Antony WasteDate 12.09.2025

Antony Waste Handling Cell Ltd

Timeframe : Day Chart

About

(1) Engaged in the business of mechanical power sweeping of roads, collection and transportation of waste.

(2) The company operates one of the largest single-location waste processing plants in Asia

(3) The company entered the Waste-to-Energy (WTE) sector featuring a power generation capacity of 14 MW

Revenue Mix

(1) MSW C&T: 62%

(2) MSW Processing: 23%

(3) Contracts & Others: 15%

MSW : Municipal Solid Waste

Operational Metrics

(1) Waste Managed (MMT): 2.37

(2) Refuse Derived Fuel Sold (Tonnes): 64,500

(3) Compost Sold (Tonnes): 10,000

Vehicles Fleet

(1) Company has 2,295 vehicles

(2) 1,436 Small Tippers

(3) 446 Compactors

(4) 100 Big Tippers

(5) 93 EVs

Its key equipment vendors include Bucher, Hyvam, Caterpillar, etc.

Debt

(1) The total debt has increased from Rs. 200 Cr in FY20 to Rs. 429 Cr in Q2 FY5

(2) While the cost of borrowings decreased from 12.4% to 9.6%

Focus

(1) Aims for a 25% CAGR in revenue growth over the next 3–5 years

(2) Sustaining EBITDA margins at 23–24%

Regards,

Ankur

Trade ideas

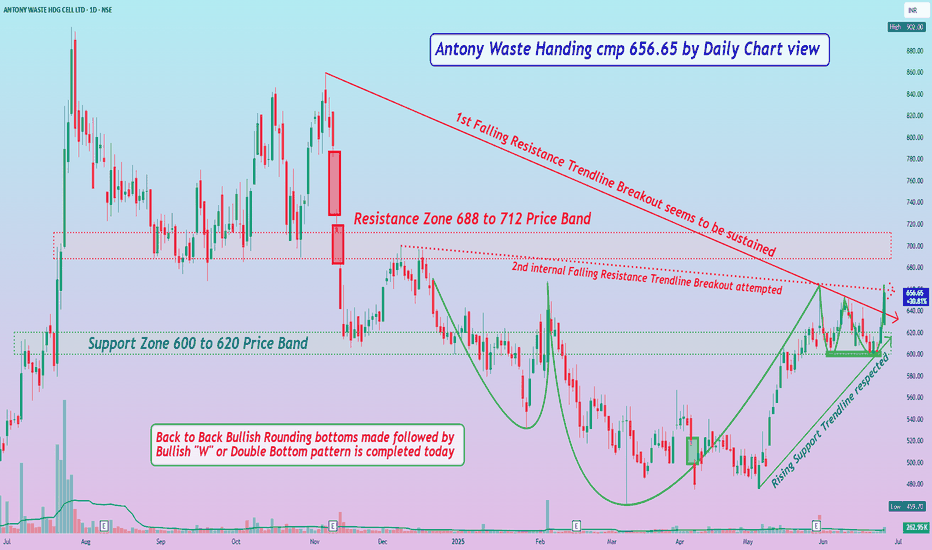

Antony Waste Handing cmp 656.65 by Daily Chart view*Antony Waste Handing cmp 656.65 by Daily Chart view*

- Support Zone 600 to 620 Price Band

- Resistance Zone 688 to 712 Price Band

- Rising Support Trendline seems respected

- 1st Falling Resistance Trendline Breakout seems sustained

- 2nd internal Falling Resistance Trendline Breakout attempted

- Bullish Double Bottom has been made at the 598 to 602 Price Band

- Old Gap Down Openings of Nov 2024 would act as good strong resistance gaps to crossover

- Volumes are seen to be in close sync with the average traded quantity with good spike done today

- Back to Back Bullish Rounding bottoms made followed by Bullish "W" or Double Bottom pattern completed today

Antony Waste Handling Cell Ltd (AWHCL)Key Business Operations

Services: Antony Waste offers door-to-door waste collection, mechanized and non-mechanized road sweeping, waste segregation, processing (composting, recycling, refuse-derived fuel), and disposal. It also manages waste-to-energy projects and construction and demolition waste.

