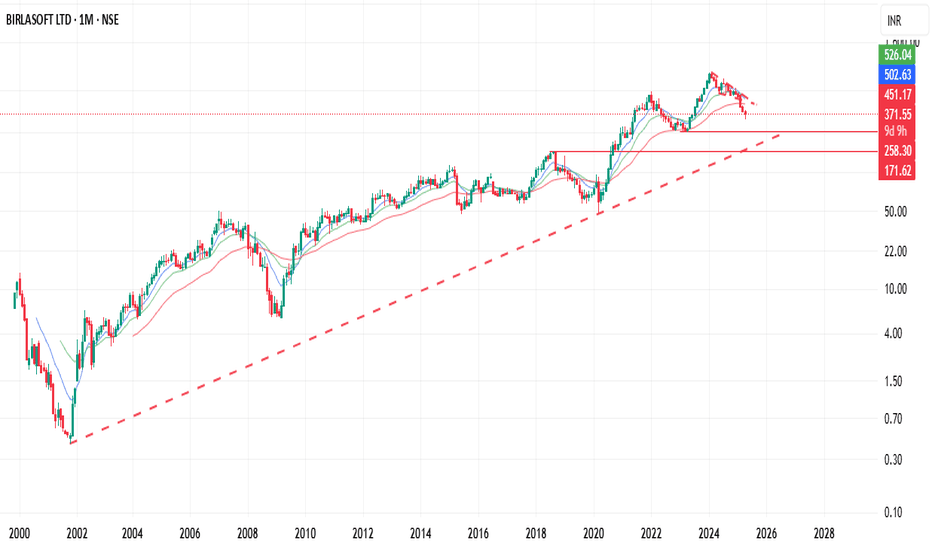

BSOFT : BULLISH SETUP BSOFT (BIRLASOFT LTD) has broke out from year long trendline as well as inverted head and shoulder pattern. And retest is in progress. On success break out from retest level expecting a target of 9% (475) and 30% (562) .

Reason for Bullishness

1) Break out from year long trendline

2) Break out from inverted head and shoulder pattern

3) Retest in progress

This analysis is for educational purposes only. I’m not a SEBI-registered advisor and this is not a trading or investment recommendation.

BSOFT trade ideas

Birlasoft Ltd (NSE)_Will break short term resistance ???

🔧 Key Watchouts:

A decisive breakout with strong volume above the ₹447 level is essential to validate the pattern.

Traders and investors typically watch for breakout confirmation before taking directional positions.

Risk of false breakout exists; volume and price action confirmation remain crucial.

📌 Disclaimer:

This content is prepared strictly for educational and informational purposes based on publicly available data and standard chart patterns. It does not constitute any kind of buy/sell recommendation or investment advice.

BSOFT - Watchout for Breakout above 445CMP: 440

TF: 144 Minutes

The price action is setting up nicely for a breakout beyond 445-450 and move towards 500 levels.

On Daily TF, Price is trading well above the Cloud and conversion line.

Price has been trading inside a downward sloping channel since Jan 2024.

Price is trying move back up from the bottom end of the channel and likely head towards the Top end of the channel.

A clean breakout above 445-450, could take it to 500 soon. The 200 DEMA is also placed at 500

Weekly ST resistance is placed at 460, and that could be the short term target on this counter.

Disclaimer: I am not a SEBI registered Analyst and this is not a trading advise. Views are personal and for educational purpose only. Please consult your Financial Advisor for any investment decisions. Please consider my views only to get a different perspective (FOR or AGAINST your views). Please don't trade FNO based on my views. If you like my analysis and learnt something from it, please give a BOOST. Feel free to express your thoughts and questions in the comments section.

Another undervalued gem: BSOFTThis weekly timeline chart follows Fibonacci Pattern perfectly. Following are the key points I've noticed from the pattern:

1st Fibonacci starting from Rs. 58 to Rs. 585, it corrects 60% viz. Rs. 254.

2nd Fibonacci starting from Rs. 58 to Rs. 859, it corrects 60%. viz. Rs. 364.

After reaching 3rd Fibonacci starting from Rs. 58 to Rs. 1108, I've noticed that the 3th wave's high is at 20% and 1st wave's high is at 50%. (That's why I kept 5th wave's target at Rs. 1108.

Chart shows the chart of the 5th wave which will surpass previous highs.

Please share your views on this.

Note: Check one Fibonacci at a time to avoid confusion.

Birlasoft – The Dip That Wants to Fly

Current Price: ₹429.30

Buy Zone: ₹428–₹430

Stop Loss: ₹426 (15-min close below key support)

Targets:

• ₹435

• ₹442

• ₹450 (if momentum continues)

⸻

Technical Setup

• Bullish Flag Formation: After a strong impulsive rally, BSOFT is consolidating in a tight range with higher lows — textbook flag/pennant setup.

