IRCON trade ideas

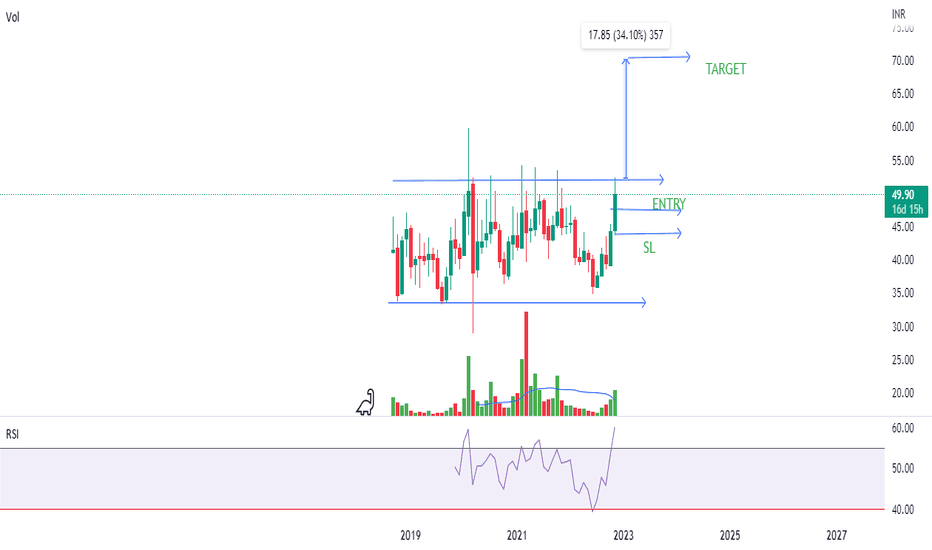

IRCONKeep an eye on the stock; the stock has tried to break the resistance many times.

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

IRCON Stock Analysis: Positive Breakout Detected in Chart Technical analysis of IRCON indicates a bullish trend: the price is rising alongside increasing trading volumes, nearing its one-year high, and displaying a robust uptrend. Additionally, recent signals suggest a bullish reversal, with the Awesome Oscillator trending upwards. This suggests a strong bullish sentiment in the market. Entry is recommended in the range of 250-253, with targets set at 269 and 289.

IRCON International (Range Breakout Seen on Daily Time Frame)IRCON has given a range breakout on the daily time frame. The stock has the potential to head towards 270, 300 in the coming few days. The low of the 26 April candle (242.60) can be the stop loss.

Disclaimer: I am not a SEBI registered analyst. All the stocks are for educational purposes. Investors must consult a financial advisor before making any investment. It is not a buy or sell recommendation.

IRCON - Long Setup, Move is ON..NSE:IRCON

✅ #IRCON trading above Resistance of 250

✅ Next Resistance is at 300

Related charts:

Charts are self-explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

BREAKOUT IN IRCON 📌SWING TRADE FOR NEXT WEEK🚀

Hello Traders⚡

I am a Swing Trader by Passion i only trade on Momentum Stock's.

📌I Post Daily SWING CHARTS Analysis on My Trading view profile..

So let's Start

📌TRADE ANALYSIS OF IRCON

• Potential Breakout Chart

• VCP Pattern

• Short Range Consolidation

• Price Can Take Retest from support Line

• Overall The Price Is Moving In HH-HL Formation

• Volume Buildup Near BO Zone

• Looks Good For 10-20% Upside Levels After The Breakout

📌 If you have any questions about any stock you can comment on post 📱

📌Disclaimer:-

This all chatrs analysis are only for educational purposes only

I do not provide any CALL or Tips

IRCON DAILYstock ready for new high stock face tuff resistance on 240 level if daily candle close above 240 then stock will be rocket can go upto 320

NOTE: only for educational purpose

RULE: 1: always trade with stoploss

2: decide your risk per trade and per day

3: believe to your analysis

4: stay positive and keep patience

technical analysis + money management+ physicalogy = successful trader

pls like and share

IRCON Good to StudyNSE:IRCON

Good to keep on the radar

Always respect SL & position sizing

========================

Trade Secrets By Pratik

========================

Disclaimer

SEBI UNREGISTERED

This is our personal view and this analysis

is only for educational purposes

Please consult your advisor before

investing or trading

You are solely responsible for any decisions

you take on basis of our research.

