Indian Overseas Bank

No trades

2.57 INR

33.96 B INR

337.49 B INR

1.46 B

About Indian Overseas Bank

Sector

Industry

CEO

Ajay Kumar Srivastava

Website

Headquarters

Chennai

Founded

1937

IPO date

Sep 25, 2000

Identifiers

2

ISIN INE565A01014

Indian Overseas Bank engages in the provision of commercial banking services. It operates through the following business segments: Treasury, Corporate or Wholesale Banking, Retail Banking, and Other Banking Operations. The company was founded by Muttaiya Chidambaram Chettiar Chettyar on February 10, 1937 and is headquartered in Chennai, India.

Related stocks

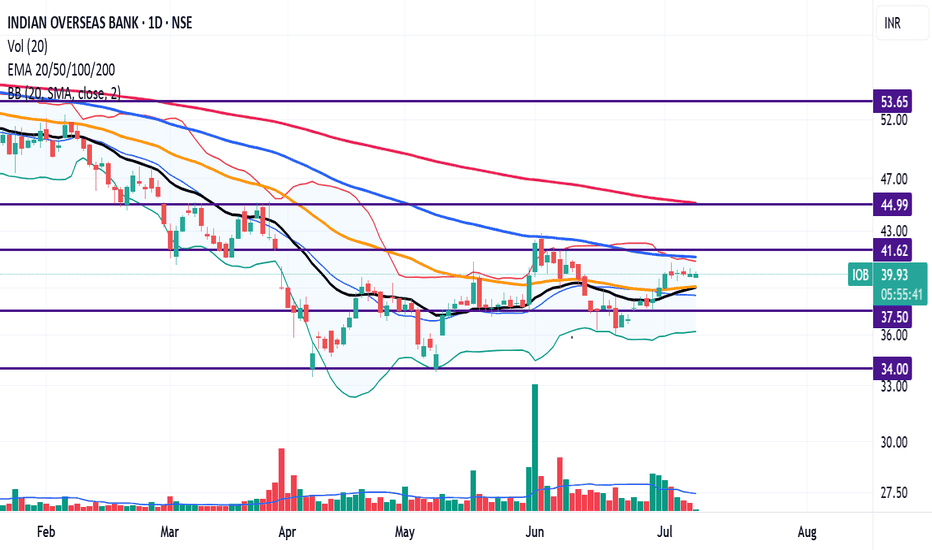

IOB 1 Week View📊 Key Technical Indicators

Moving Averages: The stock is trading below its 5-day, 50-day, and 200-day moving averages, all indicating a sell trend.

Relative Strength Index (RSI): The 14-day RSI stands at 39.62, suggesting the stock is in a neutral to bearish condition.

MACD: The MACD is negative

Stock turning Bullish: Indian Overseas Bank (IOB)IOB is taking strong support around 20 EMA (Black Line),

We can confirm the bullish trend in the stock when 20 EMA (Black Line) cross above 50 EMA (Orange Line) decisively in the weekly chart.

IOB is 44.86% away from 52 week high and

19.49% away from 52 week low

The stocks is showing Mid Range M

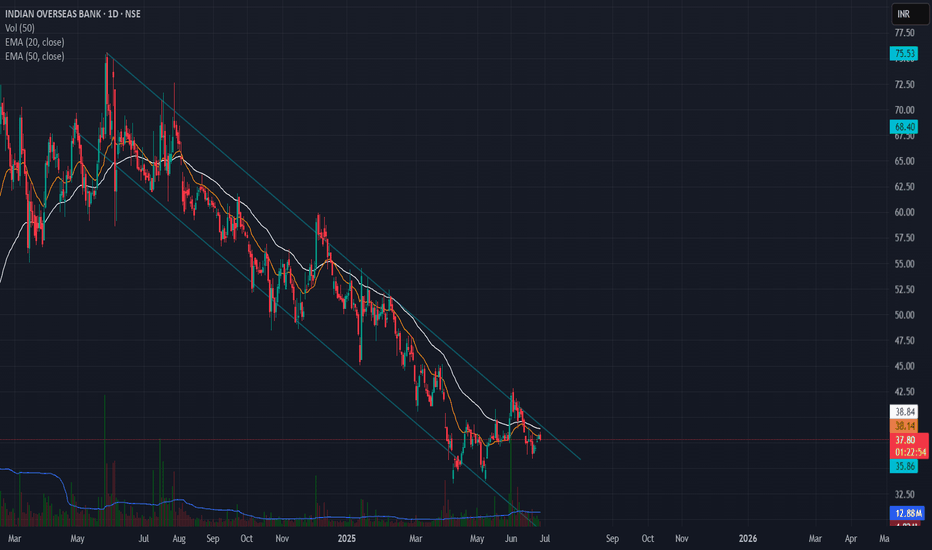

Indian Overseas Bank (IOB) - Falling Channel Breakout Setup📈 Indian Overseas Bank (IOB) – Falling Channel Breakout Setup

Watching a classic falling channel on the daily timeframe with multiple touches on both trendlines. Recent breakout above ~38.8 confirms the channel break.

✅ Planned Trade Details:

- Entry above 38.8 (confirmation)

- Stop-loss: 35.90

-

Falling Channel Pattern in Indian Overseas Bank📉 IOB (Indian Overseas Bank) - Falling Channel Setup

🔍 Daily Chart Analysis – June 26, 2025

IOB has been trading within a well-defined falling channel since early 2024. Price is currently testing the upper boundary of the channel but hasn’t confirmed a breakout yet.