Major Projects: The company operates Asia’s largest single-location waste processing plant in Kanjurmarg, Mumbai, handling nearly 90% of Mumbai’s municipal waste (4.66 million metric tonnes in FY24). It serves 24 municipalities, including Brihanmumbai Municipal Corporation (BMC), Navi Mumbai, Thane, Nagpur, and Delhi.

Fleet and Technology: Operates over 1,147 vehicles with advanced technologies like garbage compactors and mechanical sweeping machines sourced from international suppliers like BUCHER Municipal AG.

Financial and Market Highlights

Market Cap : Approximately ₹1,791.48 crore as of May 2025.

Revenue: ₹896.44 crore for FY24, with a consolidated profit of ₹86.21 crore.

Stock Performance: As of May 20, 2025, the stock price was $6.84 (₹627.25 as of May 30, 2025), with a 40.91% increase over the past year and 115.22% over three years. The P/E ratio is 23.67, and the P/B ratio is 2.4.

Order Book : ₹8,300 crore, with management projecting 18-25% revenue CAGR over the next 5 years and EBITDA margins of 22-23%.

Recent Milestone: Secured a ₹1,024 crore, 21-year contract from BMC for Western Mumbai and a bio-mining contract from CIDCO for 8.6 lakh tonnes of legacy waste

. Market Growth Potential

Industry Tailwinds: India’s waste management market is expected to grow at a CAGR of 7-10% over the next decade, fueled by rapid urbanization, rising waste generation (estimated at 1.5 lakh metric tonnes daily by 2030), and government policies like Swachh Bharat Mission and Atmanirbhar Bharat. Antony Waste, as a top-five player, is poised to capitalize on this demand.

Revenue and Profitability Outlook

Projected Growth: Management forecasts an 18-25% revenue CAGR over the next five years, driven by new projects, geographic expansion, and diversification into high-margin segments like waste-to-energy (WTE) and construction & demolition waste management.

Stock and Investment Potential

Stock Performance: The stock has risen 40.91% in the past year and 115.22% over three years (as of May 2025), reflecting investor confidence. A P/E ratio of 23.67 and P/B of 2.4 suggest reasonable valuation compared to sector peers.

AWHCL technical analysisAntony Waste Handling Cell Ltd. (NSE: AWHCL) is currently priced at INR 503.70. The company specializes in waste management services, including collection, transportation, processing, and disposal of municipal solid waste.

Key Levels

Support Level: INR 487.55

Swing Level: INR 564.10

Possible Upside Levels: INR 628.65, INR 872.50, INR 984.75, INR 1,127.70

Technical Indicators

RSI: The Relative Strength Index (RSI) is currently at 49.30, indicating a neutral market sentiment. RSI values between 30 and 70 typically suggest that the stock is neither overbought nor oversold.

Volume: The trading volume is 844.81K, which shows a significant level of trading activity. Higher volumes often indicate stronger investor interest and can confirm price movements.

Sector and Market Context

Antony Waste Handling Cell Ltd. operates within the waste management sector, which is essential for urban infrastructure and environmental sustainability. The sector has seen steady growth due to increasing urbanization and regulatory pressures for better waste management practices. The overall market trend for the sector is positive, with growing demand for efficient waste handling solutions. However, the stock's performance may be influenced by broader market trends, including economic conditions and investor sentiment towards environmental stocks.

Risk Considerations

Regulatory Changes: Any changes in environmental regulations or waste management policies could impact the company's operations and profitability.

Market Volatility: The stock may be subject to market fluctuations, influenced by broader economic conditions and investor sentiment.

Operational Risks: Challenges in waste collection, transportation, and disposal processes could affect the company's performance.

Competition: The presence of other waste management companies could impact market share and profitability.

Analysis Summary

Antony Waste Handling Cell Ltd. shows a balanced technical outlook with key support and resistance levels identified. The RSI and volume indicators suggest neutral market sentiment and significant trading activity. The company's position within the growing waste management sector provides a positive context for future performance. However, investors should consider potential risks, including regulatory changes and market volatility. Overall, the stock presents a balanced opportunity, with careful consideration of market conditions and company-specific factors.

