Sector Rotation & Thematic TradingIntroduction

In the dynamic world of stock markets, not all sectors perform equally at all times. Market leadership often shifts as economic conditions change. This shift is known as sector rotation, and when paired with thematic trading—investing based on macro-level ideas or societal trends—it becomes a powerful strategy. Together, these approaches help traders anticipate where capital might flow next, allowing them to align their portfolios accordingly.

This guide explores the foundations, strategies, tools, and risks associated with Sector Rotation and Thematic Trading, especially from the perspective of an active Indian retail or institutional trader.

1. Understanding Sector Rotation

What is Sector Rotation?

Sector rotation is a strategy that involves shifting investments among different sectors of the economy based on the current phase of the business cycle. Each sector behaves differently under various economic conditions, and recognizing these shifts can help maximize returns.

The Four Phases of the Business Cycle:

Expansion: Economy grows, GDP rises, unemployment falls.

Strong Sectors: Industrials, Technology, Consumer Discretionary

Peak: Growth slows, inflation rises.

Strong Sectors: Energy, Materials, Utilities

Contraction (Recession): GDP falls, unemployment rises.

Strong Sectors: Consumer Staples, Healthcare

Trough (Recovery): Economy bottoms out, early growth.

Strong Sectors: Financials, Industrials, Technology

Why Does Sector Rotation Work?

Institutional flow: Big funds adjust their portfolios depending on economic forecasts.

Macroeconomic sensitivity: Some sectors are more interest-rate sensitive, others more dependent on consumer confidence.

Cyclical vs Defensive Sectors: Cyclical sectors move with the economy; defensive sectors offer stability during downturns.

2. Sector Rotation in Practice

Real-Life Example: Post-COVID Recovery

2020-21: Pharma, Tech (work-from-home, vaccines)

2021-22: Commodities, Real Estate (stimulus, demand revival)

2023 onwards: Industrials, Capital Goods (infrastructure push, global reshoring)

Indian Market Examples:

Banking & Financials: Surge when RBI eases interest rates or during credit booms.

FMCG & Healthcare: Outperform during inflation or slowdowns.

Auto Sector: Grows with consumer confidence and disposable income.

Infra & PSU Stocks: Outperform during budget season or government CapEx pushes.

Tracking Sector Rotation: Tools & Indicators

Relative Strength Index (RSI) comparisons between sectors.

Sector-wise ETFs or Index tracking: Nifty Bank, Nifty IT, Nifty FMCG, etc.

FII/DII Flow Analysis sector-wise.

Economic data correlation: IIP, Inflation, GDP data.

3. Thematic Trading Explained

What is Thematic Trading?

Thematic trading focuses on investing in long-term structural trends rather than short-term economic cycles. It’s about identifying a big idea and aligning with it over time, often across multiple sectors.

Key Differences vs Sector Rotation

Feature Sector Rotation Thematic Trading

Focus Economic cycles Societal or tech trends

Duration Medium-term (months) Long-term (years)

Scope Sector-based Cross-sector or multi-sector

Tools Macro indicators, ETFs Trend analysis, qualitative research

4. Popular Themes in Indian & Global Markets

a. Green Energy & Sustainability

Stocks: Adani Green, Tata Power, IREDA

Theme: ESG investing, net-zero targets, solar & wind energy

b. Digital India & Fintech

Stocks: CAMS, Paytm, Zomato, Nykaa

Theme: UPI adoption, e-governance, cashless economy

c. EV & Battery Revolution

Stocks: Tata Motors, Exide, Amara Raja, M&M

Theme: Electric mobility, lithium-ion battery, vehicle electrification

d. Infrastructure & CapEx Cycle

Stocks: L&T, IRFC, NCC, RVNL, BEL

Theme: Government spending, Budget CapEx push, Atmanirbhar Bharat

e. Manufacturing & China+1

Stocks: Dixon, Amber, Syrma SGS, Tata Elxsi

Theme: Global supply chain diversification, PLI schemes

f. AI & Tech Transformation

Stocks: TCS, Infosys, Happiest Minds

Theme: Cloud computing, automation, generative AI

g. Rural India & Agri-Tech

Stocks: PI Industries, Dhanuka, Escorts

Theme: Digital farming, Kisan drones, government subsidies

5. How to Implement Sector Rotation & Thematic Trading

Step-by-Step Framework

Macro Analysis:

Understand current phase of the economy.

