Trade ideas

HCLTech bearish strategyHCLTECH has shown weakness since 9th July'25, and this has opened the bearish gates.

The selling opportunity is below 1526, with targets at 1475 and 1415 as T1 and T2, respectively.

The price is also inclined to pull back before it falls further, almost till 1576-75. If the price doesnt give a valid breakdown at the selling entry price, the bearish move will be at halt for sometime.

HCL Bearish View Support Price 1237Here's a detailed overview of **HCL Technologies' business model**:

---

## 🔷 **HCL Technologies – Business Model Overview**

### 🏢 **Company Overview**

* **Name:** HCL Technologies Ltd

* **Founded:** 1976 (as part of HCL Group)

* **Headquarters:** Noida, Uttar Pradesh, India

* **CEO & MD:** C. Vijayakumar

* **Industry:** Information Technology (IT) and Consulting

* **Stock Listing:** NSE: HCLTECH | BSE: 532281 | Part of Nifty 50

---

## 🔑 **Key Business Segments**

### 1. **IT and Business Services (ITBS) – \~65% Revenue**

* Application development & maintenance

* Digital transformation (Cloud, AI, IoT)

* Cybersecurity services

* IT infrastructure services (Data centers, network)

* Enterprise integration & modernization

### 2. **Engineering and R\&D Services (ERS) – \~20% Revenue**

* Product engineering & lifecycle management

* Embedded software & systems

* Industry 4.0 solutions

* Used by sectors like automotive, aerospace, healthcare, and telecom

### 3. **Products & Platforms (P\&P) – \~15% Revenue**

* Proprietary software products & platforms

* Examples: HCL BigFix (security), DRYiCE (AI Ops), Workload Automation

* Generates recurring revenue through licensing & SaaS

---

## 🌍 **Geographical Revenue Split**

* **Americas:** \~60%

* **Europe:** \~25%

* **Rest of the World (RoW):** \~15%

---

## 👥 **Target Customers**

* Large enterprises across sectors:

* BFSI (Banking & Financial Services)

* Healthcare & Life Sciences

* Manufacturing

* Retail & CPG

* Technology & Services

* Public Sector

---

## 💰 **Revenue Model**

* **Time & Material contracts** (hourly billing)

* **Fixed-price projects**

* **Managed services contracts** (long-term, outcome-based)

* **License/subscription fees** (for software products)

* **Cloud & Digital transformation fees**

---

## 🤝 **Business Strategy**

1. **Mode 1-2-3 Strategy**

* **Mode 1:** Core IT & application services

* **Mode 2:** Digital & analytics, cloud-native, IoT, cybersecurity

* **Mode 3:** Products & platforms

2. **Acquisitions & Partnerships**

* Acquired IBM software products in 2019

* Collaborations with Google Cloud, Microsoft Azure, AWS

3. **Innovation & IP Focus**

* Investment in AI, automation, and internal platforms

* DRYiCE (AIOps and service automation)

4. **Global Delivery Model**

* Offshore delivery centers in India

* Nearshore/onshore centers in the US, Europe, APAC

---

## 📈 **Growth Drivers**

* Increasing digital transformation globally

* Strong product-led business expansion

* Deep client relationships (high repeat business)

* Cost-effective delivery through offshore talent

---

## 🧾 **Recent Financial Snapshot (FY24)**

* **Revenue:** \$13.3+ Billion

* **Net Profit:** \$1.8+ Billion

* **Employees:** 225,000+ globally

* **Client Base:** 1000+ active clients; many Fortune 500 firms

---

## 📊 SWOT Analysis

| Strengths | Weaknesses |

| ------------------------ | ---------------------------------- |

| Strong global presence | Dependency on North America |

| Broad service portfolio | Low product revenue share |

| Consistent profitability | Intense competition in IT services |

| Opportunities | Threats |

| ------------------------- | --------------------------------- |

| AI & cloud service demand | Global economic slowdown |

| SaaS & product IP growth | Pricing pressure from competitors |

| Strategic acquisitions | Currency & regulatory risks |

---

Thanks

HCL Technologies Ltd.HCL Tech is a leading global IT services company, which is ranked amongst the top five Indian IT services companies in terms of revenues. Since its inception into the global landscape after its IPO in 1999, HCL Tech has focused on transformational outsourcing, and offers an integrated portfolio of services including software-led IT solutions, remote infrastructure management, engineering and R&D services and BPO. The company leverages its extensive global offshore infrastructure and network of offices in 46 countries to provide multi-service delivery in key industry verticals.

Market Cap: ₹ 4,04,363 Cr.

Promoter holding: 60.8 %

FII holding: 18.6 %

DII holding: 16.2 %

Public holding: 4.24 %

Debt: ₹ 6,276 Cr.

Debt 3Years back: ₹ 6,343 Cr.

Analysis: Current wave showing some selling pressure. This is weekly chart, so if you see there, 1310-1375 is crucial support zone. where 1300 is strong support. Once this is break then it will be give more fall till 930 where again new strong support will be formed.