AWHCL - Anthony waste ananlysis should move till 900AWHCl is currently Trading in a channel of around 690 to 900, currently at 818, at this set up. The support is at 690 and resistance at 900, If it breaks 900 with volume it should have a big move even though for now i see a 12 % upside till 900.

SL : 777

TGT : 900

Follow us for more.

AWHCL: A bullish pennant breakoutAWHCL has recently exhibited a breakout from a bullish pennant pattern on the daily chart. The breakout from the bullish pennant pattern is characterized by a significant price movement beyond the upper boundary of the pennant. This breakout is often seen as a signal of a strong buying interest and can lead to sustained upward price action.

The stock has closed above the previous week's high, a critical technical level that reinforces the positive outlook. This closure suggests increased buying pressure and establishes a strong foundation for potential growth.

AWHCL presents an attractive opportunity within the demand zone of 760-770. This area has historically demonstrated robust buying interest, indicating a potential reversal or support point for the stock. Based on current price action, the next discernible supply zone is projected to be around the 899 level. This zone may act as a resistance point where profit-taking could occur, thus requiring careful monitoring as the stock approaches this area. Based on the technical setup, AWHCL has the potential for an approximate 15% upside from the demand zone. A prudent stop-loss level may be below 731 to mitigate risk in case of adverse price movement.

Disclaimer: The information provided in this technical analysis report is for informational and educational purposes only and should not be interpreted as financial advice. Investors are encouraged to conduct their own comprehensive research or consult with a financial advisor before making any investment decisions.

Can AWHCL be a multibagger?Anthony waste handling has given a strong weekly closing above 370 after a long consolidation since its IPO listing in 2020.

Stock has support very far at 300-310.

It is better to add on dips till 350 for targets of 450 and then 2x(700).

Only risky investors should be interested in this stock.

Momentum traders can look for targets of 410 in short term.

Idea shared for educational purposes only.

ANTONY WASTE - RISING WEDGE FOLLOWED BY FALLING WEDGE (BO)Hi All,

This idea is about Antony Waste Handling Cell Ltd

Fundamentals

Market Cap - 1419 Cr

Stock PE - 16.5

ROE - 16.3

ROCE - 13.9

Promoter Stake - 46.1

Quick Ratio - 1.3

D/E - 0.78

Antony Waste Handling Cell Ltd is engaged in the business of mechanical power sweeping of roads, collection and transportation of waste, waste to energy project and undertake the designing, construction, operation and maintenance of the integrated waste management facility in Kanjurmarg, Mumbai.

Technicals

Since June 23, the price action followed a rising wedge & then the pattern changed to falling wedge since Feb 24. With the Daily price action it seems to be coming out of falling wedge formation & developing a new pattern

Immediate targets are marked as T1 and T2. Would suggest the price to rise atleast 3% post closing to confirm the continuation.

Happy Trading,

Thanks,

Stock-n-Shine

AWHCL: Ready for the Next Leg Up.After a robust upside run, AWHCL took a breather with a consolidation phase lasting around two months. This period of sideways movement allowed the stock to gather strength for its next move, and it looks like the breakout is finally here.

Technical Analysis:

Consolidation Period: AWHCL showcased resilience during the consolidation, indicating a potential accumulation of buying interest. The stock's ability to maintain a sideways range for an extended period is often a positive sign.

Breakout Confirmation: The recent breakout is a strong signal that the market sentiment has shifted. The bulls seem to have regained control, and the price action suggests a renewed interest in the stock.

Support Test: Today's move is particularly noteworthy as the stock tested a key support level, demonstrating its ability to hold ground even after the breakout. This is a positive sign of sustainability and strength in the current upward momentum.

Volume Confirmation: Always keep an eye on volume. An increase in trading volume during the breakout and support test further validates the authenticity of the move.

(Note: This is a fictional post for illustrative purposes and does not constitute financial advice. Always conduct your own research before making investment decisions.)