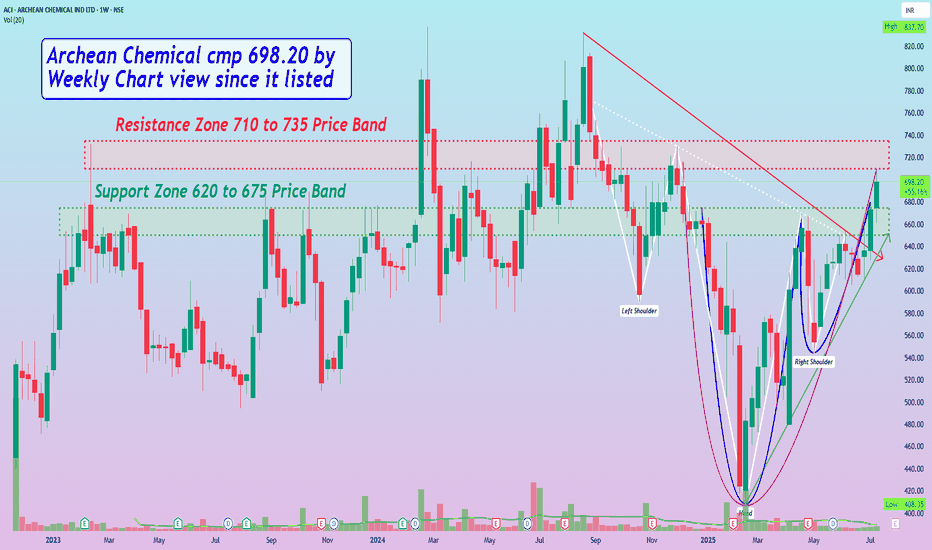

Archean Chemical cmp 698.20 by Weekly Chart view since it listedArchean Chemical cmp 698.20 by Weekly Chart view since it listed

- Support Zone 620 to 675 Price Band

- Resistance Zone 710 to 735 Price Band

- Volumes flattish, need to increase for Resistance Zone Breakout

- Bullish Rounding Bottom inclusive of Cup & Handle pattern completed

- A logically consid

ARCHEAN CHEMICAL INDUSTRIES LI

673.45INRD

−8.05−1.18%

At close at Jul 25, 11:09 GMT

INR

No trades

Next report date

Today

Report period

Q1 2025

EPS estimate

5.90 INR

Revenue estimate

3.43 B INR

13.15 INR

1.62 B INR

10.40 B INR

42.58 M

About ARCHEAN CHEMICAL IND LTD

Sector

Industry

CEO

Ranjit Pendurthi

Website

Headquarters

Chennai

Founded

2009

ISIN

INE128X01021

FIGI

BBG01BD78XR4

Archean Chemical Industries Ltd. produces sulphate of potash, gypsum, bromine, and several industrial chemicals through conversion of naturally available marine mineral deposits. Its products includes Bromine, Sulphate of Potash and Industrial Salt The company was founded on July 14, 2009 and is headquartered in Chennai, India.