🔑 Key Observations:

Structure:

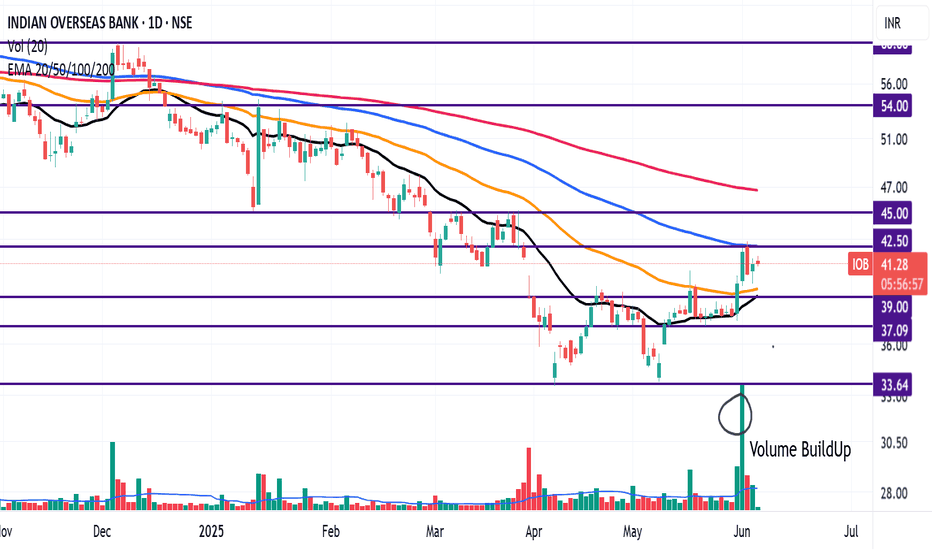

Weekly cup & Handle patternIndian Overseas Banks, weekly time frame formed Cup and Handle pattern.

IOB has made progress in improving its financial health, particularly in reducing NPAs and increasing profitability. However, it needs to address the challenges related to ROA, cost-to-income ratio, and fluctuating quarterly re

Turning Bullish: IOBIOB is trading above 20 EMA (black Line), 50 EMA (Orange Line), and nearing the 100 EMAs (Blue Line) However, it is well below the 200 EMA (Pink line).

Recently the stock turned bullish, after taking support around 20EMA.

Volume Buildup also confirms the change in trend.

We have seen spurt in volu

Indian Overseas Bank cmp 42.06 by Weekly Chart viewIndian Overseas Bank cmp 42.06 by Weekly Chart view

- Support Zone at 33.25 to 36.25 Price Band

- Resistance Zone at 44.75 to 48.50 Price Band

- Volumes are seen increasing gradually week over week

- Bullish Rounding Bottom in the making at Resistance Zone neckline

- Chart setup indicates a Descend

IOB - Progressive Cup & Handle - QuarterlyGood Progressive Cup & Handle Formation. Handle is yet to form a definite shape but it will soon.

Can accumulate at this levels and wait till the breakout above 65.

Target 1 122 in about 6-8 months

Target 2 142 in about 12 months

Please do check the fundamentals though.

The trend is strong IOB CM 52.14

Fibs- the retracement to 50% of the swing is strength. This means the trend is intact and strong.

Trendline- break of the falling trendline and retest is positive.

RSI- +ve divergence at support is indication of reversal. On the second dip the RSI is now taking support above the bull

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

90802IOB19

Indian Overseas Bank 9.0802% 24-SEP-2029Yield to maturity

10.49%

Maturity date

Sep 24, 2029

780IOB36

Indian Overseas Bank 7.8% 23-JAN-2036Yield to maturity

—

Maturity date

Jan 23, 2036

860IOB32

Indian Overseas Bank 8.6% 31-MAR-2032Yield to maturity

—

Maturity date

Mar 31, 2032

9IOB33

Indian Overseas Bank 9.0% 24-MAR-2033Yield to maturity

—

Maturity date

Mar 24, 2033

See all IOB bonds

MIDCAPETF

Mirae Asset Nifty Midcap 150 ETF Exchange Traded Fund UnitsWeight

0.14%

Market value

212.40 K

USD

PSUBNKIETF

ICICI Prudential Nifty PSU Bank ETF Exchange Traded Fund UnitsWeight

1.31%

Market value

175.27 K

USD

Explore more ETFs

Frequently Asked Questions

The current price of IOB is 34.85 INR — it has decreased by −1.11% in the past 24 hours. Watch Indian Overseas Bank stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on BSE exchange Indian Overseas Bank stocks are traded under the ticker IOB.

IOB stock has risen by 0.06% compared to the previous week, the month change is a −1.72% fall, over the last year Indian Overseas Bank has showed a −27.18% decrease.

IOB stock is 4.57% volatile and has beta coefficient of 1.74. Track Indian Overseas Bank stock price on the chart and check out the list of the most volatile stocks — is Indian Overseas Bank there?

Today Indian Overseas Bank has the market capitalization of 678.60 B, it has increased by 2.56% over the last week.

Yes, you can track Indian Overseas Bank financials in yearly and quarterly reports right on TradingView.

IOB net income for the last quarter is 14.27 B INR, while the quarter before that showed 12.59 B INR of net income which accounts for 13.37% change. Track more Indian Overseas Bank financial stats to get the full picture.

No, IOB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Feb 13, 2026, the company has 20.97 K employees. See our rating of the largest employees — is Indian Overseas Bank on this list?

Like other stocks, IOB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Indian Overseas Bank stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Indian Overseas Bank technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Indian Overseas Bank stock shows the sell signal. See more of Indian Overseas Bank technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.