IRCON stock created a proper bearish price action stock made a high off 280 then fall at 216 then make a high 2nd time again bounce on 216 and 3rd bounce on 216 and 4rth time bounce on 216 made lower high and gave breakdown

NOTE: only for educational purpose

RULE: 1: always trade with stoploss

2: decide your risk per trade and per day

3: believe to your analysis

4: stay positive and keep patience

technical analysis + money management+ physicalogy = successful trader

pls like and share

Long Ircon for target 360 It seems like you're asking for a chart analysis for Ircon International Limited (IRCON) with a target price of 360. Unfortunately, as an AI, I don't have real-time access to current market data or the ability to generate charts. However, I can guide you on how to conduct a basic chart analysis using historical price data if you have access to a financial charting platform or software.

Here's a general outline of steps you can follow:

Gather Historical Price Data: Obtain historical price data for IRCON. You can typically find this data on financial websites or through trading platforms. You'll need daily price data for a significant period, preferably several months to a few years.

Plot Price Chart: Plot the historical price data on a price chart. You can use a candlestick chart or a line chart, whichever you prefer. Make sure to adjust the chart's timeframe to your analysis horizon (e.g., months or years).

Identify Trends: Look for any discernible trends in the price movements. Trends can be upward (bullish), downward (bearish), or sideways (neutral). Trends can help you understand the overall direction of the stock's price.

Support and Resistance Levels: Identify significant support and resistance levels on the chart. Support levels are where the price tends to find buying interest, while resistance levels are where selling interest tends to emerge. These levels can help you identify potential entry and exit points.

Technical Indicators: Apply technical indicators like moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), or Stochastics to gain further insights into the stock's price movements and momentum.

Volume Analysis: Analyze trading volume alongside price movements. Volume can confirm the strength of a trend or indicate potential reversals.

Pattern Recognition: Look for chart patterns such as head and shoulders, triangles, flags, or pennants. These patterns can offer insights into potential future price movements.

Risk Management: Always consider risk management strategies such as setting stop-loss orders to limit potential losses in case the trade doesn't go as planned.

Target Price: Based on your analysis of the chart patterns, trends, and indicators, determine a target price of 360 for IRCON. Make sure your target is realistic and aligns with your risk tolerance and investment goals.

Ircon Next TargetIrcon International if closes above the level of 224 on 15th Feb, 2024 then the next target will be 251 = T1 and then 273=T2

Now in daily stochastic and RSI showing uptick

Now the stock price getting support of lower Bollinger band support.

and the targets are the previous registances.

IRCON International Super BullishEducation Purpose Only... Please Consult Your Financial Adviser Before investing..

Please Maintain Strict Stoploss...

Book 70% at Target 1 and Rest Trail and Book at Target 2 ...

Don't Risk More than 1% or 2% of your capital in a single Trade..

Strong Breakout with Good Volume...

Bullish...

Swing Trading

Ircon International Ltd - Long Setup, Move is ON...#IRCON trading above Resistance of 185

Next Resistance is at 250

Support is at 140

Here are previous charts:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. I am not SEBI registered. Please consult your financial advisor before taking any trade.

IRCON | Swing Trade📊 DETAILS

Sector: Engineering & Construction

Mkt Cap: 16,440 cr

Ircon International Limited (IRCON) commenced its business in 1976 as a railway construction company, it diversified progressively since 1985 as an integrated engineering and construction PSU specializing in large and technologically complex infrastructure projects in various sectors such as railways, highways, etc.

TTM PE : 18.58 (High PE)

Sector PE : 49.76

Beta : 1.79

📚 INSIGHTS

Strong Performer

Stock with consistent financial performance, quality management, and strong technical momentum indicating good investor enthusiasm. Currently valued at Good to expensive valuation

5.18% away from 52 week high

Underperformer - Ircon International up by 3.13% v/s NIFTY 50 up by 7.22% in last 1 month

📈 FINANCIALS

Piotroski Score of 6/9 indicates Average Financials

Disclaimer: This analysis is for educational purposes only, and I'm not a SEBI registered analyst.

If you found this analysis helpful, I encourage you to like and share it. Your observations and comments are also welcomed below. Your support, likes, follows, and comments motivate me to consistently share valuable insights with you.

🔍 More Analysis & Trade Setups 🔍

For more technical analysis and trade setups, make sure to follow me on TradingView: www.tradingview.com