Follow RBI policy, inflation, IIP, interest rate cycles.

Identify Sector Leaders:

Use Relative Strength (RS) comparison.

Look for outperforming indices or sector ETFs.

Stock Screening:

Pick stocks within strong sectors using volume, trend, and fundamentals.

Focus on high-beta stocks during sector rallies.

Thematic Mapping:

Overlay ongoing themes with sector strengths.

For example: In CapEx cycle (sector), Infra (theme), pick RVNL, L&T, NBCC.

Entry Timing:

Look for sector breakout on charts (weekly/monthly).

Confirm using sector rotation tools like RRG charts.

Exit/Rotate:

Monitor sector fatigue and capital rotation signals.

Shift to next sector as per business cycle or theme exhaustion.

Final Thoughts

Sector Rotation and Thematic Trading are no longer just institutional tools—they are critical for any modern trader or investor looking to outperform in both short-term and long-term markets. With macro awareness, charting skills, and access to quality data, traders can dynamically shift capital, aligning with both economic cycles and thematic tailwinds.

The trick is to stay informed, agile, and selective—rotating not just sectors, but your mindset as market conditions evolve.

AXISBANK trade ideas

Options Trading Strategies (Weekly/Monthly Expiry)Introduction

Options trading is a powerful tool that offers flexibility, leverage, and hedging opportunities to traders. While buying and selling options is accessible, mastering strategies tailored for weekly and monthly expiries can significantly improve your chances of success. These expiry-based strategies are designed to take advantage of time decay (Theta), volatility (Vega), direction (Delta), and price range (Gamma).

This guide will deeply explore how traders approach weekly vs monthly expiry, key option strategies, risk-reward setups, and market conditions under which they’re best applied. It’s designed in simple, human-friendly language, ideal for both beginners and experienced traders.

Part 1: Understanding Expiry Types

Weekly Expiry Options

Expiry Day: Every Thursday (for NIFTY, BANKNIFTY) or the last Thursday of the week if Friday is a holiday.

Time Horizon: 1–7 days

Used by: Intraday and short-term positional traders

Purpose: Quick premium decay (theta decay is faster), suitable for short-duration strategies.

Monthly Expiry Options

Expiry Day: Last Thursday of every month

Time Horizon: 20–30 days

Used by: Positional traders, hedgers, and institutions

Purpose: Manage risk, longer setups, or swing trades; smoother premium decay compared to weeklies.

Part 2: Key Greeks in Expiry-Based Strategies

Understanding how Greeks behave around expiry is crucial:

Theta: Time decay accelerates in the final days (especially for weekly options).

Delta: Determines direction sensitivity; weekly options are more delta-sensitive near expiry.

Vega: Volatility effect; monthly options are more exposed to volatility changes.

Gamma: High near expiry, especially in ATM (At-the-Money) options — can lead to quick losses/gains.

Part 3: Weekly Expiry Strategies

1. Intraday Short Straddle (High Theta Play)

Setup: Sell ATM Call and Put of current week’s expiry.

Objective: Capture premium decay as the price stays around a range.

Best Time: Expiry day (Thursday), typically after 9:45 AM when direction becomes clearer.

Example (NIFTY at 22,000):

Sell 22000 CE and 22000 PE for ₹60 each.

Conditions:

Low India VIX

Expected range-bound movement

No major news or global event

Risks:

Sudden movement (delta risk)

Need for proper stop-loss or delta hedging

2. Short Iron Condor (Neutral)

Setup: Sell OTM Call and Put; Buy further OTM Call and Put for protection.

Risk-defined strategy, ideal for weekly expiry when you expect low movement.

Example:

Sell 22100 CE and 21900 PE

Buy 22200 CE and 21800 PE

Benefit:

Controlled loss

Decent return if the index stays in range

When to Use:

Mid-week when implied volatility is high

Event expected to cool off

3. Long Straddle (Directional Volatility)

Setup: Buy ATM Call and Put of the same strike.

Best for: Sudden movement expected — news, results, RBI event.

Example (Bank Nifty at 48,000):

Buy 48000 CE and 48000 PE

Break-even:

Needs large move to be profitable (due to premium paid on both sides)

Risk:

Premium loss if market remains flat

4. Directional Option Buying (Momentum)

Setup: Buy CE or PE depending on market trend.

Ideal for: Trending days (Tuesday to Thursday)

Time decay: High risk in weekly expiry. Must be quick in entries and exits.

