FILATEX trade ideas

Breakout from Descending Channel, Looking Very Strong

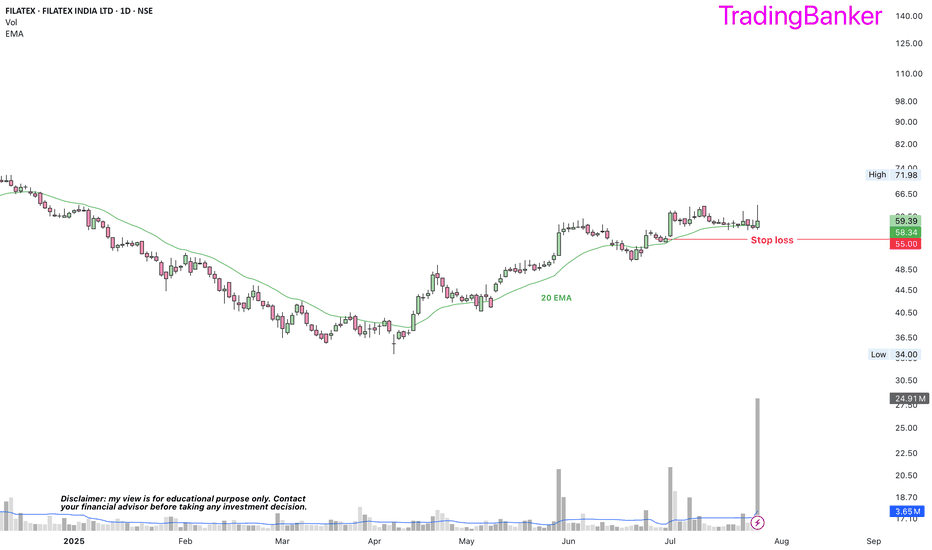

✅The stock has broken out of a descending channel on the daily chart, crossing the key resistance zone near 70 with strong volume. Sustaining above this level could lead to further upside towards the 76-80 range. RSI above 70 signals bullish momentum, making it an attractive setup for trend-following traders.

Investment Idea for Long term InvestorTrade idea for Long term Investors

High Reward Trade for High Risk Investors

Success rate 80% - 90%

"Realize Full Potential of a Stock by having Patience"

"Stock Market is more about What can happen rather-than what will Happen"

In Markets there is no 100% Guarantee but one can invest in High Probability Stocks

ALWAYS KEEP IN MIND

Rule 1 : Respect Target & Stop-loss.

Rule 2 : Hold the Trade until the Rule 1 is not met.

Rule 3 : SL on Day Close Basis

Rule 4 : Never do averaging if trade moves against your direction

Strong momentum, expecting a move towards 72 level soon- Symbol: FILATEX

- Pattern: Symmetrical Triangle Breakout

- Volume: High volume during breakout

- Retest: Retest of breakout level completed

- Support: Strong support from lower trendline

- Momentum: Strong momentum, expecting a move towards 72 level soon

Watchlist-Filatex-- stock in consolidation-wait for the breakout

--volume building

--Promoters increased stake is last Q from 1.57% to 24.81%

--Targets:- 58/65/70

Disclaimer:

- The view expressed here is my personal view

- Any decision you take, you need to take responsibility for the same

- It's your hard earned money. Treat it wisely

- Trade / Invest keeping in mind your trading style, goals and objectives, time horizon & risk tolerance

-- Do your own analysis and consult your financial adviser if needed

Round Bottom Breakout - FILATEXPlease look into the chart for a detailed understanding.

Consider these for short-term & swing trades with 2% profit.

For BTST trades consider booking

target for 1%-2%

For long-term trades look out for resistance drawn above closing.

Please consider these ideas for educational purpose

Please note that, if there are some big targets, those are drawn thinking for long term.

Filatex breakout WeeklyTaking this trade due to following reasons as per marked entry and exit:

1. Candle patten – Bullish engulfing

2. Chart Pattern – Weekly breakout

3. Volume – increase in volume for past few weeks

4. RSI – Taking support at 50 and moving to 80’s

5. Moving average – Crossing 200 SMA

Filatex - Bullish divergence RSI and PriceA bullish divergence happens when the Relative Strength Index (RSI) shows a low reading indicating oversold conditions, followed by a higher low in the RSI, while the price continues to make lower lows. This pattern may indicate that bullish momentum is building, and when the RSI breaks above the oversold level, it could be an opportunity to enter a new long position.

Above statement has been explained in the chart with invalid setup, when to enter and target to achieve.

Note: This chart is just for educational purpose.