6.5%

10.5%

14.5%

18.5%

22.5%

Q4 '23

Q1 '24

Q2 '24

Q3 '24

Q4 '24

0.00

900.00 M

1.80 B

2.70 B

3.60 B

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

0.00

900.00 M

1.80 B

2.70 B

3.60 B

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

0.00

900.00 M

1.80 B

2.70 B

3.60 B

Q4 '23

Q1 '24

Q2 '24

Q3 '24

Q4 '24

0.00

600.00 M

1.20 B

1.80 B

2.40 B

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

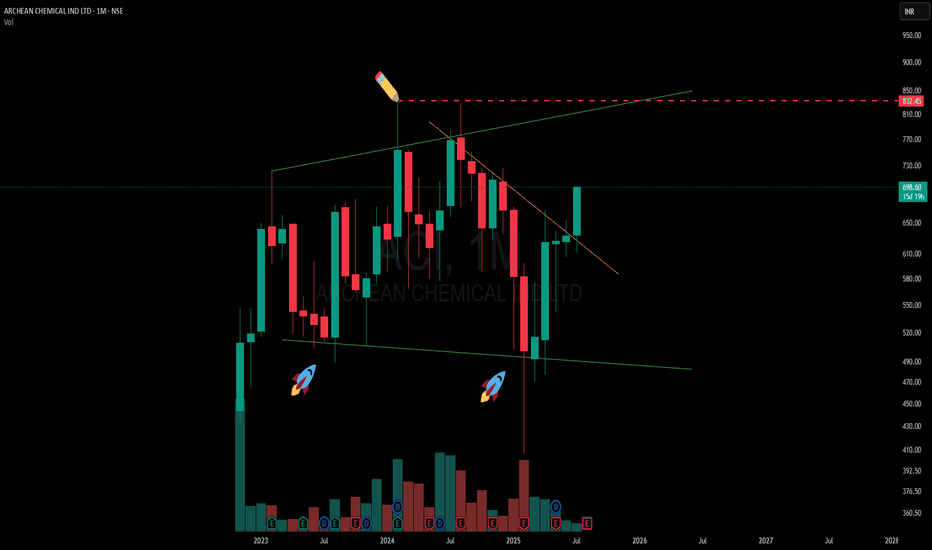

Archean Chemical – Broadening pattern and the CT ? 🟢A classic case of a broadening formation playing out on the higher timeframe (MTF). The green lines represent the broadening range, with price recently respecting the lower boundary — evident from the two support touches marked with 🚀 icons, each forming slightly lower lows before rebounding.

🟢 Th

NLong

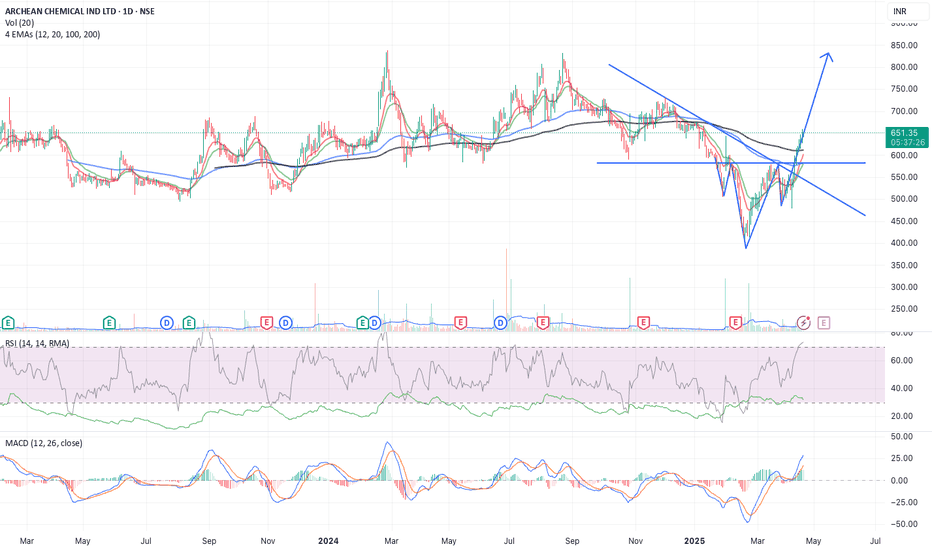

ACI - Bullish with Inverted head and Shoulder patternACI - Bullish with Inverted head and Shoulder pattern

Fundamental Outlook

Almost debt free D/E ratio is 0.02, High ICR

PE of 36.59, IND PE is 30.44, Slightly expensive.

PEG of 0.83, attractive and hence high PE

ROE = 19.45%

ROCE = 25.75% , ROCE 5yrs = 29.26%

Sales growth = -31.72%, Sales Growt

NLong

Archean Chemical - Chart of the WeekNSE:ACI has a beautiful structure in the Weekly Timeframe that qualifies for my Chart of the Week idea. It saw Decent Volumes this week and closed above its recent swing high, with RSI and MACD Trending Upwards and Closing Above all Major Short moving Averages, breaking the Trendline.

About:

NS

ACI - Double Bottom (Bullish)Archean chemical industries is a leading specialty marine chemical manufacturer in India focused on producing and exporting bromine, industrial salt, and sulphate of potash across the world. Archean is the largest exporter of bromine and industrial salt in India and has amongst the lowest cost of pr

[Mixed Signals] Archean Chemical Industries - What's your view? Archean Chemical Industries Ltd. What's your view?

Fundamentals

MCAP- 7400 Cr

PE - 27.86 < Industry PE of 32.2, Moderately priced

PEG Ratio is 0.64, excellent

Debt to Equity is 0.02 and ICR is 42

ROE is 19.45%, ROCE is 25.75% ( 5yr ROCE is 29.26%)

Sales growth is -17%, 5yr Sales growth is 18%

Archean chemicals buying opportunity near bottom trendlineChg in FII Hold 0.64 %

Chg in DII Hold 0.79 %

Industry PE and PBV are more than ACI.