Example:

Bank Nifty bullish -> Buy 48000 CE when price breaks above a resistance.

Tips:

Use support/resistance, volume, and OI data

Avoid buying deep OTM options

5. Option Scalping on Expiry Day

Method: Trade ATM options in 5-minute or 15-minute chart using price action.

Goal: Capture small moves multiple times — 10 to 20 points in NIFTY or BANKNIFTY

Works Best:

Thursday (expiry)

Volatile days with good volumes

Tools:

VWAP, OI buildup, Breakout strategy, Moving Averages

Part 4: Monthly Expiry Strategies

1. Covered Call (Long-Term Positioning)

Setup: Buy stocks (or futures), sell OTM call options

Goal: Earn premium while holding stocks

Example:

Buy Reliance stock at ₹2800

Sell 2900 CE monthly option for ₹50

Best For:

Investors with long-term holdings

Stable stocks with limited upside

2. Calendar Spread (Volatility Strategy)

Setup: Sell near expiry (weekly), buy far expiry (monthly)

Example:

Sell 22000 CE (weekly)

Buy 22000 CE (monthly)

Goal:

Earn premium from weekly decay, protect via long monthly

Best Time:

When volatility is expected to rise

Ahead of big events like elections, RBI meet

3. Bull Call Spread (Directional)

Setup: Buy ATM Call, Sell OTM Call

Risk-defined bullish strategy

Example:

Buy 22000 CE, Sell 22200 CE (monthly)

Payoff:

Limited profit, limited risk

Better risk-reward than naked option buying

Use When:

Monthly expiry in bullish trend

Budget rallies, earnings momentum

4. Bear Put Spread (Downside Protection)

Setup: Buy ATM Put, Sell OTM Put

Use for: Bearish view with limited loss

Example:

Buy 22000 PE, Sell 21800 PE (monthly)

Ideal For:

Volatile times with expected downside

FII outflows, global corrections

5. Ratio Spread (Moderately Bullish or Bearish)

Setup: Buy 1 ATM Option, Sell 2 OTM Options

Warning: Can cause unlimited loss if trade goes against you

Example (Bullish Ratio Call Spread):

Buy 22000 CE, Sell 2x 22200 CE

Conditions:

Monthly expiry

Expect mild upward move but not aggressive rally

Conclusion

Trading weekly and monthly expiry options offers unique opportunities and risks. Weekly options give fast profits but demand sharp timing and discipline. Monthly options offer more flexibility for directional, volatility, and income-based strategies.

Whether you’re a scalper, trend trader, or risk-averse investor, there’s a strategy suited for your style — but success depends on combining the right strategy with sound analysis, proper risk control, and emotional discipline.

News-Based Momentum TradingIntroduction

In the fast-paced world of financial markets, news-based momentum trading stands out as one of the most powerful short-term strategies. It harnesses the psychological impact of breaking news on investor sentiment and exploits it to ride price momentum. Whether it's a corporate earnings surprise, regulatory change, economic announcement, geopolitical conflict, or a CEO scandal — news can move markets in seconds.

This strategy aims to identify such news as early as possible and enter trades aligned with the initial price momentum triggered by the event. The idea is simple: "Buy the good news, sell the bad news", but execution is where mastery lies.

What is News-Based Momentum Trading?

News-Based Momentum Trading is a technical and sentiment-driven approach that relies on real-time news events to create a trading opportunity. When a major piece of news breaks, it often leads to a rapid price reaction. Momentum traders aim to enter the trade in the direction of that reaction, expecting further continuation of price due to:

Herd behavior

Panic or euphoria

Short covering or long liquidation

Delay in information absorption by the wider market

Unlike long-term investing where news is absorbed over time, this strategy thrives on short bursts of volatility and liquidity. The holding period can range from a few minutes to a few days.

Core Principles Behind News-Based Momentum Trading

Price Reacts Faster Than Fundamentals

News affects sentiment before it alters earnings, business models, or valuations.

Price often overshoots fundamentals in the short term due to emotional reactions.

Volume Validates News

Spikes in volume during or after a news event confirm broad market participation.

High volume ensures liquidity for entering/exiting trades efficiently.

Follow the Flow, Not the News

It's not just the content of the news but the market’s reaction to it that matters.

Some negative news gets ignored; some positive news leads to massive rallies. Focus on how price behaves, not how you feel about the news.