930 is the possible reversal level. So, If it is reversed from 930, then targets will be 1180-1467-1590-2012-2685.

So, best opportunity will come in the HCL Tech soon.

HCL Tech seems a good buy @ 1530-1520 rangeDate: 24-Jul-25

After the Q1 results on 14th July, HCL Tech seems to have bottomed out near 1500 range

Stock tried breaking 1520 but sustained and closed at 1529 with increasing volms on 23-Jul-25

Most likely it will try to touch the next resistance area of 1590 and then onward to 1620, 1640 area. Likely to reach the target by 25th Sept making 5 to 6% returns in 2 months.

The rally is over HCL Tech CMP 1726

Fib ext - the fib ext nailed both the 3tr wave and the top of 5th wave. Thats the beauty of fib ext if the points are taken correctly.

Elliott - the B wave rally is over and now the C wave downfall will begin. The minimum tgt for C wave is swing lows at 1300.

Oscillators - both the oscillators are under their averages. This is a sign of danger.

Conclusion - the negative indications have come on the monthly charts. Hence this correction will not be something that will not hurt. Last several posts I have asked u to avoid bottom fishing in IT stocks.

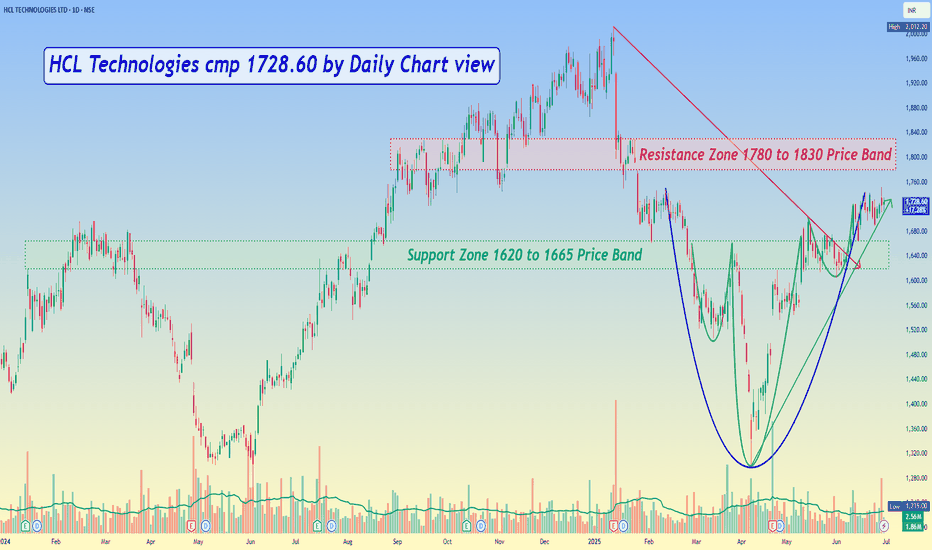

HCL Technologies cmp 1728.60 by Daily Chart viewHCL Technologies cmp 1728.60 by Daily Chart view

- Support Zone 1620 to 1665 Price Band

- Resistance Zone 1780 to 1830 Price Band

- Bullish Rounding Bottom and faintly considerate Head & Shoulder too

- Volumes have been spiking regularly well above the average traded quantity over past few weeks

HCL Tech Recovers Strongly, Eyes Resistance at Key Double Top LeTopic Statement:

HCL Tech has rebounded with the broader market, recovering from key support near 1400 and now approaching a critical resistance zone.

Key Points:

* The stock is moving in a mildly bullish up-trending channel

* The stock corrected down to the 38.2% Fibonacci retracement level around 1400 and has since staged a recovery

* The 180-day moving average at 1400 provided strong support, confirming it as a key technical level

* Price is now moving toward the 2000 mark, where it may face stiff resistance due to the potential formation of a double top candlestick pattern

Bullish Breakout in HCL TechStock breaks above key resistance zone of ₹1770

Strong bullish candle formation on the daily chart

Breakout supported by above-average volume, confirming strength

Price broke out from ascending triangle pattern — a classic bullish continuation signal

📢 Fundamental Trigger:

HCL Tech remains strong in cloud, AI, and digital transformation services

Recent deal wins and strong Q4 results supporting bullish sentiment

Attractive valuation compared to peers like TCS & Infosys

HCL TECH : LongThis chart of HCL Technologies shows an inverse head and shoulders pattern—a classic bullish reversal signal. It consists of three troughs: the left shoulder, a deeper head, and the right shoulder, followed by a breakout above the neckline. The breakout projects a target of ₹2,063.75, calculated by adding the height from the head to neckline. A stop loss is placed at ₹1,599.50, below the right shoulder. This pattern suggests a potential uptrend continuation if the neckline breakout sustains with volume.

HCLTech: Riding the Rising ChannelHCLTech: Riding the Rising Channel

HCLTech started its recent upward journey on 3rd October 2022, taking multiple supports on a trendline that later became part of a rising channel.

