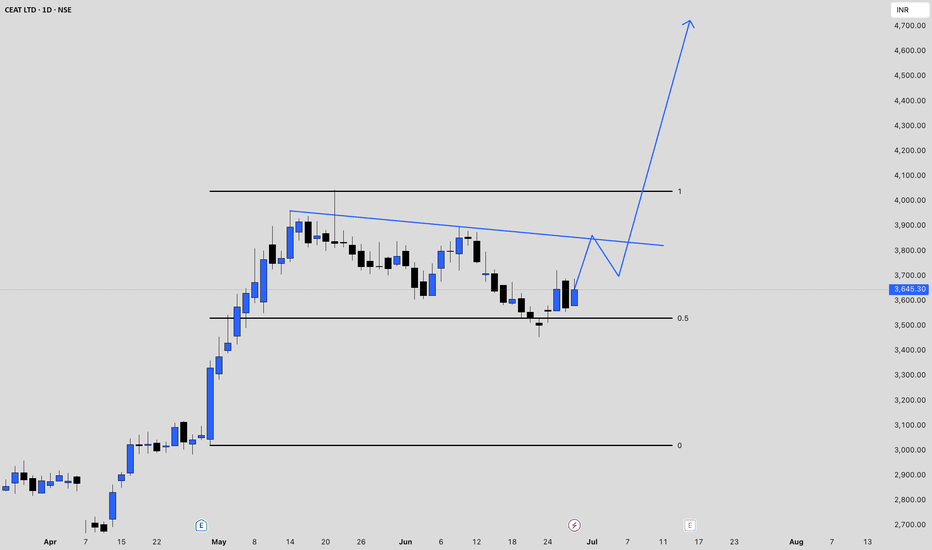

CEATPrice respected the Bullish Order Block and Discount Zone, confirming demand around 3000–3100.

A liquidity sweep occurred below 3000, trapping sellers and then reversing sharply.

Market structure shift (MSS) is visible with strong bullish candles reclaiming 3300+.

Current momentum is positive wit

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

106.55 INR

4.73 B INR

130.93 B INR

20.45 M

About CEAT Limited

Sector

Industry

CEO

Arnab Banerjee

Website

Headquarters

Mumbai

Founded

1958

ISIN

INE482A01020

FIGI

BBG000CPTHB9

CEAT Ltd. engages in the manufacture and sale of automotive tyres, tubes, and flaps. It offers tyres to all user segments and manufacturers for all vehicles including heavy-duty trucks and buses, light commercial vehicles, earthmovers, forklifts, tractors, trailers, cars, auto-rickshaws, motorcycles, and scooters,. The company was founded on March 10, 1958 and is headquartered in Mumbai, India.

Related stocks

Smart Money Footprint Visible: Ceat Testing Powerful Demand ZoneBack on 24th July , I shared an idea on Ceat. That call didn’t play out and the Stop Loss (SL) got hit . No surprises there—SLs are simply the cost of doing business in this market. hitting SL is part of trading . The key is discipline – once SL is hit, we must exit without hesitation.

Now, Ceat

CEAT Ltd: Is a Rebound on the Horizon? A Confluence of TechnicalTraders — let’s dig into CEAT Ltd NSE:CEATLTD . where both demand-supply dynamics and classic technical signals are flashing something worth watching. What’s setting up here isn’t just noise — there’s real structure underneath the surface.