Speed and Discipline are Critical

The best trades are often gone in minutes.

Emotional hesitation results in missed or failed trades.

Types of News That Create Momentum

Not all news has the same impact. Here's a breakdown of high-impact categories for momentum trading:

1. Corporate Earnings Announcements

Beats or misses of EPS/revenue estimates

Forward guidance or revision of outlook

Surprise dividend payouts or buyback plans

2. Mergers and Acquisitions (M&A)

Acquisition of a company (target tends to surge, acquirer may dip)

Strategic alliances and joint ventures

De-mergers and spin-offs

3. Regulatory Approvals or Bans

FDA approvals (biotech)

SEBI/RBI policy updates (Indian markets)

Anti-trust decisions or penalties

4. Economic Data Releases

Inflation (CPI, WPI)

GDP numbers

Employment data (e.g., U.S. Non-Farm Payrolls)

RBI/Fed interest rate decisions

5. Geopolitical Events

Wars, sanctions, terrorist attacks

Elections and political transitions

Trade disputes (e.g., U.S.-China trade war)

6. Sector-Specific News

Government incentives (PLI schemes)

Commodity price fluctuations (oil, gold, etc.)

Climate-related events (impacting agriculture, energy)

Tools & Indicators for News-Based Momentum Trading

Though news is the trigger, technical tools help refine entries:

1. Volume Spike Detector

Look for sudden surges in volume

VWAP and OBV (On-Balance Volume) indicators confirm strong participation

2. Moving Averages

9 EMA and 20 EMA help confirm short-term momentum

Price above 20 EMA post-news often signals continuation

3. VWAP (Volume Weighted Average Price)

Great tool for intraday traders

If price holds above VWAP after news, bias is bullish

4. Price Action & Candlestick Patterns

Bullish Marubozu or Engulfing candle post-news

Avoid Doji or indecisive candles immediately after news

Example: News-Based Momentum Trade (Real Case)

Stock: Tata Motors

News: JLR posts record quarterly sales, beats estimates

Initial Reaction: Stock gaps up 4% at open

Volume: Highest in 3 months

Action:

Entry: Break above 2-day high at ₹880

SL: ₹868 (below VWAP and breakout candle low)

Target: ₹910 (Fibonacci extension level)

Result: Stock hit ₹915 within 2 sessions.

Why it worked:

Strong earnings surprise

Sector-wide interest in autos

Clean technical breakout

Risks and Challenges in News-Based Momentum Trading

1. Fakeouts / Whipsaws

Not all news leads to sustained momentum.

Price may reverse after a knee-jerk reaction.

2. Late Entry

Retail traders often enter after the move is already 80% done.

Chasing rallies often leads to losses.

3. Overtrading and Emotion

Frequent news events can tempt traders to overtrade.

Not every piece of news is tradable.

4. Slippage and Gaps

Entry and exit prices may not be ideal due to fast moves.

Pre-market or after-hours news leads to gaps.

5. Fake News / Rumors

Always confirm the source.

Do not trade on unverified social media posts.

Tools & Indicators for News-Based Momentum Trading

Though news is the trigger, technical tools help refine entries:

1. Volume Spike Detector

Look for sudden surges in volume

VWAP and OBV (On-Balance Volume) indicators confirm strong participation

2. Moving Averages

9 EMA and 20 EMA help confirm short-term momentum

Price above 20 EMA post-news often signals continuation

3. VWAP (Volume Weighted Average Price)

Great tool for intraday traders

If price holds above VWAP after news, bias is bullish

4. Price Action & Candlestick Patterns

Bullish Marubozu or Engulfing candle post-news

Avoid Doji or indecisive candles immediately after news

Example: News-Based Momentum Trade (Real Case)

Stock: Tata Motors

News: JLR posts record quarterly sales, beats estimates

Initial Reaction: Stock gaps up 4% at open

Volume: Highest in 3 months

Action:

Entry: Break above 2-day high at ₹880

SL: ₹868 (below VWAP and breakout candle low)

Target: ₹910 (Fibonacci extension level)

Result: Stock hit ₹915 within 2 sessions.

Why it worked:

Strong earnings surprise

Sector-wide interest in autos

Clean technical breakout

Risks and Challenges in News-Based Momentum Trading

1. Fakeouts / Whipsaws

Not all news leads to sustained momentum.

Price may reverse after a knee-jerk reaction.

2. Late Entry

Retail traders often enter after the move is already 80% done.