• Volume Confirmation: Breakout from ₹428 came with significant volume spikes. The pullback has been on low volume — classic bullish continuation sign.

• Support Retest Done Right: The breakout zone around ₹428 has been retested cleanly and held so far. If it sustains, it’s a launchpad.

⸻

Fundamental Tailwinds

• Tech Sector Rotation: With Nifty IT holding ground despite overall market weakness, midcap IT stocks like Birlasoft are gaining relative strength.

• Valuations Reasonable: Birlasoft still trades at a discount to peers like LTIMindtree or Persistent, offering room for re-rating.

• Strong Order Book & Client Wins: The company has recently secured mid-sized transformation deals in BFSI and manufacturing – sectors showing early capex recovery.

⸻

Trade Setup Summary

• Entry: Buy in the ₹428–₹430 range

• Stop: ₹426 (tight risk control)

• Targets: ₹435 → ₹442 → ₹450

• Time Horizon: 2–5 sessions

• Risk-Reward: >1:2

⸻

Conclusion

Birlasoft looks like it’s paused to catch its breath — not reverse direction. Price action, volume, and structure point toward continuation. A strong close above ₹430 with rising volume could flip the switch for another leg higher.

Birlasoft Breaks the Box – Ctrl + Alt + Buy! Buy Call: Birlasoft Ltd (BSOFT) – ₹405.75

Rationale:

Breakout After Strong Consolidation

Birlasoft has broken out of a tight consolidation range between ₹394–₹405 on strong volumes, indicating fresh bullish momentum. The stock has made a clean breakout from resistance, suggesting upside continuation.

Macro Tailwinds in Play

Indian IT stocks are seeing renewed buying interest today, thanks to dovish global cues and expectations of a soft-landing in the US. The broader Nifty IT index is up, lending support to individual names like Birlasoft.

Technical Confirmation

A clean bullish structure with higher lows and a breakout above multiple resistance levels on the 15-min chart reinforces this buy signal. MACD is also aligned positively.

Birlasoft giving some buy signals?

Trade Setup: Buy Birlasoft Above ₹398 – Intraday to Short-Term

Technical Highlights:

• Birlasoft has given a decisive breakout above a long-standing downward trendline, backed by strong bullish candles and sustained volume.

• Price action confirms a retest and hold above the breakout zone, signaling strength and institutional buying interest.

• A move above ₹398 marks continuation of momentum, offering a clean entry with limited downside risk.

Broader Market Context:

• Expectation of a recovery in the broader markets, particularly after recent dips in major indices, supports the risk-on sentiment.

• Mid and Small Cap segments are showing leadership, and Birlasoft—being a high-beta midcap IT play—is well-positioned to outperform in short bursts.

Trade Plan

• Entry: Above ₹398 (preferably on a 15-min close or breakout candle with volume)

• Targets:

• T1: ₹406

• T2: ₹414

• T3: ₹420 (swing extension if momentum sustains)

• Stop-Loss: Below ₹391 (just under trendline breakout zone)

Bias: Bullish

Timeframe: Intraday to 2–3 sessions

Conviction: High, driven by technical breakout + favorable market sentiment

Intraday/ST Long on Birlasoft

Trade Setup: Strong Buy at 395-396

The stock has exhibited a bullish breakout from a well-defined base formation, following a brief false breakdown—a classic bear trap that adds conviction to the upward move. This breakout is supported by multi-timeframe confluence, with trendlines holding firm on both the daily and monthly charts, indicating structural strength.

Currently initiating a long position for intraday momentum, with potential to carry forward for a positional trade, given the supportive technical setup and trend integrity.

Action: Go Long

Bias: Bullish across timeframes

Conviction Level: High

BirlaSoft : Giving another Multibagger Opportunity of ~145% ?Hi Friends,

BirlaSoft a looking very good in terms of chart formation at this junture. Though The fundamentals are yet to reflect.

It usually corrects by 55-75% from the top. This time it has corrected by 60% almost .

Now the Target comes out to be around ~600 level (~145%) from the current levels .

How Target was calculated :

----------------------------------

yellow parallel lines are for channel which is respected by the stock . The same lower yellow channel line should be treated as stoploss (5-8% below the lower Yellow channel line must be stoploss).

Target is Upper yellow line of the channel.

Please feel free to share your thoughts & ask if any query related to any analysis done by me .

Note : I am not a SEBI registered advisor . Please consider my analysis only for Education purpose .

Trend Reversal setup in BSOFT(Inverted H&S Pattern)!Birlasoft (NSE:BSOFT) – Bullish Reversal on Inverted Head & Shoulders

📌 Technical Pattern: A classic Inverted Head and Shoulders pattern is forming, suggesting a potential reversal from the recent downtrend.