Demand Zone & Institutional Footprints

Let’s start

CEATLTD Price actionCEAT Ltd has recently shown a recovery in its price action after a period of volatility. The stock closed at ₹3,645.30, rebounding over 2% in the latest session following a brief dip earlier in the week. Over the past month, CEAT experienced a mild correction, with the price dropping about 4%, but t

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

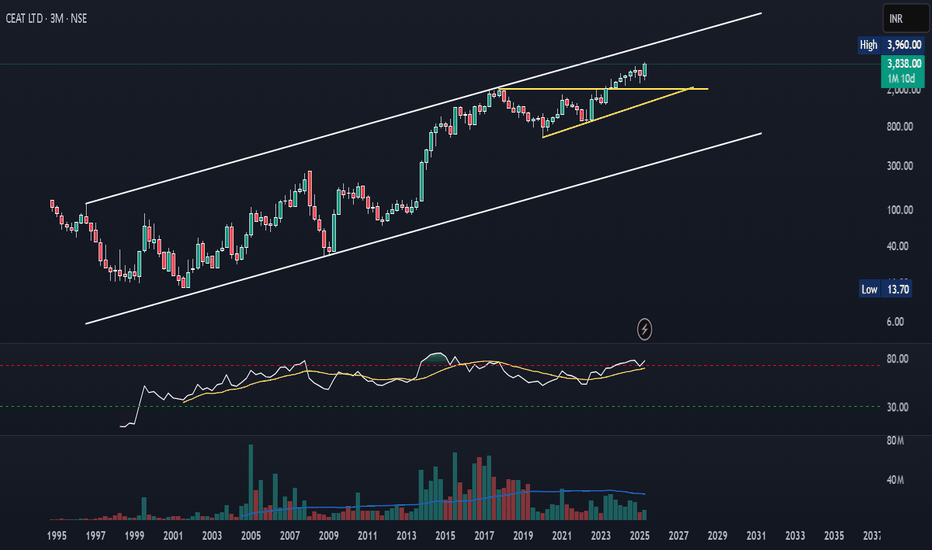

CEATAfter a multiyear breakout of 6 year from 2017-2023 lost momentum was back to retest zone near 2300-2400 zone seeing strong buying interest any fall towards 3000-3200 range in coming weeks would be good long opportunity for big bounce towards 5000-6000 range .view fails if monthly start closing belo

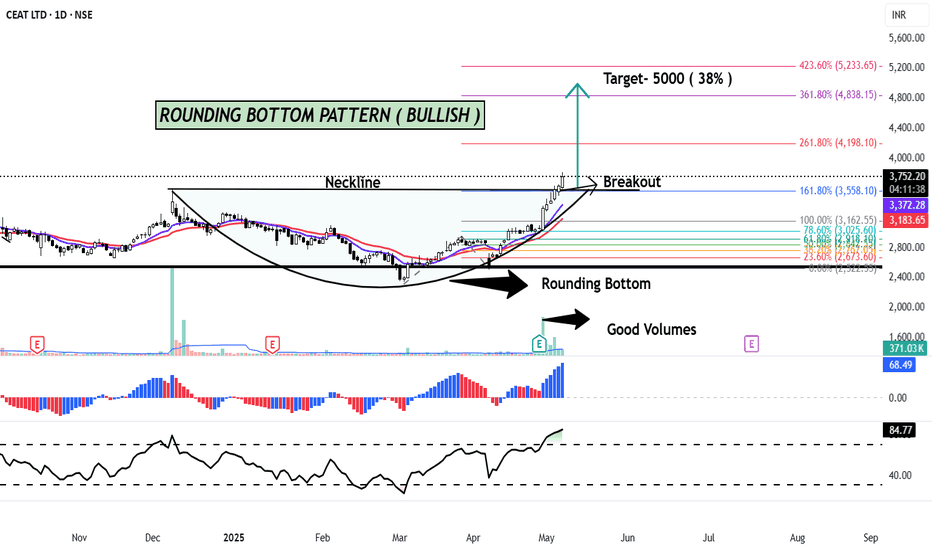

CEAT - Bullish Price actions satisfies following conditions.

1) Supertrend cross over 50 DMA

2) 50 DMA cross over 200 DMA

3) daily vol > 30 DMA Vol

4) ADX > 25

Breakout has already come and hence the stock will rise with all its might. Targets are marked as per Fibonacci retracement

The study is for academic p

Ceat- Rounding Bottom Breakout, cruising towards 5000 ?Ceat made a rounding bottom breakout on its daily chart. The target price of this pattern comes to 5000.