Chasing rallies often leads to losses.

3. Overtrading and Emotion

Frequent news events can tempt traders to overtrade.

Not every piece of news is tradable.

4. Slippage and Gaps

Entry and exit prices may not be ideal due to fast moves.

Pre-market or after-hours news leads to gaps.

5. Fake News / Rumors

Always confirm the source.

Do not trade on unverified social media posts.

Institutional Intraday option Trading🏛️ Institutional Intraday Option Trading

Trade like the big players — with speed, strategy, and smart money precision.

This is high-level intraday options trading the way institutions do it — not with guesswork, but with structure, volume, and calculated risk.

🔥 What You’ll Learn:

Smart Money Concepts – Recognize institutional footprints & price manipulation

Intraday Market Structure – Breakouts, fakeouts, traps & liquidity zones

High-Volume Option Levels – Trade where institutions act

Scalp-to-Swing Entries – Fast setups with defined risk

Tight Risk Management – Stop loss placement like a pro

Time & Premium Decay Tactics – Trade with Theta on your side

💼 Perfect For:

✅ Intraday Option Traders

✅ Scalpers & Index Traders (Nifty/BankNifty )

✅ Anyone ready to follow the real momentum

📌 Fast markets need smart strategies.

Learn to dominate intraday moves with institutional logic.

Institutional Intraday option Trading🧠 What is Institutional Intraday Options Trading?

Institutional intraday options trading refers to short-term options strategies executed by large institutions with the intent to profit from price movements, volatility, and order flow within a single trading session.

Unlike positional or swing trading, intraday strategies demand high accuracy, precision, and speed, which institutions handle using advanced systems and huge capital.

🏢 Who Are the Institutions?

Institutions that dominate intraday options trading include:

Hedge Funds

Proprietary Trading Desks (Prop Desks)

Foreign Institutional Investors (FIIs)

Domestic Institutional Investors (DIIs)

Investment Banks

Market Makers

These players have access to deep capital, faster execution platforms, and exclusive market data.

🔄 Institutional Objectives in Intraday Options

Capture Short-Term Volatility

Using strategies like Straddles, Strangles, Iron Condors.

Targeting events like news, economic data releases, or earnings.

Liquidity Management

Institutions provide liquidity through market-making and benefit from spreads.

Risk Hedging

Intraday options are also used to hedge large cash or futures positions.

Arbitrage Opportunities

Spot-Future arbitrage

Volatility arbitrage

Calendar spread arbitrage

📈 Common Institutional Intraday Option Strategies

1. Delta Neutral Scalping

Strategy: Sell ATM straddle and keep delta hedged.

Objective: Earn from theta decay and re-hedging.

2. Gamma Scalping

Based on buying options and adjusting delta frequently as prices move.

Profitable during high intraday volatility.

3. Option Writing with IV Crush

Institutions short options during events like RBI policy, Budget, or results.

Profits from rapid drop in Implied Volatility after the event.

4. Directional Betting with Flow Analysis

Tracking aggressive option buying/selling in OTM/ATM strikes.

Directional trades using high-volume & OI shifts.

5. Statistical Arbitrage

Using quant models to exploit temporary mispricings.

🧩 Institutional Footprints on Option Charts

Retail traders can spot institutional footprints by:

Large ATM Straddle positions

IV divergence in option chain

Open Interest buildup without price movement (Smart money quietly entering)

Options being written at key support/resistance zones

Example:

If Bank Nifty is consolidating near a resistance and suddenly 2 lakh OI is built up in 50 point OTM Calls with low IV – this may be Call writing by institutions expecting price rejection.

⚠️ Risks and Control Measures Used by Institutions

Real-time Risk Monitoring Tools

Delta/Gamma/Vega Exposure Management

Limit on maximum intraday drawdown

AI-driven decision engines to avoid emotional trades

✅ How Can Retail Traders Learn from Institutions?

Follow Open Interest + Volume Patterns

Observe institutional behavior on expiry days

Study option flow at key market levels

Backtest Straddles/Strangles on high IV days

Use Option Greeks for proper understanding

Always trade with risk-defined strategies (no naked selling without hedge)

📌 Final Thoughts

Institutional Intraday Options Trading is not about gambling or just clicking buy/sell — it’s an advanced, mathematically balanced, and data-backed approach to generate consistent intraday alpha from the market. Institutions often move ahead of retail due to technology, access, discipline, and experience.