✅ Key Highlights:

RSI Divergence at the head hints at waning bearish momentum and potential reversal.

Price is testing the neckline zone; a breakout could confirm the bullish setup.

50-period EMA (~₹452) remains overhead, acting as a dynamic resistance.

📈 Target: ~₹516, calculated from the pattern height.

🔻 Stop Loss: Near ₹376, just below the right shoulder structure.

🧠 Strategy Note: A sustained close above the neckline, preferably on volume, can offer a strong risk-reward trade setup. RSI currently at 58 supports bullish momentum continuation.

Disclaimer: Consider my analysis for educational purposes only.

Before entering any trade:

1️⃣ Educate Yourself – Understand market dynamics and technical patterns.

2️⃣ Do Your Own Research & Analysis – Never rely solely on external opinions.

3️⃣ Define Your Risk-Reward Ratio – Ensure your trade aligns with your risk appetite.

4️⃣ Never Trade with Full Capital – Always manage risk and preserve capital.

Trade wisely! ✅📊

Birlasoft | Trendline Breakout with RetestBirlasoft (NSE: BSOFT) has successfully broken out of its descending trendline resistance, with a confirmed close above ₹400. The price action indicates a clean breakout followed by a retest of the trendline, validating the breakout structure.

Upside Potential Towards 430–450-480

Key technical highlights:

Support zone: ₹380 – ₹390

Immediate resistance: ₹430 – ₹450

Major resistance: ₹480

RSI: Sustaining above 60, showing strength without being overbought

The stock is showing early signs of trend reversal after a prolonged downtrend, supported by a bullish momentum on both price and RSI. A sustained move above ₹400 increases the probability of reaching ₹430–450 in the short term.

A close below ₹380 would invalidate this breakout view. Traders may consider partial profit booking near resistance zones while maintaining strict risk management.

#Birlasoft #TechnicalAnalysis #Breakout #SwingTrade #NSE #PriceAction #RSI #TrendlineBreakout

BSOFT rejecting trendline for bullish runBSOFT ready for another rally?

RSI oversold at same trendline from where it has a rally of 230+ % from the same trendline.

Points to note:

1. No divergence to support this rally so far except oversold process.

2. Fake breakout at trendline.

3. Close above this trendline and retest it as a support is most important factor here.

Pure analysis for bullish and long term investment purpose, purely technical. Kindly check for fundamental analysis for investing purpose.

BSoft (IT/Software Company)BSoft is often associated with technology companies, such as:

BSoft India: A Bangalore-based IT services and software solutions provider, offering products in healthcare management, enterprise resource planning (ERP), and other domains.

B-Soft Co., Ltd. (Hangzhou B-Soft): A Chinese healthcare IT company specializing in medical information systems, electronic health records (EHR), and hospital management software. It is publicly traded on the Shenzhen Stock Exchange (SZSE: 300451).

2. Software Tool/Platform

BSOFT might refer to proprietary software used in niche industries, such as:

Biomedical simulation tools.

Business process management (BPM) software.

Custom enterprise solutions (e.g., inventory management, CRM).

3. Acronym

BSOFT could stand for a phrase like:

Business Software

Bioinformatics Software

Blockchain Solutions Framework

4. Typo or Miscommunication

If the term was heard verbally, it might be a mispronunciation (e.g., "B-Soft," "BeSoft," or even "Blizzard Software" in a different context).

Birla soft Date 11.02.2025

Birlasoft

Timeframe : Day chart

Remark :

Key note/s mentioned in the chart.

Price action approval means, reversal or bullish confirmation on closing basis daily or weekly.

Few example are Bullish Engulfing, Morning Star, Hammer, Tweezer Bottom, Pin Bar, Bullish Piercing or Bullish Harami

Regards,

Ankur

Birlasoft Ltd : Ready for a BreakoutBirlasoft Ltd is a company engaged in computer programming, consultancy, and related activities. It provides software development and IT consulting services.

Pro:

Almost debt-free

Good profit growth of 18.2% CAGR over the last 5 years

Healthy dividend payout of 28.3%

Technical Analysis: \

The stock is forming a Descending triangle pattern , indicating a potential breakout.

Volume is also building up from the last swing low.

Expecting a good profit for the upcoming quarters

Stop Loss of 25 points with a target of 350 ++ points.

One can consider this stock for a shorter period with a target of 600 to 605.

BIRLASOFT at RetestBelow are the some points to go through for better analysis:

1. At Retest level

2. Risk Reward is almost 1:2 to 1:6.

Disclaimer:

Content shared on or through social site channels are for information and education purposes only and should not be treated as investment or trading advice. Please do your own analysis or take independent professional financial advice before making any investments based on your own personal circumstances. Investment in securities are subject to market risks, please carry out your due diligence before investing. And last but not the least, past performance is not indicative of future returns.