Positional Holding for 4-7 Days.#JETAIRWAYS

### Positional Holding for 4-7 Days.

Double Bottom in Day Frame. As well 2nd time retest in same bottom level.

Entry @ 39-40 with SL 37

1st Target: 46, 2nd Target: 51-52

JETAIRWAYS trade ideas

Jetwairways - unrestricted-daily-volume-growth-3-months-time-fraJetwairways - unrestricted-daily-volume-growth-3-months-time-fra

1) Trendline Breakout

2) Retest done

3) Ready to boom

Volume mein mat faso...Chill karo meri jaan

JETAIRWAYS levels...28.09.2021 ( W candle) JETAIRWAYS now in sell trend...once its break 115 levels ...its move on up to 170+

JET AIRWAYS... EXPECTING 50% IN SHORTB TERM Triangle breakout.. given retracement and started moving up.

Target 150 (50% upward move)

Long Jet Airways Jet Airways

CMP - 103

Stop - 70 on DCB

Expectation -

T1 - 170

T2 - 400, Review at 170

Expected Holding Period - 120 trading days or earlier for T1

Ideas being shared only for educational purpose

JET AIRWAYS Weekly Analysis - CMP 104 CUP AND HANDLE BREAKOUT JET AIRWAYS Weekly Analysis - CMP 104

CUP AND HANDLE BREAKOUT

BUY FOR TARGET 150- 200- 250- 275- 300+

SL below 70

Holding period 2-3 Years

Live Challenging Signal BUY JETAIRWAYS @ 102.62Live Challenging Signal BUY JETAIRWAYS @ 102.62

Signal Specification

Pair: JETAIRWAYS

Entry Type: Buy

Entry1: 102.62

Tp: 169.65

Sl: 9085

R/R: 6.43

Our Unique Features:

—————————————————————

1. Follow our 15 signals ….10% equity will increase in your account for sure.

2. We are not Trailing stop! or average the trades.

3. 2% Risk Management Per trade.

4. Risk vs Reward up to 1:7.

Note:

Trade signals would usually have a risk to reward ratio of 1:2.

It means that even 2 out of 4 signals hits their SL marks, the other two would have closed with profit.

This allows you to be good in overall pips profit.

Signals are usually inter-day (Based on the daily candle) therefore, trades would usually have a holding time of an average minimum of 24 hours.

Note: Everything works with Best money management.

Note: Please leave comments for any query.

Disclaimer: This is my trading experience, it is not an invite or recommendation to trade.

Best Wishes

Forex Tamil

What a trap looks likeI don't get why people still get into these stocks. On a long position, as long as the stock is hitting upper circuits it's all rainbows and sunshine. But look at that trap after a few UCs. A series of LCs where the person with the long position can't help losing his/her sleep.

Ridiculous.

NSE:JETAIRWAYS

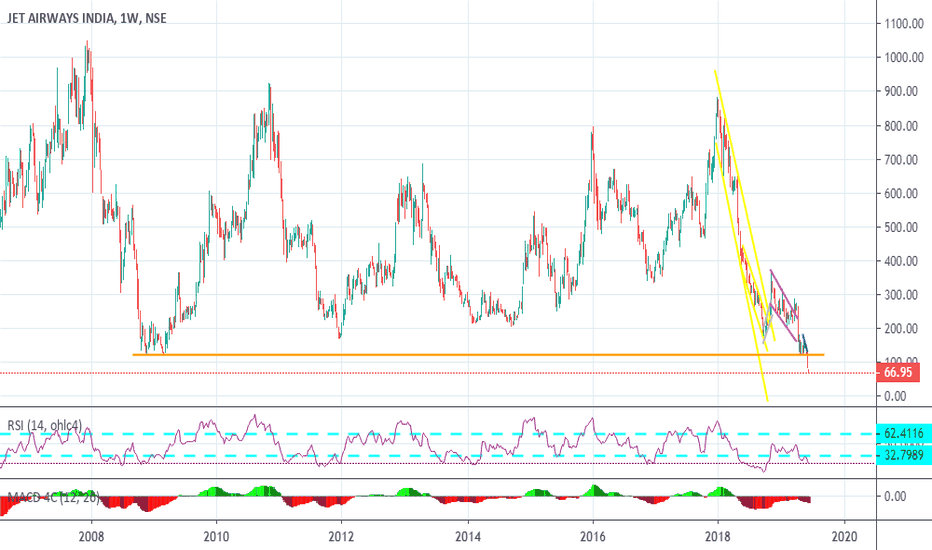

Jet Air ways may find new lows 160, 115 or even 80,it will have strong resistance at the long term TL (support turned resistance) line around 280 - 300 range. Scrip is technically weak, and fundamentally a broke. The market is moving with reasons either for technical or fundamental objectives. So there is definitely a reason that the stock is oversold and can show some buying interest make an up move based on that, but it cannot give any better gain unless the company show a strong fundamental change in its financial. It is having a better sales, is a hopeful thing, it can bring in to good earnings any time.

Watch the volume game. The stock is have abroad equity base of 11.36 crore stocks with a 1.25 cr in public hand. The day to day trade is 4 to 6 crores and the Delivery % is very nominal. Caution advised.

Stay Away from JetBounce for Jet - Very Tough, unless Government finds some owner for Jet Airways..As you can see Jet broke below all time support of Rs. 120..If there is further delay in finding a buyer for Jet then stock might slip below 50 levels as well..

JET - A SMALL RESPITEJET IS GIVING BUY SIGNAL IN 15M CHART. THIS SHOULD SEE PRICE LEVELS OF 128 - 132.

IT IS BETTER TO GET OFF AT 132+ LEVELS.

HOUR CHART INDICATES THE MOVEMENT COULD BE UP TO 134.

ALL THE BEST WITH THE JOURNEY!

Bullish Bat - JetAirways - 4hr Bullish Bat - JetAirways - 4hr

PRZ: 125-128 (Risky Trade coz it's News based)

SL: 119

TGT: 137, 145

10-06-2019

Possible But how likely?Jet has an interesting pattern on the Weekly. There could be a corrective Up move now that its at its weekly low. Selling here doesnt have a good Risk/reward whereas buy looks promising, IF and ONLY IF we get a clear pattern indicating a break to the upside. Now, there is a possibility, but, how likely is the question. Gotta wait for more patterns to form and develop.

Consolidation before Turn around I am looking this as triple three pattern

most likely they will move the price in side ways market until all the Open market orders are absorbed

I have pulled some trend line , price can be slightly here & there but it will be most likely in the same horizontal pattern

One can look to trade with in this range with pre-defined stop & exit methods

it will be slow and time consuming factor before any new trend starts

jet airways hedged strategyshort jetairways ATM ce

long jetairways fut

price difference leads to profit

#JETAIRWAYSSave yourself from such stocks with use of #NimblrTA

It guides you entry and exit strategy