Loss Recommendations:

For Long Trades: Place a stop-loss below ₹466.67.

For Short Trades: Place a stop-loss above ₹472.17.

Right Chemistry for a Brighter TomorrowAarti Industries Ltd, the flagship company of the Aarti group, manufacturing organic and inorganic chemicals at its major facilities in Vapi, Jhagadia, Dahej and Kutch, in Gujarat and in Tarapur in Maharashtra. The company has a strong market position in the NCB-based specialty chemicals segment.

Aarti Ind CMP - 464.

This is just to boost my confidence. No Suggestions for buying.

Disclosure: I am not SEBI registered. The information provided here is for educational purposes only. I will not be responsible for any of your profit/loss with these suggestions. Consult your financial advisor before making any decisions.

Aarti Industries.This stocks likely to be finishing double correction and may rise in counter trend for B or X

Rsi and price action suggesting some reversal at this levels. lets see

# disclaimer : this chart is only for educational purpose of Elliott wave practitioners.

Do not take this as a recommendations as Elliott wave is always a subjective concept.

Bullish divergence in AARTIINDA positive divergence in AARTIIND, which enables a buying opportunity above the last high, i.e., 446

Targets are the selective levels from the default pitchfork.

T1 is around 476, and T2 is around 495.

These targets consider not only the price but also the time factor in the calculation; therefore, the targets are subjective, based on when the candles reach the trendlines.

Entry is active only on breakout of high 446, and if waited for retest of this level will validate it more. An entry on lower time not less than 4h is suggested.

Alternatively, I will also be looking for 1 hour for early entry.

Shooting Star Candlestick Pattern The Shooting Star is a key candlestick pattern that signals the end of an uptrend. It looks like a small body with a long upper shadow, and very little or no lower shadow. This pattern often appears at the peak of an uptrend and can indicate a potential reversal.

How to Identify the Shooting Star:

1) Long upper shadow: The upper shadow should be at least twice as long as the body.

2) Gap up: Price opens higher than the previous day’s close.

3) Small body near the bottom: The body of the candle is small and near the bottom of the price range for the day.

4) No lower shadow: The lower shadow is very short or nonexistent.

What It Means:

The market opens strong and pushes higher during the day, but by the end, the price falls back down, showing that sellers are starting to take control. This could indicate that the uptrend is losing momentum and a reversal might be near.

Confirmation:

Look for a bearish candle or a gap down the next day to confirm the Shooting Star pattern.

Key Insights:

1) The longer the upper shadow, the stronger the potential for a reversal.

2) A gap up followed by a Shooting Star can signal an even stronger reversal.

3) High volume on the Shooting Star day can increase the chances of a significant price change.

Example with AARTIIND (Daily Chart) 📊:

This is a daily time frame chart of AARTIIND, where a Shooting Star pattern is forming at the top of an uptrend. This visual example will help you better understand how the pattern works in real market conditions.

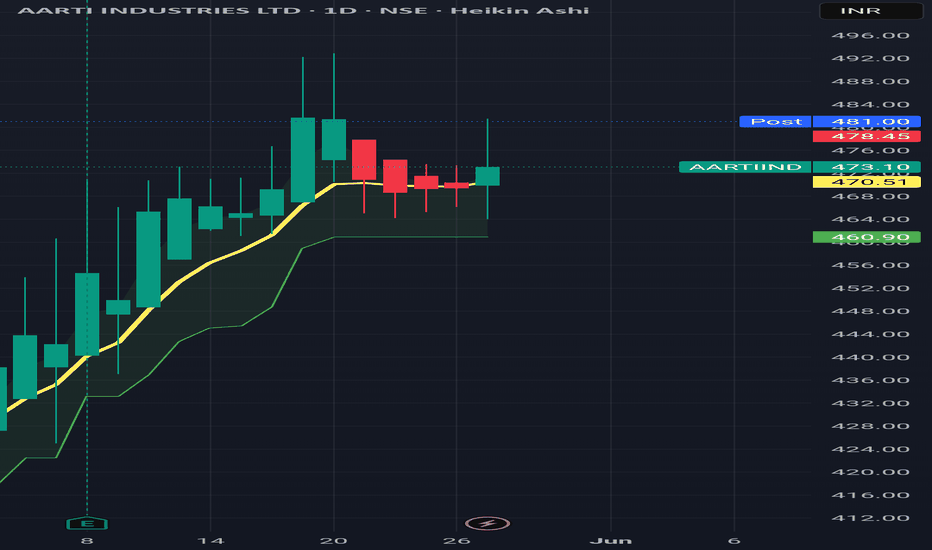

AARTIIND - DAILY CHARTAARTIIND is taping in Order Block, seems in the buying zone. Probability of an upside move.