I already published an article on Ceat () in which I talked about Fibonacci Retracement and Targets. It looks like the Ceat is cruising along and will soon achieve its target in near term.

Fun

Amazing breakout on WEEKLY Timeframe - CEATLTDCheckout an amazing breakout happened in the stock in Weekly timeframe, macroscopically seen in Daily timeframe. Having a great favor that the stock might be bullish expecting a staggering returns of minimum 25% TGT. IMPORTANT BREAKOUT LEVELS ARE ALWAYS RESPECTED!

NOTE for learners: Place the break

CEAT on a roll.Ceat announced its quarterly results on 29.4.2025 and the market gave big thumbsup to its numbers making the stock price surge up to 8% to Rs.3300 at the time of writing.

On the technical charts CEAT is looking very strong for the more upmove ahead. The stock has broken out of its Resitance zone of

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMALLCAP

Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF Units Exchange Traded FundWeight

1.12%

Market value

861.17 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of CEATLTD is 3,574.70 INR — it has increased by 1.01% in the past 24 hours. Watch CEAT Limited stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange CEAT Limited stocks are traded under the ticker CEATLTD.

CEATLTD stock has risen by 0.34% compared to the previous week, the month change is a 3.28% rise, over the last year CEAT Limited has showed a 19.83% increase.

We've gathered analysts' opinions on CEAT Limited future price: according to them, CEATLTD price has a max estimate of 4,700.00 INR and a min estimate of 2,900.00 INR. Watch CEATLTD chart and read a more detailed CEAT Limited stock forecast: see what analysts think of CEAT Limited and suggest that you do with its stocks.

CEATLTD reached its all-time high on Jul 15, 2025 with the price of 4,048.95 INR, and its all-time low was 14.80 INR and was reached on Sep 27, 2001. View more price dynamics on CEATLTD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CEATLTD stock is 2.39% volatile and has beta coefficient of 1.27. Track CEAT Limited stock price on the chart and check out the list of the most volatile stocks — is CEAT Limited there?

Today CEAT Limited has the market capitalization of 143.04 B, it has increased by 2.50% over the last week.

Yes, you can track CEAT Limited financials in yearly and quarterly reports right on TradingView.

CEAT Limited is going to release the next earnings report on Oct 17, 2025. Keep track of upcoming events with our Earnings Calendar.

CEATLTD earnings for the last quarter are 28.60 INR per share, whereas the estimation was 34.50 INR resulting in a −17.10% surprise. The estimated earnings for the next quarter are 36.18 INR per share. See more details about CEAT Limited earnings.

CEAT Limited revenue for the last quarter amounts to 35.29 B INR, despite the estimated figure of 35.09 B INR. In the next quarter, revenue is expected to reach 36.22 B INR.

CEATLTD net income for the last quarter is 1.12 B INR, while the quarter before that showed 994.90 M INR of net income which accounts for 13.03% change. Track more CEAT Limited financial stats to get the full picture.

Yes, CEATLTD dividends are paid annually. The last dividend per share was 30.00 INR. As of today, Dividend Yield (TTM)% is 0.85%. Tracking CEAT Limited dividends might help you take more informed decisions.

CEAT Limited dividend yield was 1.04% in 2024, and payout ratio reached 25.67%. The year before the numbers were 1.12% and 18.88% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Oct 13, 2025, the company has 9.21 K employees. See our rating of the largest employees — is CEAT Limited on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CEAT Limited EBITDA is 14.79 B INR, and current EBITDA margin is 10.54%. See more stats in CEAT Limited financial statements.

Like other stocks, CEATLTD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CEAT Limited stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So CEAT Limited technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating CEAT Limited stock shows the strong buy signal. See more of CEAT Limited technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.