Retail traders can’t copy the scale but can adapt the logic:

Focus on analyzing institutional footprints

Learn to read the option chain like a map

Use data, not emotions

AXISBANK – 1D Timeframe📊 AXISBANK – DAILY CHART (1D TIMEFRAME)

📅 Date: July 18, 2025

Closing Price: ₹1,099

Change: –₹60.50 (–5.2%)

Intraday Range: ₹1,074 (Low) – ₹1,159 (High)

52‑Week Range: ₹867 – ₹1,186

YTD Return: Approx. +8%

Volume: Heavier than average, indicating strong selling pressure.

⚠️ MARKET CONTEXT & TREND

Bearish Trend: Axis Bank has broken below key support zones.

Oversold RSI: While it suggests possible short-term bounce, confirmation is needed.

Strong ADX: Indicates trend strength is increasing — in this case, on the downside.

High Volume Sell-off: Indicates institutional or heavy selling pressure.

No reversal indicators yet – MACD is still negative and falling.

🔍 SUMMARY VIEW

Trend: Strongly Bearish

Momentum: Weak, heavily oversold

Volatility: High

Reversal Signs: Not yet confirmed

Short-Term Outlook: Bearish to sideway unless price reclaims ₹1,120–1,150 zone

🔮 WHAT TO WATCH NEXT

Reversal Confirmation: Look for RSI climbing back above 30 and MACD crossover.

Volume Drop on Red Days: If selling volume dries up, it may signal weakening bears.

Breakout above ₹1,150: Could confirm fresh buying and trend reversal.

Further Drop Below ₹1,070: Could lead to panic selling and deeper correction

Axis Bank Looking good on weekly chartNSE:AXISBANK

Expecting to form nice pattern of HnS in weekly chart.

Good to keep on the radar

Always respect SL & position sizing

========================

Trade Secrets By Pratik

========================

Disclaimer

NOT SEBI REGISTERED

This is our personal view and this analysis

is only for educational purposes

Please consult your advisor before

investing or trading

You are solely responsible for any decisions

you take on basis of our research.

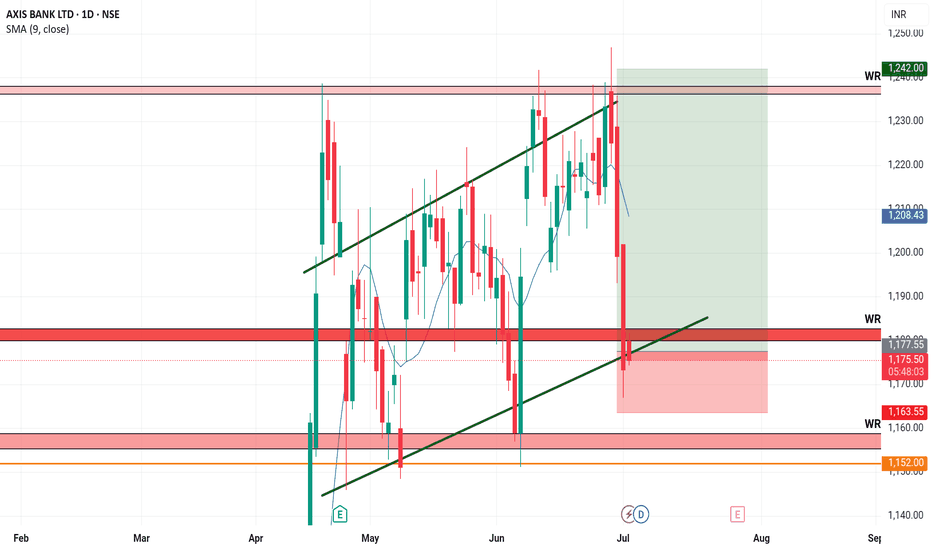

Axisbank near the Bottom of rangeAxis Bank has been in a consolidation range since last 70+ days. Price's been making high of Rs 1240 and low of Rs 1150 since then.

Now, the price has come near 1150 (Range Low). Again price is expected to bounce from the range low to 1240 leaving an opportunity to grab near about 7% profit in a shorter period of time.

With Risk Taking till price reaches below Rs. 1150.

Price breaching below range low i.e. Rs. 1150 with good volume can lead the price to go to 1030 and 1000 price point.

Note: This analysis is for Educational Purpose Only. Please invest after consulting a professional financial advisor.

