KARNATAKA BANK - DAY CHART - 28.12.2022 - BAHAVAN CAPITALKARNATAKA BANK as per Day Chart Analysis

ABOVE 152 TARGET 155

For the last four sessions FII had been selling and DII only in Marginal Buying.

Hence tomorrow being month end expiry trade safely....

Happy Profitable Trading to All.

Advance Happy New Year 2023 wishes to all....

KTKBANK trade ideas

The Karnataka Bank LimitedKTKBANK:- breakout soon after 14 year, keep on eye.....

Hello traders,

As always, simple and neat charts so everyone can understand and not make it too complicated.

rest details mentioned in the chart.

will be posting more such ideas like this. Until that, like share and follow :)

check my other ideas to get to know about all the successful trades based on price action.

Thanks,

Ajay.

keep learning and keep earning.

17 Years Sideways Parallel Channel Breakout at KTKBANK17 Years Sideways Parallel Channel #Multiyear #Breakout at #KTKBANK (Karnataka Bank Ltd) Weekly Chart. Its #Outperformed #Nifty

BSE: 532652 / NSE : KTKBANK

What Is the Inverse Head and Shoulders?

An inverse head and shoulders, also called a "head and shoulders bottom", is similar to the standard head and shoulders pattern, but inverted: with the head and shoulders top used to predict reversals in downtrends.

This pattern is identified when the price action of a security meets the following characteristics: the price falls to a trough and then rises; the price falls below the former trough and then rises again; finally, the price falls again but not as far as the second trough. Once the final trough is made, the price heads upward, toward the resistance found near the top of the previous troughs.

ONLY FOR #educational

NOT SEBI REGISTERED. #LEARNEARN (TRUST YOURSELF)

#nifty50 #sharemarket #BREAKOUTSTOCKS #Multibagger #sharemarket #sharemarketindia #sensex #technicalanalysis #Chartanalysis #headandshoulders #doubletop #doublebottom #parallelchannel #relativestrength

DISCLAIMER: I am not SEBI registered analyst. All posts are for educational purpose only. I am not responsible for your any loss or profit. Consult your adviser before taking any trade. I help people to learn technical analysis & charts reading.

Karnataka bank Karnataka bank was given when it was at 84..from there it reach at 150+ in 2 month almost 80% gain...now stock is breaking big trendline. Fresh buy triggered at this level CMP: 151 sl:125(wcb) Target: 190/ above 190 target is open...as some minor correction is expected in market add more qty in dips

KTKBANK - Ichimoku Bullish Breakout Stock Name - The Karnataka Bank Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at Current Market Price

and more bullishness AFTER crossing 113

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, it motivates me to do analysis.

Karnataka Bank Cup & Handle BreakoutKARNATAKA BANK

Chart Time Frame: WEEKLY

On Weekly Basis Time Frame the Stock has given a Good Breakout of Cup & Handle Pattern with decent volumes on the Chart

So as per the Chart Stock looks Good for Long Position for Short to Medium as per the Levels given below:

CMP - 84.25 or BoD 79

Target 1 - 90.40

Target 2 - 99.10

Target 3 - 108.00

SL - 70.50

Holding Time Frame - Short to Medium Term

All charts posted here are only for EDUCATIONAL PURPOSE

Before entering into any Trade / Investment Position kindly consult your Financial Advisor

RSI Color Zones by Feroz Usage GuideIt is chart showing how RSI & Overbought & Oversold Zones help visually in finding low risk setups

Example chart Used - Karnataka bank

Indicator Used - RSI Color Zones by Feroz

Indicator link

Note: Not suggesting any Investing/Trade Idea. Its just for Educational Purpose.

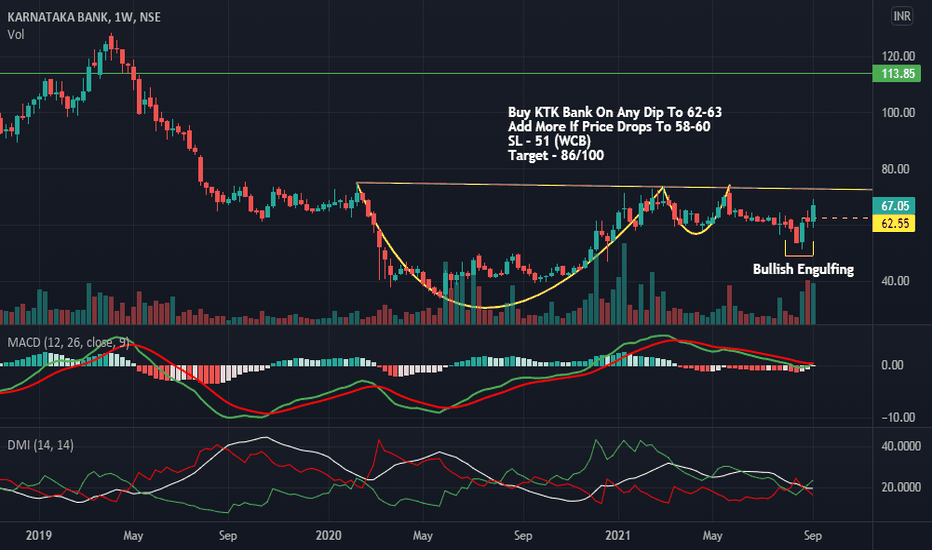

long ktk bankbullish formation, multiyear breakout. book value 228. best entry around 67-70 sl and traget according to risk appetite

only for information and education purpose. please consult your adviser before investing.

#trading #long #midcap #india #banking #chart #bullish #chartpattern #priceaction #technical analysis

YR 2022 Idea #117: Long on KTKBANKThis is a public swing trade idea and is only for Learning and observational purpose. Please understand your risk and take full responsibility of your actions. I might trail my stoploss after I get an entry but even if my original Stoploss hits, i exit the trade with pre-planned loss (risk). At target, I book usually 75% positions and trail stoploss for rest. Our objective to help anyone who wants to learn technical analysis using charts by demonstrating my real trade entries. You can post your queries in comment section here and we will try to answer them asap.

KTKBANK - Ichimoku Bullish Breakout Stock Name - The Karnataka Bank Limited

Ichimoku Cloud Setup :

1). Today's close is above the Conversion Line

2). Future Kumo is Turning Bullish

3). Chikou span is slanting upwards

All these parameters are showing bullishness at CMP

and more bullishness AFTER crossing 73.

#This is not Buy and Sell recommendation to any one. This is for education purpose and a helping hand to learn trading in Market.

# Cloud Trading

# Ichimoku Cloud

# Ichimoku Followers

I hope you all like my analysis.

Please do share your thoughts into comment section.

Please give a like, it motivates me to do analysis.

Karnataka Bank - can give breakout ?Karnataka bank posts its highest ever profit.

Book Value: 214

Volume in past are good with big green towers can be seen.

1 fake breakout in Nov'21

Can it give true breakout this time ?

200 EMA is acting as its resistance, needs to be taken out to confirm breakout.

Trendline indicates that this script has potential to reach 164 . . . 214. let's see

Disclaimer: Not a recommendation. Pls invest at your own risk.