Company has no debt.

Part of Goldman Sachs Funds - Goldman Sachs India Equity Portfolio.

Last few quarters.

1.02 1.61 1.80 2.25 2.37

Source - Screener.in

NLong

Archean chemical looks goos aroung 696-700 levelsArchean chemicals looks good at level of 696-700 with strict sl of 685 fo rtarge for 735++ 758++ 794++ 810++

NLong

morning star,price ready to shoot upA perfect morning star takesthe price upwards

Long position above the candle high

Good risk reward ratio

rsi showing bullish divergence

Follow with strict stoploss

NLong

ACI gives brake out on daily chartNSE:ACI

ACI gives brake out on daily chart.

I am buying this stock

Near 760

And follow sl on 640

My target will be 930

My risk reward ratio is 1:1.60

Return on capital 20%

NLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ACI is 673.45 INR — it has decreased by −1.18% in the past 24 hours. Watch ARCHEAN CHEMICAL INDUSTRIES LI stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange ARCHEAN CHEMICAL INDUSTRIES LI stocks are traded under the ticker ACI.

ACI stock has fallen by −2.50% compared to the previous week, the month change is a 9.38% rise, over the last year ARCHEAN CHEMICAL INDUSTRIES LI has showed a −8.22% decrease.

We've gathered analysts' opinions on ARCHEAN CHEMICAL INDUSTRIES LI future price: according to them, ACI price has a max estimate of 750.00 INR and a min estimate of 585.00 INR. Watch ACI chart and read a more detailed ARCHEAN CHEMICAL INDUSTRIES LI stock forecast: see what analysts think of ARCHEAN CHEMICAL INDUSTRIES LI and suggest that you do with its stocks.

ACI stock is 4.52% volatile and has beta coefficient of 0.69. Track ARCHEAN CHEMICAL INDUSTRIES LI stock price on the chart and check out the list of the most volatile stocks — is ARCHEAN CHEMICAL INDUSTRIES LI there?

Today ARCHEAN CHEMICAL INDUSTRIES LI has the market capitalization of 83.12 B, it has increased by 3.95% over the last week.

Yes, you can track ARCHEAN CHEMICAL INDUSTRIES LI financials in yearly and quarterly reports right on TradingView.

ARCHEAN CHEMICAL INDUSTRIES LI is going to release the next earnings report on Jul 28, 2025. Keep track of upcoming events with our Earnings Calendar.

ACI earnings for the last quarter are 4.35 INR per share, whereas the estimation was 7.10 INR resulting in a −38.73% surprise. The estimated earnings for the next quarter are 5.90 INR per share. See more details about ARCHEAN CHEMICAL INDUSTRIES LI earnings.

ARCHEAN CHEMICAL INDUSTRIES LI revenue for the last quarter amounts to 3.46 B INR, despite the estimated figure of 3.28 B INR. In the next quarter, revenue is expected to reach 3.43 B INR.

ACI net income for the last quarter is 535.39 M INR, while the quarter before that showed 479.71 M INR of net income which accounts for 11.61% change. Track more ARCHEAN CHEMICAL INDUSTRIES LI financial stats to get the full picture.

Yes, ACI dividends are paid annually. The last dividend per share was 3.00 INR. As of today, Dividend Yield (TTM)% is 0.45%. Tracking ARCHEAN CHEMICAL INDUSTRIES LI dividends might help you take more informed decisions.

ARCHEAN CHEMICAL INDUSTRIES LI dividend yield was 0.58% in 2024, and payout ratio reached 22.83%. The year before the numbers were 0.45% and 11.58% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 28, 2025, the company has 707 employees. See our rating of the largest employees — is ARCHEAN CHEMICAL INDUSTRIES LI on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ARCHEAN CHEMICAL INDUSTRIES LI EBITDA is 3.14 B INR, and current EBITDA margin is 31.69%. See more stats in ARCHEAN CHEMICAL INDUSTRIES LI financial statements.

Like other stocks, ACI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ARCHEAN CHEMICAL INDUSTRIES LI stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ARCHEAN CHEMICAL INDUSTRIES LI technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ARCHEAN CHEMICAL INDUSTRIES LI stock shows the strong buy signal. See more of ARCHEAN CHEMICAL INDUSTRIES LI technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.