What is a Rising Channel?

A rising channel, also known as an ascending channel, is a bullish chart pattern characterized by two parallel, upward-sloping trendlines that contain price fluctuations.

The lower trendline connects higher lows, acting as support.

The upper trendline connects higher highs, acting as resistance.

This pattern indicates an ongoing uptrend, where buyers are in control and prices move steadily higher.

What’s in it for Traders/Investors?

Entry Point: Around ₹1650

Target Price: ₹1950 (We do not wait for the price to touch the upper end of the channel fully)

Time Frame: 6 months

Potential Gain: Approximately 21%

Stop Loss (SL): Strong support at ₹1375

Disclaimer

Always conduct your own analysis before taking any position. Consider your risk-reward ratio.

Do not allocate more than 2%–3% of your trading capital to a single stock.

Review the stock’s performance regularly and take appropriate action if it underperforms.

HCLTECH - Potential Head and Shoulders Pattern FormingTicker: HCLTECH (NSE: HCLTECH)

Timeframe: 1D (Daily)

Overview:

A potential Head and Shoulders (H&S) topping pattern appears to be forming on the daily chart of HCL Technologies. This classic reversal pattern, if confirmed, could signal a bearish trend reversal.

Key Observations (referencing the provided image):

Left Shoulder: The stock formed an initial peak around the 1,600 - 1,700 level in late 2023, subsequently pulling back.

Head: HCLTECH then rallied to form a higher peak (the "Head") around the 2,000 - 2,100 level in early 2024, followed by a significant decline.

Right Shoulder: Currently, the price seems to be forming the "Right Shoulder," with a rally attempting to reach similar levels as the Left Shoulder (around 1,600 - 1,700). However, it appears to be struggling to break higher.

Neckline: A clear neckline (marked by the green horizontal line in the image) can be drawn connecting the troughs between the shoulders and the head. This neckline is currently around the 1,300 - 1,350 level.

What to Watch For:

Neckline Break: The most critical confirmation for this H&S pattern would be a decisive daily close below the neckline (currently around 1,300 - 1,350) on increased volume.

Volume Confirmation: Look for higher volume during the decline from the right shoulder and a significant surge in volume upon a neckline break.

Target Calculation: If the pattern confirms, a potential downside target can be calculated by measuring the vertical distance from the peak of the Head to the Neckline and projecting that distance downwards from the point of the neckline break.

Potential Scenarios:

Bearish Confirmation: A break below the neckline would strongly suggest further downside movement, with the pattern's target being the primary objective.

Invalidation: The pattern would be invalidated if HCLTECH manages to break significantly above the peak of the Right Shoulder or the Head on strong volume, indicating renewed bullish momentum.

Disclaimer:

This is an idea based on technical analysis patterns and is not financial advice. Always conduct your own research and consider multiple factors before making any trading decisions. Past performance is not indicative of future results.

Trend Reversal setup in HCLTECH(Inverted H&S Pattern)!HCL Technologies (NSE:HCLTECH) – Bullish Reversal Setup

📌 Pattern Identified: A clear Inverted Head and Shoulders formation is visible on the daily chart, indicating a potential bullish reversal.

✅ Key Observations:

Price has broken above the neckline and also crossed the 50-period EMA, showing strength.

Notable volume buildup at the right shoulder, supporting the bullish move.

RSI is above 60, suggesting improving momentum.

📈 Projected Target: ~₹2,074 based on the pattern's height.

🔻 Stop Loss: Placed slightly below the right shoulder near ₹1,537.

⚠️ Watch Levels:

₹1,696: Minor resistance.

₹1,780: Key resistance level before the target zone.

📝 Conclusion: A breakout above the neckline with volume confirms the bullish pattern. As long as the price sustains above the stop loss, the risk-reward appears favorable.

Disclaimer: Consider my analysis for educational purposes only.

Before entering any trade:

1️⃣ Educate Yourself – Understand market dynamics and technical patterns.

2️⃣ Do Your Own Research & Analysis – Never rely solely on external opinions.

3️⃣ Define Your Risk-Reward Ratio – Ensure your trade aligns with your risk appetite.

4️⃣ Never Trade with Full Capital – Always manage risk and preserve capital.

Trade wisely! ✅📊

HCL TECH: Golden Opportunity for Buys⚡ Price Analysis:

1️⃣ Price near Dz.

2️⃣ Too good to miss this setup.

3️⃣ History may repeat!

⭐ Key Observations:

➡️ Rally might take time since the entire sector is beaten down, but the price is near buying zone so upmove is possible.

➡️ All timeframes aligned for potential upside move.

➡️ Perfect RRR (Risk-Reward Ratio) setup forming at these levels.

⚠️ Disclaimer: This is NOT a buy/sell recommendation. This post is meant for learning purposes only. Views are personal. Please, do your due diligence before investing.⚠️

💬 What are your thoughts on this share it in the comments below. ✌️

🔥 Happy Trading!✅🚀