AXIS BANK🏦 AXIS BANK – Tight Consolidation Below Major Resistance | Breakout Watch 🚨

📅 Date: June 21, 2025

🕰️ Timeframe: Daily Chart

💸 CMP: ₹1,220.70 (+0.26%)

📊 Volume: 4.65M

📦 Price Action Overview:

🔲 Axis Bank has been consolidating in a tight rectangle pattern between ₹1,160 and ₹1,240 for nearly 7 weeks.

📌 Current price is approaching the upper end of the range, indicating a possible breakout setup.

🟡 There’s a strong historical resistance zone near ₹1,280–1,300 from October 2024 – if broken, this can open the gates for a new rally.

📈 Technical Levels:

Support Zone: ₹1,160 – ₹1,180

Resistance Zone: ₹1,240 (box top)

Major Resistance: ₹1,280 – ₹1,300

Breakout Target 1: ₹1,275

Breakout Target 2: ₹1,310+

🎯 Trade Plan:

✅ Entry: Buy above ₹1,242–1,245 (on daily close with volume confirmation)

🛑 Stop-loss: ₹1,180

🚀 Target 1: ₹1,275

🚀 Target 2: ₹1,310+

📊 Volume Insight:

Healthy volume near the upper range = accumulation in progress

Breakout candle with > average volume = confirmation trigger

✅ Conclusion:

Axis Bank is setting up a bullish continuation pattern after a sharp rally from ₹920. A breakout above ₹1,240 can attract fresh buying, aiming toward its previous resistance zone. Keep this stock on your breakout radar! 📡

🔖 #Hashtags for Visibility:

#AxisBank #BreakoutStocks #SwingTrading #NSEIndia #TechnicalAnalysis #RectanglePattern #BankingStocks #ChartPattern #PriceAction #TradingViewIndia #AatrishaCapital

Axis Bank Climbs Steadily Within a Moderate UptrendTopic Statement:

Axis Bank is on a moderate bull run, advancing within a stable uptrending channel but with less momentum compared to its peers.

Key Points:

* The stock is moving upwards in a bullish uptrending channel, making channel trading straightforward

* It is trading close to its lifetime high, reflecting gradual strength

* Accumulating the stock near or below the 180-day EMA offers a favorable risk-reward setup

AXISBANKAXISBANK has been trading within a Channel Up since the Jan 27 bottom and last week it unfolded its latest technical Bearish Leg.

As the 2H RSI bottomed on the 30.00 oversold barrier and the 2H MACD formed a Bearish Cross.

waiting for break 1177,

Stop Loss Placement :

- Aggressive Stop: ₹1215 (below breakout level)

- Conservative Stop: ₹1201 (midpoint between support and breakout)

Exit Strategy :

- Target 1: ₹1148 (immediate Support)

- Target 2: ₹1125 ( Down Channel support level)

The top is already madeAxis Bank CMP-1207

I think what everyone is interested is, in the extent of damage. So here comes the longer term charts.

Elliott - this rally to the 1200 odd levels is the 2nd wave of C. The 3rd wave is the most devastating. To me the 3rd with start from here.

Fibs -the 3rd wave is generally 1.618 of 1st wave. So combining fib extension on the left and fib retracement on the right, in my view this wave will come down minimum to 760/780.

RSI - Now look at the oscillator on two time frame. Both on the weekly and monthly charts the rally has halted in the bear zone.

Trendlines - the retest of the channel from below is an opportunity to exit.

Conclusion - Mkt generally uses events to further its cause. Since today is the quarterly result, no matter what the outcome of the result this stock will make an imp top today. So investors u will not get a better exit.

Triangle Tension: Axis at the EdgeHi friends! Sharing daily chart of Axis bank as we can see price is forming a classic Ascending triangle pattern on provided time farme a bullish setup that often signals accumulation before breakout and the price is pressing against a well established horizontal resistance which has historically acted as a strong support as marked by green arrows.

A decisive breakout above 1115 resistance backed by strong volume, could lead to a significant upward move toward marked targets. However if the price fails to break out we may see a retest of the rising trendline support.

This setup offers a clean structure for traders watching for a potential breakout or pullback entry. The pattern sketch in the chart serves as a visual reference for educational purposes.

Targets mentioned on provided chart and a good support can be consider a close below rising support line after breakout.

This idea is meant for only learning purpose.

Hope you like the publication, Thanks in advance.