Must use SL.

If you like my analysis, please follow me as a token of appreciation :)

in.tradingview.com/u/SatpalS/

For learning and educational purposes only, not trading advice. Please consult your financial advisor before investing.

Aarti Industries Breakout Long Call Technical Alert: Aarti Industries (AARTIIND)

Breakout Confirmation

Aarti Industries has successfully breached the crucial resistance level of ₹460, closing above it. This breakout is significant, as the stock has resisted this level three times in the past.

Trade Setup: Long Call

- Target: ₹515

- Stop Loss (SL): ₹450

- Risk-Reward Ratio: Favorable

Technical Analysis:

1. Moving Averages: AARTIIND is trading above its 44-day moving average, indicating a strong uptrend.

2. Candle Pattern: The breakout is supported by a bullish candle pattern, suggesting further upside.

3. Resistance Levels: As per the chart, there is no significant resistance above ₹472, paving the way for the stock to reach its target.

Trade Rationale:

The target of ₹515 is calculated based on the support-to-resistance breakout level. With a favorable risk-reward ratio, this trade setup offers an attractive opportunity for investors.

Disclaimer: This is a technical analysis-based trade setup. Investors are advised to conduct their own research and consult with their financial advisors before making any investment decisions.

AARTIIND (Aarti Industries Ltd)- AnalysisBullish Levels -day closing above 457 (early entry risky) then 493 to 501 then 528 to 546 (safe entry if day closing above this) first target can be around 629 if sustain above this for a week or two then we can expect targets targets around 806 then 940 above this more bullish

Bearish levels :- Day closing below 409 to 401 then 374 then 338 good support best for averaging with SL of 329 to 325 strict SL for Long term Investor below this more bearish.

**Consider some Points buffer in above levels

**Disclaimer -

I am not a SEBI registered analyst or advisor. I does not represent or endorse the accuracy or reliability of any information, conversation, or content. Stock trading is inherently risky and the users agree to assume complete and full responsibility for the outcomes of all trading decisions that they make, including but not limited to loss of capital. None of these communications should be construed as an offer to buy or sell securities, nor advice to do so. The users understands and acknowledges that there is a very high risk involved in trading securities. By using this information, the user agrees that use of this information is entirely at their own risk.

Thank you.

Aarti Ind - Low Risk OpportunityIn the last 6 months, the stock price has come down around 40%. This time has been consolidating in a small range in recent days.

MACD is showing a possible reversal on a weekly basis.

If it gives a reversal, it may go into a bullish phase again.

Possible targets are 485/570/620++.

If it sustains below 370, the setup goes weak.

One has to keep the position size in accordance with risk management.

This illustration is my own view. It is only for learning and sharing purposes. It is not a buying recommendation.

All the best.

Aarti IndustriesSL 1Hr candle close only, Target Trigger Price

All detail for chat. good entry at mark price only. and must stoploss minimum risk and good profit. risk ratio 1:1 to manage modified SL. This is not call, Just my idea. Please understand your risk and take full responsibility of your actions

Positional Long : Aarti Industries

Aarti Industry has given a good correction of ~64% from its top due to weakness in its energy business, drop in Mono Methyl Aniline (MMA) margins ,and is trading near a important support area i.e 400 level.

Currently its following a descending channel pattern and has formed a double bottom pattern.

Earlier price has formed a Head & Shoulder pattern, & price descended ~25% which was due as per the H&S Pattern.

Given the headwinds looks like a good positional buy with a staggered accumulation approach in major dips.

⚡Note: This is just for analysis purpose, please do your own research before punching any orders.

🔍 For more technical analysis and trade setups, make sure to follow me on trading view.

🔗 Trading View: in.tradingview.com/u/DebasisT/