BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

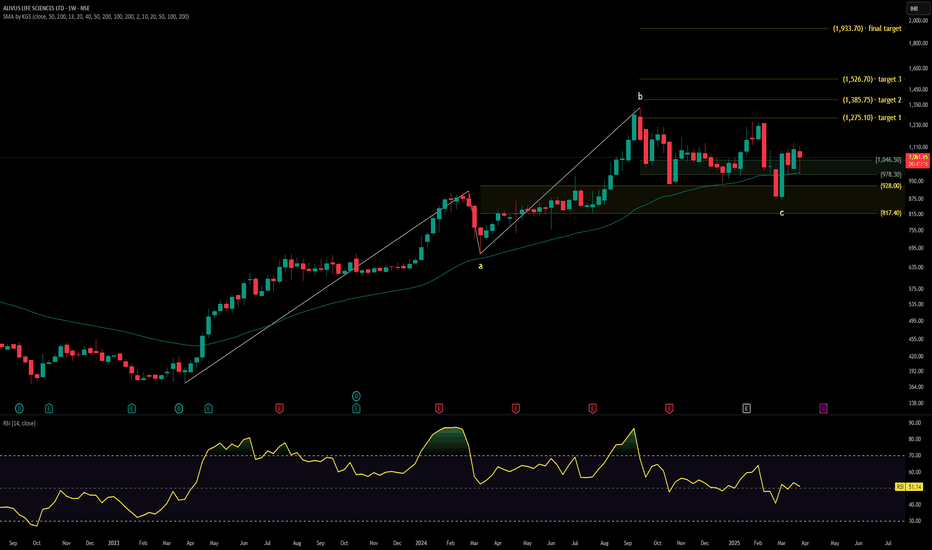

Trendline Breakout in ALIVUS

BUY TODAY SELL TOMORROW for 5%

ALIVUS trade ideas

Alivus Life Sciences Alivus Life Sciences brings together specialty API focus, globally compliant manufacturing, and CDMO services—all under a revitalized identity. With healthy profitability, strong capital ratios, and global traction, it positions itself as an attractive midcap pharma-API play in India.

ALIVUS LIFESCIENCESStock Overview: Alivus Life Sciences Ltd, NSE, current price: ₹1,061.65. Alivus Life Sciences Ltd specializes in pharmaceuticals and life sciences, focusing on drug development and healthcare products.

Key Levels:

Support level (Yellow Zone): ₹817.40

Swing zone (Green Zone): ₹928.00 - ₹1,046.50

Target levels (T): T1: ₹1,275.10, T2: ₹1,385.75, T3: ₹1,526.70, Final target: ₹1,933.70

Technical Indicators:

RSI (Relative Strength Index): Currently at 51.14, indicating neutral momentum as it is neither overbought nor oversold.

Volume: Significant spikes during price movements, reflecting strong trading activity and investor interest.

MA (Moving Average): The stock price is above the 200-period moving average, suggesting a long-term bullish trend.

Sector and Market Context: The pharmaceutical sector has demonstrated resilience and growth potential due to ongoing healthcare demands. Alivus Life Sciences Ltd's performance aligns with this trend, showing cautious optimism in a market focused on stable growth sectors.

Risk Considerations: Potential risks include regulatory changes, market competition, and global economic conditions affecting the pharmaceutical industry. Adverse events related to drug approvals or clinical trials could also impact the stock's movement.

Analysis Summary: Alivus Life Sciences Ltd presents a promising technical setup with identified support and target levels. Neutral to bullish indicators like RSI and moving averages, coupled with strong volume activity, suggest investor interest. However, sector-specific risks and broader market conditions should be carefully considered. This analysis is for informational purposes and does not constitute a direct buy/sell recommendation.

ALIVUS - Breakout in Daily timeframeALIVUS (Alivus Life Sciences Limited, formerly Glenmark Life Sciences) - Breakout

Breakout observed in daily timeframe of Alivus, the company has a very good chart pattern and is in a good uptrend and recently broke out with good volumes. The breakout has also been retested and sustained. There could be a good upside in this stock. The company also has good fundamentals as written below.

Fundamentals.

MCap 14,299Cr

Stock P/E 32.4

Industry P/E 31.6

ROCE 28.1%

ROE 21.1%

NPM 20.6%

PEG Ratio 1.69

Debt 16Cr

Reserves 2,514Cr

EPS 36.05

Promoter holding 75%

API contribution 9MFY24

Chronic : 69%

Acute : 31%

Key Therapeutic areas contribution 9MFY24

Diabetes : 4%

CVS : 41%

CNS : 17%

Pain Management : 6%

Others : 32%

Business segments

The company has two key segments - Generics and Complex APIs (92% of FY23 revenue) and Contract Development and Manufacturing Operations (CDMO) (8% of FY23 revenue)