Stock Analysis Update – Brainbees Solutions (FirstCry)🚨 Stock Analysis Update – Brainbees Solutions (FirstCry) 🚨

📊 Timeframe: 4H (NSE)

📍 Current Price: ₹400.85

✅ Support Zone: ₹350 – ₹375 (green box)

⚠️ Demand Zone: ₹285 – ₹325 (red box)

🎯 Target 3: ₹660+

The stock has taken support in the demand zone and is showing signs of reversal. If momentum continues, we may see a strong move toward higher levels in the coming weeks/months.

👉 Key Levels to Watch:

Holding above ₹375 is crucial for bullish momentum.

Breakdown below ₹325 may invalidate the setup.

⚡ Trade with proper risk management. This is for educational purposes only, not financial advice.

FIRSTCRY trade ideas

FIRSTCRY (Breakout Candidate) - Swing Pick#FIRSTCRY #stage1stock #breakoutstock #Trendingstock

FIRSTCRY : Swing / Short term (1-3 months)

>> Ready for Stage 1 breakout

>> Momentum stock

>> Volumes Spike Visible

>> Good strength in stock

>> Swing Traders can target 18% move, short term traders can look for Higher Targets

Swing Traders can lock profit at 10% and keep Trailing

Please Boost, comment and follow us for more Learnings

Disc : Charts shared are for learning purpose only, not a Trade recommendation. Do your own research and consult your financial advisor before taking any position.

FirstCry Breakout: Bullish Momentum Returns Above ₹400". This tBullish momentum on short and medium timeframes; sustained move above ₹400 could target ₹420–₹450.

Strong support at ₹354; dips towards this level may attract buyers.

Watch for consolidation or profit booking above ₹407.80; a break above ₹400 with volume provides conviction for further gains.

The GST news has catalyzed fresh trend strength; keep an eye on news-driven volatility.

FirstCry 1 Day ViewIntraday Overview (1-Day Time-Frame)

Current / Last Traded Price (LTP): ₹392–₹393 range, reflecting an ~11 % gain over the previous close of ₹352.20

Previous Close: ₹352.20

Intraday Percentage Gain: Approximately +11.3 %

VWAP (Volume Weighted Average Price): ₹384.39–₹384.85

Open / High / Low (Today):

Opening price around ₹354–₹355

Intraday range observed between low: ₹354.20 and high: ₹395.80

Interpretation & Insights

Brainbees Solutions is exhibiting strong intraday momentum, trading well above its VWAP—a typical indication of bullish sentiment among intraday traders (on 5 Sept, LTP ~₹352 earlier but now at ₹392–₹393, significantly above VWAP of ~₹384)

Such a movement suggests significant buying interest during the session, pushing both price and volume upward.

With a low intraday at ₹354.20, the stock had a wide trading range, potentially offering good intraday opportunity for active traders depending on entry/exit strategies.

What This Indicates

Strong Intraday Rally: The stock opened near the lower end of its trading range but surged sharply, trading well above VWAP—suggesting substantial buying momentum

High Volatility: With a wide range from ₹ 354 to ₹ 395, intraday traders had ample opportunity—though caution is advised in such volatile swings.

Bullish Sentiment: Momentum indicators like VWAP positioning and high-volatility trading are consistent with bullish intraday sentiment.

Brainbees Solutions Ltd – Possible Trend Reversal in Play!📊 After weeks of consolidation and strong base formation, Brainbees is showing signs of a potential reversal. The stock has respected its support trendline and is now approaching a crucial resistance zone.

🔑 Key Highlights:

✅ Strong consolidation with higher lows forming.

✅ Good volume spikes observed in recent weeks – a sign of accumulation.

✅ Breakout above resistance could open the gates toward ₹506 → ₹650 → ₹732 levels.

📌 Levels to Watch:

Support: Trendline support around ₹350–360

Resistance: ₹390–400 zone (immediate breakout level)

Targets: ₹506 / ₹650 / ₹732

💡 If momentum sustains, this could be the start of a strong upside move. Keep it on your radar!

#Brainbees #SwingTrading #BreakoutStocks #TrendReversal #StockMarketIndia #TradingSetup #PriceAction #VolumeAnalysis #NSEStocks #SwingTradeIdeas

FIRSTCRY On the daily candle chart it is clearly visible that big boys are exchanging their shares at a lower level. Look at the candles and volume bars below; you will understand. Near the completion of one year since IPO, some pre-IPO investors will sell their shares, as they could not sell after IPO till now due to compliance. One can start accumulating shares of Firstcry, which deals in baby products, with a stop loss below 300. This stock could be doubled in the coming months.

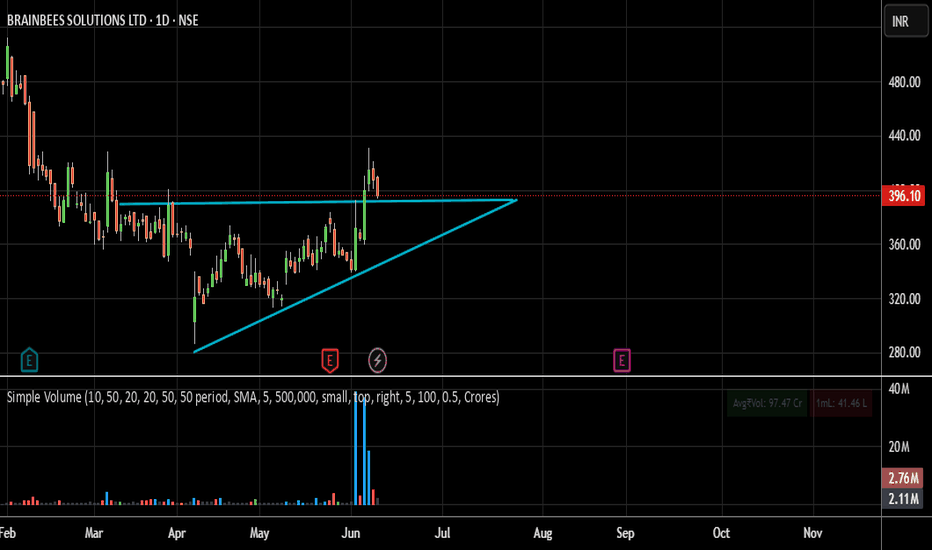

FIRSTCRY - LONGThe triangle formed after a strong downtrend, indicating this could be a reversal triangle. Volume contraction inside the triangle, then explosion on breakout—textbook behavior.

Look at the volume bars during breakout (early June)—they’re massive compared to the base, suggesting strong institutional participation.

After breakout, price retested the breakout zone (~390–400) and is currently consolidating slightly.

This pullback is healthy, possibly offering a re-entry opportunity.

Immediate Support Levels: ₹390–396 (breakout zone).

Stronger Support Levels: Trendline support (~₹360).

Resistance / Target

First target: Previous swing high near ₹440–₹460.

Target ≈ ₹590 (swing target over medium-term).

Brainbees Solutions Ltd view for Intraday 23rd Dec #FIRSTCRY

Brainbees Solutions Ltd view for Intraday 23rd Dec #FIRSTCRY

Resistance 645-650 Watching above 651 for upside movement...

Support area 628-630 Below 640 ignoring upside momentum for intraday

Support 628-630 Watching below 627 or downside movement...

Resistance area 645-650

Above 635-640 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,